Introduction

During the year 2012, the UK Government has announced a number of changes that impact on the purchase and ownership of UK residential properties. Some of these measures were detailed in the Budget on 21 March and are already in force. Details of further measures have been under consultation. The results of that consultation and some draft legislation were published on 11 December. These measures will take effect from April 2013. Further draft legislation is due in January 2013.

The changes affect the purchasing and ownership of UK residential property worth over £2 million held by 'non-natural persons' in three respects:

- an annual residential property tax;

- an extension to the scope of capital gains tax (CGT); and

- stamp duty land tax (SDLT) at 15%.

Annual residential property tax

An annual residential property tax (ARPT) is to apply on UK residential property worth over £2 million held by 'non-natural persons'.

The draft legislation confirms that the annual charge will apply to the same categories of non-natural person as the 15% rate of SDLT, being:

- companies;

- collective investment schemes; and

- partnerships that include a company.

The Government has announced a number of significant reliefs for genuine businesses carrying out genuine commercial activity. The following dwellings will be relieved from the tax:

- dwellings held for the purpose of the property development trade of the company;

- dwellings held for the purposes of letting to third parties for rent on a commercial basis;

- dwellings held for the purposes of a trade of buying and selling property;

- properties open to the public with access to the interior for at least 28 days per year on a commercial basis, as a venue, location or to provide accommodation or other services;

- dwellings held to provide employee accommodation for the company's commercial purposes, where the employee has less than a 5% interest in the company;

- dwellings owned by charities and held for charitable purposes;

- farmhouses where a working farmer occupies a farmhouse connected to the farm land for the purposes of farming the land;

- certain other diplomatic, publicly owned properties or properties conditionally exempt from inheritance tax.

The first annual charge will arise on UK residential properties owned at 1 April 2013 or acquired, built or converted from a non-residential property after that date and will be payable in advance for the period 1 April 2013 to 31 March 2014.

The amount of the annual charge depends on the market value of the property. If the property was owned on 1 April 2012 the value at that date will be used to calculate the charge at 1 April 2013, for properties acquired after 1 April 2012 the value at the date of acquisition will be used. Properties will have to be revalued every 5 years so for properties held at 1 April 2012 the next valuation date will be 1 April 2017 which will form the basis of the April 2018 annual charge.

The annual charge will be self-assessed so those persons liable to the charge will be responsible for obtaining the market value of their property at the respective dates. The due date for returns and payment of tax will normally be by 30 April of each year. However, for the first year the due date for the return will be 1 October 2013 with payment made by 31 October 2013. There are different time limits for the first return when dwellings are first acquired after 1 April 2013.

A non-natural person must make a nil-charge return to claim relief from the ARPT.

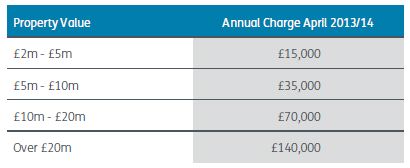

The bands and annual charge for 2013/14 are as follows:

The annual charge will be indexed to the Consumer Price Index (CPI) and updated each year. There are no proposals to uplift the rate bands with the CPI.

If the property is not held for the whole of the charge period the charge will apply pro-rata. This will also be the case for properties which move into or out of the Annual Charge (e.g. due to conversion from commercial property to residential property, or vice versa).

CGT charge on disposals of certain UK residential property

The scope of CGT is to be extended to include a charge on disposals of UK residential property over £2 million by non-resident 'non-natural persons'.

Under existing legislation Capital Gains Tax (CGT) is only payable by UK residents. Anti-avoidance legislation treats gains on disposals by non-resident companies and trusts as accruing to UK resident individuals in certain circumstances.

However the consultation document proposes that CGT will now be levied on disposals of UK residential property by non-resident 'non-natural persons' from 6 April 2013 where the value of the consideration for the disposal exceeds £2 million. Draft legislation is due to be published in January 2013 but the Government has responded to the consultation process to provide some further detail.

The category of non-natural person for CGT is the same as that for the ARPT and the 15% rate. In addition, largely the same reliefs will apply. There will be some exceptions in the treatment of certain entities between the two taxes, to reflect differences in nature between CGT and ARPT and SDLT, for example in relation to partnerships. Details have yet to be published.

The CGT charge will apply to gains on the disposal, or part disposal, of high value UK residential property, including the grant of an option over such property.

Government announcements on 31 May proposed that this charge would also apply to any gains that accrue on the disposal of shares in a non-resident company which held a high value residential property. However, it appears that the Government has abandoned this idea.

The gain will be calculated following normal CGT rules. The rate of CGT will be 28%, with a tapering relief for gains where the property is worth just over £2million. As non-resident non-natural persons are not currently subject to the CGT regime, this charge will apply only to that part of the gain that is accrued on or after 6 April 2013.

If losses arise on the sale of properties within the charge, these will only be available to set against gains on disposals of UK residential property in the same or future years.

The computation of gains will take into account those periods where the non-natural person qualifies for the reliefs against the ARPT as detailed above.

