Welcome to the latest edition of our Quarterly Corporate Update covering recent developments in the British Virgin Islands.

Q3 of 2023 has been a busy quarter for the BVI office. Our corporate team continued to advise on several of the jurisdiction's leading transactions, while also contributing various thought leadership pieces to assist clients in understanding a number of company law developments and legislative changes affecting BVI companies and registered agents.

Transactions

Among the highlights, partner Rachael Pape advised B2Gold Corp. (TSX: BTO) (NSX: B2G) in relation to an up to USD60 million purchase agreement with AngloGold Ashanti Limited to acquire AngloGold's 50% stake in the Gramalote Project, located In the Department of Antioquia, Colombia. B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, B2Gold has operating gold mines in Mali, Namibia and the Philippines, as well as numerous exploration and development projects in various countries including Mali, Colombia, Finland and Uzbekistan. Since completing the acquisition on 5 October 2023, B2Gold now owns 100% of the Gramalote Project.

Rachael and associate Nina Goodman also advised AdvancedAdvT Limited (LSE: ADVT) on its acquisition of five software businesses from Capita plc. for a combined enterprise value of approximately GBP33 million, funded by the company's cash reserves. In 2022, the acquired businesses generated a total revenue of approximately GBP35 million. AdvancedAdvT Limited was formed for the purpose of acquiring and investing in digital technologies.

Counsel Nicholas Kuria advised long-standing client, Commonwealth Bank of Australia, alongside Clifford Chance, Sydney, in connection with a five-year AUD500 million syndicated credit facility, with an AUD100 million accordion option, to Gold Fields Limited (JSE, NYSE: GFI) as borrower. The new financing is one of the first sustainability-linked loan transactions in the Australian mining industry and the first for a gold mining company in the country. Under the terms of the financing, Gold Fields has committed to driving positive social and environmental change by embedding ambitious targets in a new sustainability-linked loan backed by a syndicate of ten Australian and international banks.

In addition, partner Anton Goldstein and associate Nina Goodman advised Dubai-headquartered firm Telegram Group, Inc. in connection with its issuance of USD210 million bonds sold to private investors. The Conyers BVI team worked alongside Skadden, Arps, Slate, Meagher & Flom (UK) LLP on the transaction.

Publications

Our attorneys continued throughout Q3 to produce thought leadership articles covering a range of pivotal issues and developments impacting offshore entities and the BVI. These include articles outlining the restoration process for BVI companies struck off before 1 January 2023, new annual return requirements for BVI companies, anti-money laundering measures in the BVI and their impact on BVI funds, as well as the use of BVI companies in avoiding succession problems.

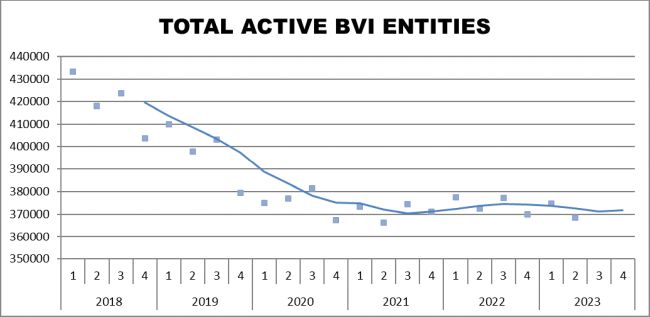

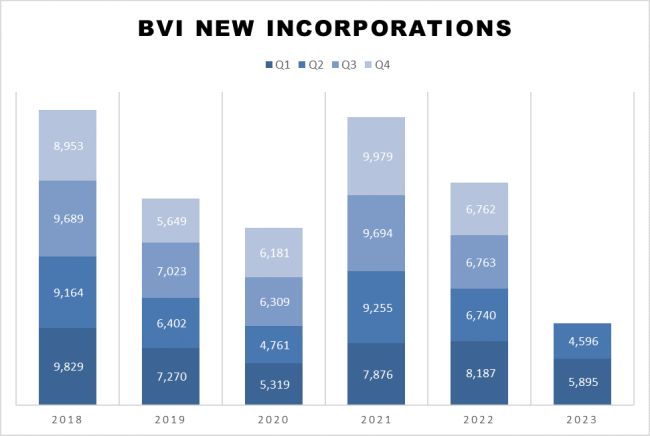

Incorporation Statistics

To help provide an overview of the BVI market, every quarter we provide information on the numbers of new BVI incorporations, total active BVI entities and registered investment funds. We hope they help provide a snapshot of the BVI market.

https://www.bvifsc.vg/sites/default/files/q2_2023_statistical_bulletin.pdf

Source: Statistical Bulletin of BVI FSC.

Source: Statistical Bulletin of BVI FSC.

*Figures for 2023 are as at 30 June 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.