Lawmakers are scheduled to return to Washington in the wake of the election to convene a lame duck legislative session that will focus heavily on unfinished tax issues.

The election did not change the current balance of power in Washington and does not necessarily settle the outlook for tax legislation for the rest of 2012 and the future. Democrats will keep the White House and retain their slim majority the Senate, while Republicans will retain a comfortable majority of approximately 238 to 197 in the House after dropping a projected 15 seats. Any resolution on the unfinished tax items before the end of the year will depend on both parties' willingness to strike a deal. The important tax issues for consideration include:

- expired provisions like tax "extenders" and the alternative minimum tax (AMT),

- new Medicare taxes scheduled to take effect in 2013,

- the Bush-era tax cuts scheduled to expire at the end of 2012, and

- current estate and gift rules scheduled to expire at the end of 2012.

The election results also do not necessarily clarify the long-term outlook for tax reform, which may depend heavily on economic and budget challenges.

Because the balance of power in Washington will shift very little in 2013, lawmakers should have flexibility to come together on a compromise before the end of the year. But deep divisions remain between the parties. The president campaigned on a pledge to veto any bill extending the tax cuts on income over $200,000 for single filers and $250,000 for joint filers. House Republicans, meanwhile, have opposed all tax increases, and House Speaker John Boehner, R-Ohio, said last night that the retention of the Republican majority in the House means there is "no mandate for raising tax rates."

If Republicans refuse to budge, it could pressure the president to stand by his pledge to let the tax cuts expire unless they are rolled back for high-income earners. But there are many factors that should force lawmakers to find common ground. The expiration of the cuts will coincide with major debt and spending issues. Unpopular mandatory spending cuts are scheduled to begin in 2013, just as the Treasury again approaches its statutory debt limit. Economists have warned that the combination of the expiration of tax cuts and the forced spending "sequestration" represent a fiscal cliff that could throw the country back into recession.

The fragile state of the recovery and the shared responsibility for the welfare of the country under a divided government should motivate lawmakers to address all of these issues as part of a large compromise package. Plus, there is broad bipartisan support for reinstating many tax extender provisions and addressing the AMT, and these issues essentially need to be tackled before the end of the year.

Potential outcomes

Expect lawmakers to look for an agreement on all the debt and tax issues as part of a package. There are many potential areas for compromise. Lawmakers could give ground on some tax issues to secure agreements on others, or trade concessions on spending issues for concessions on tax issues. Democrats may offer to extend the tax cuts up to an income threshold exceeding $200,000 and $250,000, as several Democrats hinted earlier in the year. Or Democrats could propose "decoupling" the tax cuts by extending them for a short period for high-income taxpayers and a longer period for everyone else.

Lawmakers are likely looking for only a short-term agreement that would allow them to address the debt and tax issues more permanently next year. Democrats may be willing to agree to extend all the tax cuts for a short period in order to avoid the fiscal cliff if future revenue triggers or opportunities to renegotiate are built in. Both Republicans and Democrats have discussed tax reform over the past two years, and the president recently said in an interview that he believed he and Republicans could reach a "grand bargain" to reform entitlements and the tax code during the next six months. The president and Boehner came close to reaching such a bargain during debt negotiations over the summer but could not agree on how much revenue should be raised through tax reform.

Several tax issues do not currently appear to be part of the discussion. The administration is unlikely to agree to postpone or repeal the Medicare tax as part of any compromise. The Medicare taxes were enacted to help fund the 2010 health care reform bill, which the president has fiercely defended. In addition, there seems to be little momentum for extending recent economic recovery tax incentives such as 100% bonus depreciation or the reduced 4.2% rate on the individual share of Social Security taxes.

For more information on the tax issues facing the lame duck session, see the following.

Tax issues for lame duck session

2001 and 2003 tax cuts

Without legislation, the expiration of the 2001 and 2003 tax cuts would result in:

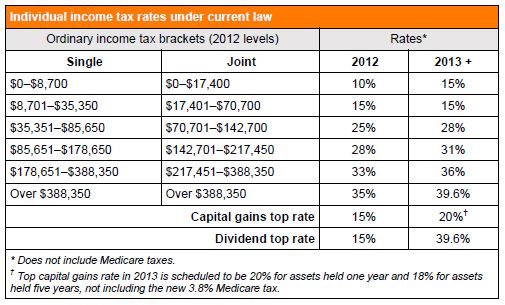

- rate increases across all tax brackets, with a top rate of 39.6% (see chart);

- an increase in the capital gains rate from 15% to 20%;

- the reinstatement of the personal exemption phaseout (PEP) and "Pease" phaseout of itemized deductions; and

- the end of marriage penalty relief, the $1,000 refundable child tax credit and several other benefits, including increased dependent care and adoption credits, and enhanced education incentives.

Estate and gift

The current, gift and generation-skipping transfer (GST) tax rules for 2012 generally provide:

- reunification of estate and gift taxes with a 35% rate and a $5.12 million exemption,

- identical rate and exemption for GST tax, and

- portability in estate tax exemption amounts between spouses.

If no legislation is enacted, the estate, gift and GST taxes would all revert to the rules in place in 2000, with top rates of 55% and exemptions of just $1 million.

Medicare tax and health care reform

New Medicare taxes enacted in the health care legislation are also scheduled to take effect in 2013. First, the rate of the individual share of Medicare tax will increase from 1.45% to 2.35% on earned income above $200,000 for single filers and $250,000 for joint filers. The 1.45% employer share will not change, creating a top rate of 3.8% on self-employment income. Second, investment income such as capital gains, dividends and interest will be subject for the first time to a 3.8% Medicare tax to the extent AGI exceeds $200,000 (single) or $250,000 (joint). This tax will not apply to active trade or business income that is not otherwise considered to be self-employment income, or to distributions from qualified retirement plans.

Extenders and AMT

Dozens of popular tax provisions expired at the end of 2011, including:

- research credit,

- special 15-year recovery periods for qualified leasehold improvements and qualified restaurant and retail property,

- alternative fuel credit (including propane used in forklifts),

- work opportunity credit,

- new markets tax credit,

- 100% exclusion from gain on qualified small business stock,

- wind energy production credit,

- the ability to take the Section 48 credit in lieu of the Section 45 credit,

- the Subpart F "active financing" exception and the "look through" treatment for payments between related controlled foreign corporations (CFCs), and

- increased limits on Section 179 expensing.

In addition to these extenders, Congress must address the AMT, which would affect millions more taxpayers in 2012 if the exemptions are not adjusted.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.