California, the world's fifth-largest economy and 18th in total carbon emissions if it were a separate country1, is rapidly moving forward with the development of its cap and trade program scheduled to be implemented in 2013. This has drawn a lot of attention from businesses generating high quantities of carbon emissions or who consume large amounts of energy or fuel. Carbon futures linked to Californian's cap and trade program slipped recently2, but after a test auction in late August 2012, news articles reported that major banks are weighing whether to wade into the California carbon market, which experts believe could grow into a $40 billion-a-year market by 2020. The California state legislature passed Assembly Bill 32 (AB 32) in September 2006 requiring the state to reduce greenhouse gases emissions to 1990 levels by 2020, a 17 percent reduction—and eventually to an 80 percent reduction by 2050. There are complications to the California cap and trade system that do not exist in other cap and trade programs to date. For example, California's program covers all six "Kyoto" GHGs—a multi-gas-wrinkle that the EU-ETS will only be tackling in this, its third compliance period. Further, the California Air Resources Board (CARB) retains the ability to reverse trades of carbon offsets or credits in order to enforce holding limits under the CARB regulations. These will present unique challenges to compliance entities, as well as to the brokers, traders, suppliers, and others trying to create a new carbon market. To understand the basic underpinnings of the California cap and trade system, this Alert sets forth design elements of the system: the "what, who, when, and hows" of cap and trade under AB 32.

WHAT is cap and trade?

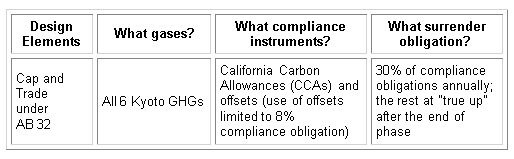

- A key element of AB 32's GHG emissions reduction

requirements is the Cap and Trade Program that was adopted in

December 2011. The Cap and Trade Program creates a carbon market in

which major emitters of GHGs may buy, sell, and trade GHG

compliance instruments.

- At the end of the compliance period, covered entities must

relinquish these compliance instruments to CARB via a registry

account in an amount equal to their GHG emissions.

- The cap starts at expected business-as-usual emissions levels in 2012, and declines 2 percent to 3 percent per year through 2020.4 Fewer and fewer allowances are available each year, requiring polluters to reduce their emissions or pay increasingly high allowance prices.

WHAT is an allowance? An allowance is a

compliance instrument equal to one ton of carbon dioxide. Under the

California cap and trade system, the sole type of allowance

recognized is a carbon credit called a CCA. Offsets can also be

used to meet compliance obligations.

HOW do offsets play in the program?

- Offsets are pollution reductions that occur outside of capped

sectors, but that can be used to meet compliance obligations under

the cap and trade program.

- An entity may meet no more than 8 percent of its compliance

obligation with offsets.5

- To date, CARB has approved only four offset project types. Each

offset must comply with detailed accounting and reporting

requirements (known as an "offset protocol") and all

offsets must be verified by a third party.6

- Offset credits can only be generated by projects located in the United States – no international offsets can be used in the California program at this time.7 Further, California is discouraging the use of offsets by introducing risks for compliance entities using offset to meet compliance obligations (e.g., "buyer liability" associated with invalidated offsets).

For more discussion of the "offset" issue under the

California cap and trade program, see our accompanying Client Alert

"Client Alert: AB 32 and Offset

Basics."

WHAT is the cap? The program contains three

compliance periods: (1) 2013-2014; (2) 2015-2017; and (3)

2018-2020. According to the draft regulations, the California

carbon market will be comprised of 2.7 billion allowances from

2013-2020, starting with 162.8 million metric tons of carbon

dioxide equivalent (MtCO2e) in 2013 under the cap.8 AB

32 defines "greenhouse gases" as carbon dioxide, methane,

nitrous oxide, sulfur hexafluoride, hydrofluorocarbons,

perfluorocarbons and other fluorinated gases specifically

identified in the regulations.9 The aggregate cap

includes a cap for the electricity distribution industry of

97.7 million MtCO2e, which is further reduced by an

"adjustment factor" to 98.1 percent, for a total cap

of 95.8 million MtCO2e in 2013.10 Industrial

sectors and other regulated sectors are treated differently from

the electricity sector. These sectors do not have a numerical total

allocation number, but instead receive the allowances remaining

after the electric distribution sector receives allowances (and

CARB takes a "reserve" portion).

WHO is a "covered entity"? By 2020, the cap and trade program will cover 85 percent of California's emissions and an estimated 22.5 percent of necessary emission reductions under AB 32.11

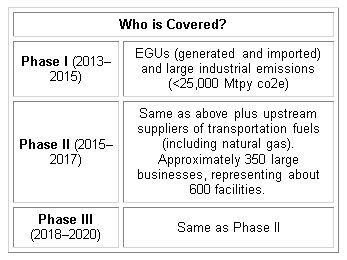

In the first compliance period (2013-2014), scope includes:

- All electricity generated and imported into California. The

first deliverer of electricity into the state is the capped entity

(the one that will have to purchase and surrender

allowances).

- Large industrial facilities emitting more than 25,000 tons of GHG pollution/year. Examples include oil refineries and cement manufacturers.

the second compliance period (2015-2017), scope expands to:

- Distributors of transportation fuels (including gasoline and diesel), natural gas, and other fuels. The regulated entity will be the fuel provider that distributes the fuel upstream (not the gas station).

