In India, job security is the most vital issue we face, regularly, and if you are a youngster, it becomes more difficult for you to sustain a job. The worst phase was seen during the pandemic (COVID-19), people were forced to do overtime to save their jobs without the actual payment for their overtime. This was the issue that white-collared employees faced but what about the migrant labour class or minimum wage labour, for them, the pandemic was the most horrendous ever possible, losing their livelihoods and whatnot. They had to deal on many fronts and do overtime on their jobs without a genuine pay scale.

It is the need of the hour, that people educate themselves concerning this issue.

INTRODUCTION

Overtime payment is the concept that people don't have proper knowledge about or are just misinformed regarding its law and regulations. Governments trying their foremost to give dignified and respectable lives to the labour classes and wage workers, it is pertinent to state that several legislations and regulations are functioning to curb this immoral practice.

Many rules in India set limits on the number of hours of overtime that are permitted as well as a method for calculating those hours. Many sectors are currently unable to use the overtime legislation for paid workers. The situation could improve over the next few days when new labour laws are put into effect in India. Employees and laborers may find it helpful to consult with local labour lawyers to determine who is entitled to overtime pay and who is not.

WHAT ARE NORMAL WORKING HOURS?

The law in India prescribes a particular number of hours that the workers are supposed to work to complete their shift, these working hours are referred to as the Normal Working Hours.

The prescribed 'Normal Working Hours' are not more than 48 hours as under the ambit of Section 51 of the Factories Act, 1948.

OVERTIME

Overtime can be referred to as any number of hours worked over the Normal Working Hours. Any employee who works more than the prescribed number of hours i.e., 48 hours a week, is entitled to receive an overtime charge at the rates prescribed by the law.

PROVISIONS FOR OVERTIME

1) Provisions under the Minimum Wages Act, 1948:

- Section 14: Minimum rate of pay is determined 'by the hour, by the day, or by any such period', and' is regarded to have worked overtime if they put in more time than that.

- If employees work longer than the set hours, they are entitled to overtime pay for those extra hours or portions of those hours.

- The Overtime pay rate may be fixed by the appropriate government.

- Any employee who works on a rest day will also be entitled to wages on overtime rate

- Maximum punishment for infraction: six months in prison or a fine of Rs. 500

2) Provisions under the Factories Act, 1948:

- Section 59: Overtime pay at a rate that is double that worker's regular rate of pay.

- Violation: Sentence up to 'two years in prison, a fine up to one lakh rupees, or a combination of the two'. Further, in case of continuation, up to one thousand rupees for each day is perpetuated.

- Section 51: A maximum of 9 hours a day is the daily limit whereas a maximum 48 hours a week is the weekly limit.

- Section 55: A worker is not supposed to work for more than 5 hrs without a break.

- Section 56: Working hours, including breaks, cannot exceed 10.5 hours.

- Overtime limit: The maximum daily workday, including overtime, is 10 hours, or 60 hours per week. 50 hours of overtime cannot be worked in a quarter (3-month period).

3) Provisions under the Mines Act, 1952:

- Working Hours: Nine hours above the ground and Eight hours below the ground, daily

- Section 33: a maximum of five hours of continuous work

- In the event that an employee is paid on a piece rate, the payment will be equivalent.

- Section 35: The maximum number of hours worked per day, including overtime, is 10.

4) Provisions under the Beedi and Cigar Workers (Conditions of Employment) Act, 1966:

- Sections 17 and 18: 10 hrs per day and 54 hrs per week is the prescribed limit of total working hours including the overtime hours.

- Section 33: anyone who violates any of the terms of this Act or any rules imposed under it would be subject to a fine that may reach 250 rupees for a first offense (Rs 250). A second or subsequent offense would result in a sentence of imprisonment for 'a time of not less than one month nor more than six months, or a fine of not less than one hundred rupees nor more than five hundred rupees, or both'.

5) Provisions under the Contract Labour (Regulation & Abolition) Act, 1970:

- Rule 79: Register of Overtime in Form XXIII is to be kept by every contractor, which must include all information on overtime computation, hours of additional labour, employee name, etc.

6) Provisions under the Building and Other Construction Workers (Regulation of Employment Service) Act, 1996:

- Sections 28 and 29: employees who work overtime are entitled to compensation that is double their regular hourly rate.

- Violation: In case of no express penalty elsewhere for the violation or failure, 'a fine that may not exceed one thousand rupees for each such violation or failure, as the case may be. Continuing violation or failure, as the case may be, would result in an additional fine that might reach one hundred rupees for each day that it persisted'.

7) Provisions under the Working Journalist (Conditions of Service) and Miscellaneous Provisions Act, 1955:

- Rule 10: A working journalist who clocks in for more than 6 hours during the day or 512 hours during the night on any given day is entitled to remuneration in the form of rest hours equal to the number of hours they worked beyond their contracted hours.

- Violation: A fine of up to 200 rupees may be imposed. And anyone who has previously been found guilty of an offense under this Act and is found guilty again of an offense involving a violation of the same provision may face a fine that might reach 500 rupees.

8) Provisions under the Plantation Labour Act, 1951:

- Section 19: Overtime workers are entitled to twice the regular salary rates for their overtime hours. However, no such employee should be permitted to work more than 9 hours on any given day or more than 54 hours on any given week.

- Violation: The violator is subjected to a period of imprisonment that may last up to three months, a fine that may amount to 500 rupees, or both.

ELIGIBILITY

The workers who are eligible to receive overtime are; factory workers, workers in an underground or above-ground mine, working journalists, scheduled employees, employees of any shop or establishment, labour working on a contractual basis, and workers on building and construction projects.

The proposed Labour standards in India do feature overtime payment rules for salaried white-collar workers, although some states may not support this legislation. Workers such as armed forces personnel and any individual who exceeds the permitted overtime limits or clocks in extra hours without permission will not be eligible to receive overtime pay.

CALCULATION FOR OVERTIME

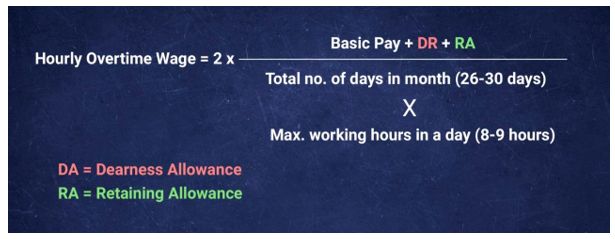

According to Indian overtime payment regulations, it is based on the basic wage. Additionally, any other allowance or dearness may be included. However, it should be noted that any bonus or other form of incentive is disregarded for determining or calculating India's overtime payment regulations. In any event, the rules regarding overtime payment take no account of the total wage. However, Indian overtime payment laws do not prohibit employers from rewarding devoted workers voluntarily in the absence of a legal need. In such a situation, it is up to the employer to decide whether overtime is paid in India on a basic or gross basis.

CONCLUSION

As overtime payment is a crucial yet ambiguous issue, it is very important for all the workers to get educated about their rights and update their information about the same. Each worker working more than the prescribed rate of working hours deserves to get paid for the same as they are working harder in order to get the work done for their respective employers. Overtime Payments also act as a reward for the worker in order to motivate them and give their hard work some recognition. Hence, it is the need of the hour to address this issue and not violate the rights of the workers.

Author: Upasna Rana - a student of LLM (IIT), in case of any queries please contact Khurana & Khurana, Advocates and IP Attorney.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.