Mexico is the second largest economy in Latin America and is growing at an astonishing rate. Despite a slight deceleration in growth in 2018, mostly triggered by a struggle to recover from the earthquakes in September 2017 that shook, economically and physically, the capital to its core, Mexico is comfortably one of the most influential economies in the world and is estimated to be the 7th largest global power in the world by 2050. The most popular legal structures in Mexico are: Corporation (S.A), Sociedad Anónima de Capital Variable (SA de CV), and Limited Liability Company (S de RL).

In recent years, a number of highly competitive industries have flourished and have rendered the Mexican market a far more varied, dynamic and interesting platform for foreign investment than ever before.

SA de CV & S de RL de CV. Types of Legal structures in

Mexico

One new market that has experienced particular success in recent years is the emergence of new markets such as the production of medical equipment and devices. As of 2016, this industry is valued by ProMexico, the governmental agency responsible for encouraging foreign investment, at over USD$13 billion.

This same report highlights savings of over 20% when compared to fabrication in the US. This industry, as typifies all emerging industries in Mexico, is driven by an incredibly well educated, and economically accessible workforce. This 'Holy Trio' of innovative industries, cheap fabrication costs and a qualified workforce can be applied to any of the countless emerging industries and has been the crucial distinguishing factor between Mexico and other emerging economies.

The most straightforward way to tap into the goldmine of opportunities that exist is to incorporate a Mexican company directly into the local market. The following article will focus on the 3 most common and most important types of companies/legal entities that can be formed in Mexico. Keep reading or go ahead and contact us now to discuss how we can be of assistance.

These are the types of legal structures in Mexico:

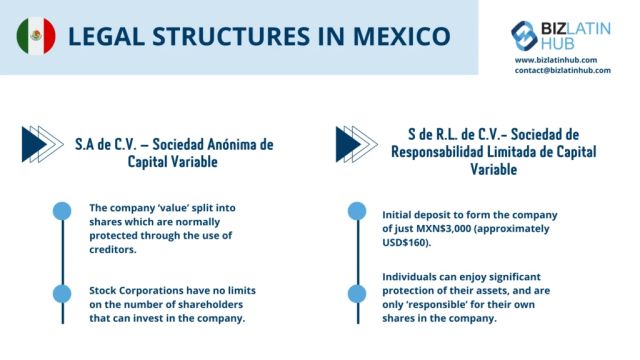

- S.A de C.V. – Sociedad Anónima de Capital Variable (Stock Corporation)

- S de R.L. de C.V.- Sociedad de Responsabilidad Limitada de Capital Variable (LLC- Limited Liability Company)

- SAS- Sociedad por Acciones Simplificada (Simplified Shares Company)

It is also worth noting that there are two more categories:

- SAPI: Sociedad Anónima Promotora de Inversión (Stock Corporation for Investment Promotion)

- SOFOM: Sociedad Financiera de Objeto Múltiple (Multi Purpose Financial Company)>

REMEMBER: These final two corporate structures focus on companies looking to enter the Mexican Stock Exchange (Bolsa Mexicana de Valores, also referred to as the MexBol or the BMV). For this reason this article will not go into detail on these structures. If you have any queries regarding these company types, do not hesitate to get in touch with our team.

S.A de C.V. – Sociedad Anónima de Capital Variable (Stock Corporation)

The key facts for the Stock Corporation and most popular legal structure in Mexico are:

- The company is formed and the company 'value' split into shares which are normally protected through the use of creditors.

- Stock Corporations have no limits on the number of shareholders that can invest in the company. This means that raising the necessary capital (MXN$50,000 – approximately USD$2,700) is very achievable for new companies as an unlimited number of people can contribute.

- Although this structure includes certain bureaucratic and administrative burdens, it is undoubtedly the structure that has the largest potential for growth and profit.

SA de CV. Accounting and taxation in Mexico. Sociedad

Anónima

S de R.L. de C.V.- Sociedad de Responsabilidad Limitada de Capital Variable (LLC- Limited Liability Company)

The second most popular typeof legal structures in Mexico is the Limited Liability Company. It is also based on shares and has the following distinguishing features:

- An LLC is very accessible for SMEs with an initial deposit to form the company of just MXN$3,000 (approximately USD$160).

- Another advantage is that taxes are paid through individual members tax return, rather than as a collective company.

- Individuals can enjoy significant protection of their assets, and are only 'responsible' for their own shares in the company, as suggested by the name.

SAS- Sociedad por Acciones Simplificada (Simplified Shares Company)

The third major legal structure in Mexico is the SAS, which is mirrored in other Latin America jurisdictions such as Argentina and Colombia. It is a relatively new concept that was announced in 2016 as part of the reforms to the General Law of Commercial Companies. The advantage of this structure is clear and stems from the very reason that this structure was introduced. Mexico is making significant steps to open up their market for foreign investment, and have made many reforms to different pieces of commercial legislation to simplify and encourage foreign operations. The SAS is a perfect example of this.

Some key characteristics of the Mexican SAS include:

- A relatively cheap, fast and simple formation process and corporate structure, and is ideal for SMEs looking for an easy route-to-market.

- One potential problem involved with this corporate structure is the fact that there is an annual maximum permissible profit of MXN$5,000,000 (approximately USD$265,000). For this reason, the SAS is preferred amongst SMEs as opposed to multinationals looking to expand operations.

Steps for LLC formation in Mexico. SA de CV. Sociedad

Anónima

Don't Forget: It is possible to adjust your legal entity to have a new corporate structure if your company reaches a point where it is making profits exceeding this limit of MXN$5,000,000.

Your specific business objectives and requirements will impact on the ideal corporate structure for your company. Before jumping in and incorporating a type of legal structures in Mexico, it is best to consult with local experts who can guide you towards the best type of legal structure based on your Mexican operations.

Originally published 21 September, 2018 | Updated on: 27 June, 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.