The Canada Not-for-profit Corporations Act, S.C. 2009, c. 23 (NPCA) came into force on October 17, 2011. The NPCA supersedes Part II of the Canada Corporations Act (CCA), the former federal legislation for those seeking to incorporate a not-for-profit corporation (NFP). The CCA has long been recognized as outdated, having been last substantially revised in 1919. The NPCA is intended to provide a comprehensive framework, covering all aspects of corporations without share capital incorporated at the federal level. The NPCA mirrors the Canada Business Corporations Act (CBCA) in several respects, providing a familiar framework for practitioners to work with.

The main objective of the NPCA is to bring the advantages of a modern corporate statute to the not-for-profit sector. In Alberta, the practice has been to use Part IX of the Companies Act and in Ontario, to use the Corporations Act. Both of those acts are largely out of date and thus the proposed federal legislation will be the most modern available Canadian legislation.

Advantages of the NPCA

- The NPCA streamlines the incorporation process for NFPs by permitting incorporation as of right. Under Part II of the CCA, the Minister had to approve the issuance of letters patent to the NFP. In contrast, under the NPCA, filing may be made electronically and approval of incorporation is automatic as long as the statutory requirements are satisfied.

- The NPCA gives an NFP the powers and capacity of a natural person, including the right to buy and sell property, to make investments and borrow money and to issue debt obligations.

- It is not necessary to pass a by-law in order to confer any particular power on a corporation or on its directors.

- The NPCA replaces the cumbersome process for amending by-laws under the CCA, which required the approval of members and Corporations Canada. Under the NPCA, directors have the power to pass or amend bylaws. These by-laws take immediate effect and remain in effect unless the members fail to confirm them at the next annual meeting. No government approval is required.

- Under the NPCA, directors of NFPs are subject to the same duty and standard of care as directors of business corporations incorporated under the CBCA. The NPCA also provides directors with a due-diligence defence against potential liabilities.

- The NPCA expressly permits the indemnification of directors and the purchase of insurance for directors and officers.

- The NPCA mirrors the CBCA with respect to the procedures for the disclosure of a director's interest in any material contract with the NFP.

- The NPCA sets out the rights of members of the corporation concerning voting, attending and calling meetings. It allows for absentee voting by proxy, mailed-in ballots and telephone or electronic means.

- NFPs will no longer be required to have a corporate seal.

Soliciting vs. Non-Soliciting Corporations

The NPCA divides NFPs into soliciting and non-soliciting corporations. Soliciting corporations are basically those seeking donations from the public. The premise of the distinction is that NFPs receiving funds from members of the public should be subject to stricter standards of disclosure and governance than those which do not.

The characterization of an NFP as either a soliciting or nonsoliciting corporation has several implications. For example, upon wind-up, the residual assets of a soliciting corporation must be distributed exclusively to "qualified donees" under the Income Tax Act. By contrast, there are no restrictions upon the distribution of the residual assets of a non-soliciting corporation. Soliciting corporations must have a minimum of three directors, at least two of which must not be officers or employees of the NFP. Non-soliciting corporations may have only one director and there are no restrictions on the number of directors from management.

A soliciting corporation is one that receives income in excess of a prescribed amount ($10,000, based on the regulations) within a prescribed period (the last financial year, based on the regulations) from the following sources:

1. Public donors (persons who are not members, directors, officers or employees of the NFP or persons who are not related by blood, marriage or cohabitation arrangement to members, directors, officers, or employees);

2. Governments or governmental agencies (federal, provincial, or municipal); or

3. Other soliciting corporations or entities that have received funds in excess of the prescribed amount over the prescribed period from the sources outlined above (intended to capture indirect contributions).

The relevant point in time for assessing the status of a donor is when the request for funding is made. As a result, a donation from a person who is not an existing member, director, officer, or employee at the time of the request for funding but who becomes a member, director, officer, or employee of the NFP after giving a donation is included in determining whether an NFP has crossed the monetary threshold. Once an NFP has crossed the monetary threshold for solicitation, it becomes a soliciting corporation on the date of its next annual meeting and ending (unless extended by revenues from a subsequent fiscal year) at the annual meeting held three years later.

