Dealmakers Diverge on PE Outlook Amid Market Uncertainty

Middle-market private equity (PE) firms have mixed expectations for the U.S. mergers and acquisitions (M&A) market in 2023, citing high inflation and concern that interest rates will keep climbing-but dealmakers are maintaining cautious optimism in key sectors. Though many investors expect to make additional acquisitions, some are bracing for a challenging regulatory environment, while others are prioritizing alternative deal types to mitigate impacts from macroeconomic volatility.

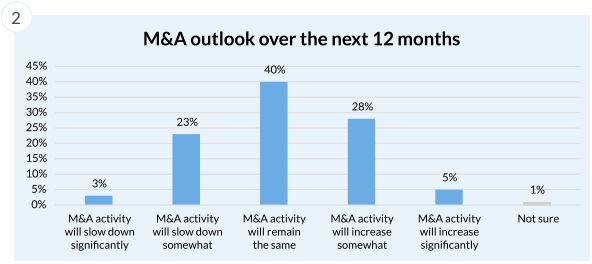

That split outlook is reflected in this report, which is based on a survey of 100 U.S. middle-market PE dealmakers engaged in a diverse array of industries, including financial services, education, health care, insurance, manufacturing and industrial, media and entertainment, real estate and technology. Nearly three-quarters of investors expect deal activity in 2023 to either remain at the same level as last year or increase (40 percent and 33 percent, respectively), while over a quarter (26 percent) expect a slowdown.

The amount of dry powder that PE firms have on hand could be driving this disconnect-especially as an overheated economy, domestic policymaking and geopolitical tensions come to a boil. With debt markets tightening and financing harder to procure, liquidity has become crucial to snapping up deals. Though some dealmakers have struggled, others have taken advantage of lower valuations to expand on investments in technology and finance. With the darkening clouds of a potential recession on the horizon-and a clearer picture of what a post-COVID-19 economy will look like-it should come as no surprise that while the majority of market players don't anticipate a deal slowdown in 2023, they are not overwhelmingly bullish either.

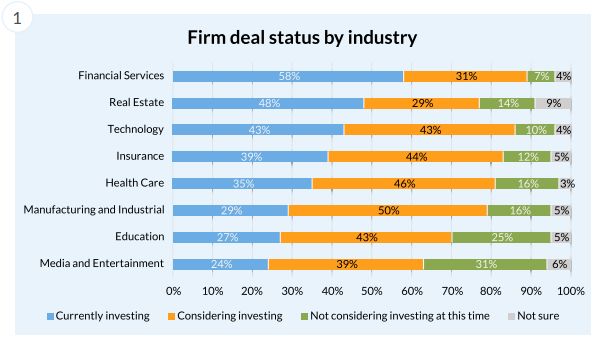

When it comes to individual sectors, some dealmakers remain optimistic despite recent media reports of tech and financial sector layoffs, falling stock prices and signs of slowdowns in key industries. More than half of PE firms (58 percent) are investing in financial services, the leading sector, followed by real estate at 48 percent and technology at 43 percent. Further, respondents see ample opportunity in technology and finance, with dealmakers seeing the potential to leverage falling valuations in the tech industry as well as transformational opportunities in the finance sector in the coming months.

Those factors have spurred a series of swift and varied strategies from investors, many of whom have pivoted toward all-equity backstopped deals to gain an upper hand in the bidding process. This deal structure requires that private equity firms agree to fund the full purchase price of a company upfront if they are unable to get debt financing in place prior to the closing date. All-equity deals are viewed by some as particularly aggressive in today's debt-constricted market; however, they ranked as the most important element in successful deal creation in 2023, and a majority of respondents anticipate an uptick in all-equity transactions moving forward.

Whether the current political and economic turbulence will dampen M&A or spur additional activity, it's clear that 2023 presents a wide range of opportunities for dealmakers - even if that means adopting new acquisition strategies to adapt, and thrive, in the face of global market disruption.

M&A Market Remains Buoyant in the Face of Economic Uncertainty and Rate Hikes

WHAT IS YOUR FIRM'S CURRENT STATUS WHEN IT COMES TO THE DEALS IN THE FOLLOWING INDUSTRIES?

HOW DO YOU SEE THE OUTLOOK FOR M&A OVER THE NEXT 12 MONTHS?

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.