It is proposed that the definition of residential property follows the meaning of 'dwelling' used for the ARPT and the 15% SDLT rate, as follows:

"A building or part of a building counts as a dwelling if –

a) it is used or suitable for use as a single dwelling, or

b) it is in the process of being constructed or adapted for such use.

Land that is, or is to be, occupied or enjoyed with a dwelling as a garden or grounds (including any building or structure on such land) is taken to be part of that dwelling.

Land that subsists, or is to subsist, for the benefit of a dwelling is taken to be part of that dwelling."

It is understood that HMRC takes the view that a dwelling's gardens or grounds has the same meaning as would apply to land associated with a dwelling for principal private residence exemption for CGT. This has implications for country estates owned by non-resident non-natural persons.

There will be a review of the interaction of the new CGT charge with existing charges such as TCGA s13, s86 and s87 with the aim of avoiding unnecessary complexity and to ensure a sensible prioritisation of charging provisions.

For consistency, the Government is considering extending the CGT regime to apply to disposals of high value residential property by UK resident non-natural persons currently subject to corporation tax. This would mean that UK resident companies would pay CGT (currently 28%) on the sale of high value UK residential property rather than lower rates of corporation tax.

Stamp duty land tax (SDLT)

7% rate of SDLT on consideration of more than £2 million

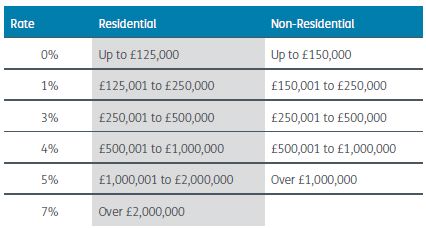

A 7% rate of SDLT applies to residential property transactions valued at more than £2 million with an effective date (normally completion) on or after 22 March 2012.

The standard rates of SDLT payable on land purchases are now as follows:

15% rate of SDLT on consideration of more than £2 million where UK residential property acquired by 'non-natural persons'

Where the acquisition of a UK residential property in excess of £2 million is by a 'non-natural person' the rate of SDLT payable on the purchase will be 15% rather than the 7% rate outlined above. This affects all purchases entered into on or after 22 March 2012.

'Non-natural persons' for this purpose has the same definition as for the ARPT.

There are certain companies and partnerships excluded from the 15% charge as follows:

- a company does not include a company acting in its capacity as a trustee of the settlement;

- a bona fide property development business is excluded provided

that:

- the property is acquired in the course of a bona fide property development business; and

- the business has been operating for a minimum of two years; and

- the property was purchased with the intention of re-development and re-sale (note that development and letting is not excluded).

- charities are excluded from the charge.

These exclusions will be in point until Royal Assent of the Finance Bill 2013 (June / July).

The draft legislation and summary of proposals published on 11 December 2012 include a number of significant modifications to the scope of the 15% rate.

It is proposed that there will be a series of reliefs from the 15% SDLT rate (so that SDLT is instead charged at 7%) for genuine property businesses purchasing residential property for over £2million. It is intended that where possible, these reliefs will operate in tandem with the reliefs detailed above in relation to the ARPT. The result being that generally a transaction to which the 15% rate of SDLT is charged is also liable to the ARPT.

The most significant new reliefs will apply to persons running property rental and property trading businesses. Furthermore, the two year trading condition referred to above for property developers is also to be removed.

Relief may be withdrawn if within three years of acquisition, the dwelling ceases to be used for a relievable purpose or the dwelling is occupied by any person connected with the owner (except for farmhouses and houses exploited for public access).

Existing Structures - What should be done now

There will be no generic right answer for all types of structure; each one will need to be considered taking account of the individual facts of the situation.

In each case it will be necessary to undertake cost analysis of maintaining or dismantling an existing structure, as well as the tax consequences of each alternative.

In some circumstances it would be preferable to keep existing structures and pay the new taxes so as to keep the current UK inheritance tax protection. Property owners may also have concerns about property tax charges in other jurisdictions.

Others will need to consider the SDLT and CGT consequences of dismantling a structure and their future IHT exposure. The position will depend to a large degree on the residence and domicile status of the individual concerned.

Draft legislation on the CGT charge is due in January 2013 and it would be wise to wait until this has been published before undertaking any restructuring of existing property structures. As the Government has confirmed that a form of rebasing will be available such that it is only the gain accruing post 6 April 2013 that will be subject to the new CGT charge, for some there may no longer be such an urgency to complete any restructuring prior to 6 April 2013. However, for others completing any restructuring prior to 6 April 2013 would still be sensible, prior to potential changes including the introduction of a general anti-abuse rule (due to apply to transactions after the date that the Finance Act 2013 receives Royal Assent).

Please Note

We have taken care to ensure the accuracy of this publication, which is based on material in the public domain at the time of issue. However, the publication is written in general terms for information purposes only and in no way constitutes specific advice.

You are strongly recommended to seek specific advice before taking any action in relation to the matters referred to in this publication. No responsibility can be taken for any errors contained in the publication or for any loss arising from action taken or refrained from on the basis of this publication or its contents.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.