Continuances

Every NFP governed by Part II of the CCA has until October 17, 2014, to formally make the transition to the NPCA before the Director (as defined by the Act) will take steps to dissolve the corporation. Continuances are not limited to CCA Part II companies. Non-profit corporations established pursuant to provincial statutes may also be continued under the NPCA if permitted by the laws of its home jurisdiction. Such continuances will ordinarily require a special resolution of members. It will not be possible for organizations incorporated under the Societies Act, R.S.A. 2000, c. S-14 or the Companies Act, R.S.A. 2000, c. C-21 to continue, since these statutes do not permit continuations outside of Alberta.

The procedure for filing a continuance requires the submission of articles of continuance to the Director in the prescribed form. The articles of continuance must contain the following information:

- The name of the corporation;

- The location of the registered office;

- The number of directors (or a minimum and maximum number);

- The classes or groups of members that the corporation is authorized to establish, and if there is more than one class or group, the voting rights attached to each of those classes or groups;

- Any restrictions on the activities that the corporation may carry on;

- A statement of the purpose of the corporation; and

- A statement concerning the distribution of the property of the corporation.

Protection of Corporate Name

The name of an NFP incorporated under the CCA and continued pursuant to the NPCA will be protected; however, the name of provincial corporations continued under the NPCA may not be protected. The name of a provincial corporation is only protected in the jurisdictions in which it is incorporated and extra-provincially registered. In contrast, the name of a federal corporation is protected across Canada.

A provincial corporation continuing under the NPCA will need to run a NUANS search when filing its articles of continuation to ensure that there are no conflicting names. An NFP can reserve a name for a prescribed period (90 days, based on s. 58 of the regulations).

Extra-Provincial Registration

NFPs incorporated pursuant to the NPCA must register extraprovincially in Alberta, Ontario, and several other provinces. In Alberta, the standard fee is $100, but the Registrar has the power to waive the fees for corporations that do not operate for the purpose of gain.

Charitable Status Issues

An NFP which is a registered charity and which is continued pursuant to the NPCA will have to adopt voluntary restrictions on its activities to ensure that it does not lose its designation as a registered charity pursuant to the Income Tax Act. By itself, however, a continuation should not affect the charitable status of an NFP.

Financial Reporting and Disclosure Requirements

The board of directors must approve all financial statements of the NFP. The financial statements must be signed by at least one director. Subject to the by-laws, the board must also send financial statements to the members within a prescribed period prior to the annual meeting. To avoid having to send financial statements to all members, an NFP should pass a bylaw allowing any member to inspect the financial statements or obtain a copy for a fee.

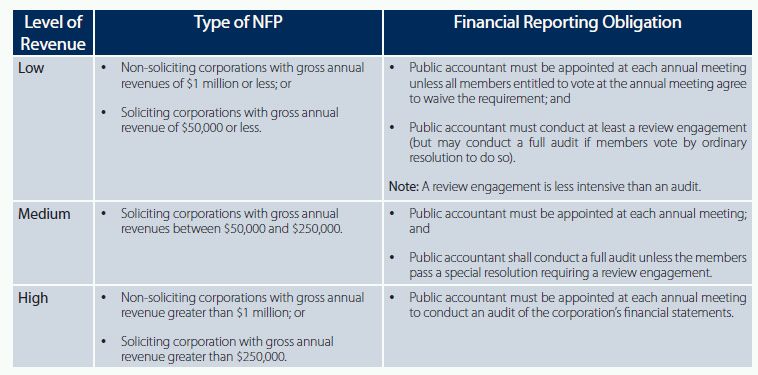

The NPCA imposes different financial reporting requirements on NFPs, depending on their status as either a soliciting or non-soliciting corporation and depending on the amount of revenue they receive. Revenues are not specifically defined in the NPCA. The table below outlines the relevant financial reporting obligations of an NFP:

Soliciting corporations are required to file annual financial statements with Corporations Canada, where they are available for inspection or copying by the public.

Unanimous Members'

Agreements The NPCA allows for a unanimous members' agreement (UMA), or in the case of an organization with only one member, a unanimous member declaration. However, UMAs are restricted to non-soliciting corporations only. Unless otherwise provided for in the agreement, a UMA may be terminated by a special resolution. Therefore, in order to avoid this odd result, a UMA should expressly deal with how the agreement may be terminated.

Remedies

The NPCA expands the remedies of members of an NFP by allowing them to bring a derivative action to assert the rights of the corporation and to bring an oppression claim against the corporation. It remains to be seen how frequently these provisions will be used and how effective they will be.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.