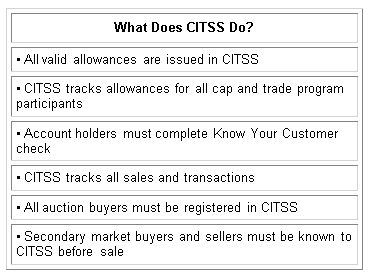

WHO can trade? The short answer is that

anyone with a Compliance Instrument Tracking System Service

("CITSS") account can trade. California will use CITSS as

a registry and transaction log for compliance instruments. To

participate in California's cap and trade program, an

individual or entity must have a CITSS account to hold, transfer,

and retire compliance instruments (allowances or offsets).

Thus, the CITSS is a key component of a multi-jurisdiction

administrative system being developed to support the implementation

of state and provincial greenhouse gas (GHG) emissions trading

programs. It is important to note, however, that the CITSS is not

the auction platform and will not manage the auction. CARB's

cap and trade auction will be managed by Markit North America

and Deutsche Bank13

WHAT is CITSS? The primary purpose of the CITSS is to serve as an account and transaction registry to accommodate:

- Account management for compliance entities, including industrial sources and non-emitting units (e.g., load-serving entities)

- Account management for non-compliance entities, including registry administrators, government agencies or representatives, brokers, non-governmental organizations, and private citizens

- Allowance and offset transaction tracking and management14

Under the California program, multiple parties may be registered and involved in holding, trading and selling allowances. First, there are covered entities. These are the actual facility operators with associated GHG emissions. Second, there are opt-in covered entities that do not exceed the inclusion thresholds to be a covered entity, but that wish to voluntarily opt-in to the cap and trade program. Third, there are also voluntarily associated entities that may hold compliance instruments. This includes entities that intend to purchase, hold, sell or voluntarily retire compliance instruments (like traders and banks), entities operating offset projects, and entities providing clearing services that take temporary possession of compliance instruments. Finally there are other registered participants that do not qualify to hold compliance instruments (these include parties such as verification bodies and registries).

Multiple types of accounts are also created for registered entities. These include holding accounts, limited use holding accounts, compliance accounts and exchange clearing house holding accounts.

Other than covered and opt-in covered entities, no geographic

restrictions are associated with becoming a registered entity.

However, in the registration process, the registering party must

provide detailed disclosure information regarding direct and

indirect corporate associations with other registered

entities.

WHEN do "covered entities" require emissions

allowances? Starting in 2014, entities must annually

surrender allowances equal to 30 percent of their verified

emissions from the year before.16 At the end of each

compliance period at "true up," each entity must

surrender allowances or offsets equal to all of the pollution it

has emitted in the compliance period adjusted for the surrender

obligation by Nov. 1 of the following year. Compliance entities can

meet their allowance obligations through a combination of on-site

emissions reductions, allowance purchases, and verified reductions

made at other sources (i.e., offsets).

There are two ways to get an allowance initially: get it for free

or buy it. After that, entities can purchase and sell allowances

among themselves (bilateral trades). One of the controversial

aspects is how regulated facilities will receive their emission

allowances: some sectors will receive allowances through free

allocations issued by CARB, while other sectors will be required to

purchase allowances via auctions or market-based trades. For

more discussion of the "auction" under the California cap

and trade program, see our accompanying Client Alert "Client

Alert: AB 32 and Auction Basics."

Footnotes

1 The AB 32 Challenge: Reducing

California's GHG Emissions, Los Angeles County

Economic Development Corp (2008)

2

http://www.bloomberg.com/news/2012-08-30/california-s-simulated-carbon-auction-seen-as-slam-dunk-.html

3

http://www.reuters.com/article/2012/09/07/us-california-carbon-idUSBRE88600S20120907

4 Sec 95841 Table 6-1

5 Sec 95971

6 Sec. 95973

7 Sec 95971 (although there is room in the program for

approval of other offsets at a later date)

8 Based on allowance budgets in 2013 and the auction price

floor of $10 per metric ton (discussed infra), the California

allowance market value would be worth $1.6 billion. By comparison,

850 million MtCO2e traded in 2009 in the Regional Greenhouse Gas

Initiative (RGGI) program in the Northeast United States, with a

value of more than $2 billion. Both of these U.S. markets, however,

will continue to lag behind the EU-ETS, which saw more than 11

percent growth in the allowance market in 2011 for a total value of

more than $118 billion. (See, State and Trends in

Carbon Market, Carbon Finance at the World Bank, May

2012.)

9 For comparison, other successful cap and trade programs

are limited to single pollutants (e.g., in the case of Phase I and

II of the EU-ETS, and RGGI, carbon dioxide).

10 Sec 95812(c)

11 CARB's Supplement to the AB 32 Scoping Plan, page

20

12

http://www.arb.ca.gov/cc/capandtrade/markettrackingsystem/markettrackingsystem.htm

13

http://www.arb.ca.gov/cc/capandtrade/auction/auction.htm

14

http://www.arb.ca.gov/cc/capandtrade/markettrackingsystem/markettrackingsystem.htm

15

http://www.arb.ca.gov/cc/capandtrade/markettrackingsystem/markettrackingsystem.htm

16 Sec 95856(a)-(g)

17 Id.

18 As another controversial matter, the cap on

non-electrical emissions declines more rapidly than the cap on

electrical sector allocations. Electrical sector allocations

decline a total of 13.3 percent from 2013 to 2020, while industrial

and other sector allocations decline 20.5 percent from 2015 to

2020.

This article is presented for informational purposes only and is not intended to constitute legal advice.