On 15 June 2018, the Swiss parliament adopted the Swiss Financial Services Act (FinSA) and the Swiss Financial Institutions Act (FinIA). On 24 October 2018, the Swiss Federal Council opened a consultation process regarding the implementing ordinances, the draft Ordinance on Financial Services, the draft Ordinance on Financial Institutions and the draft Ordinance on Supervisory Organizations, which will last until 6 February 2019. The acts and the three ordinances are expected to enter into force on 1 January 2020 and will introduce a new regulatory framework governing the Swiss financial markets.

One fundamental change is the introduction of a new duty for portfolio managers, trustees, and managers of collective assets to obtain a licence under the FinIA. In this briefing, we examine the new regulatory regime for portfolio managers, trustees, and managers of collective assets under the FinIA.

Scope of the Licensing Duty

FinIA introduces the obligation for portfolio managers, trustees and managers of occupational pension schemes to obtain a licence from the Financial Market Supervisory Authority FINMA. Portfolio managers and trustees will require a new dedicated type of licence, whereas the FinIA extends the current regulatory regime applicable to managers of collective investment schemes to managers of occupational pension schemes under the new designation of managers of collective assets.

These three activities are defined as follows under the FinIA:

- portfolio managers are defined as persons acting on a commercial basis who are empowered on the basis of a mandate to dispose of assets in the name of and on behalf of clients. This definition covers all types of portfolio managers, including not only managers who have a discretionary mandate, but also investment advisers who have the power to execute transactions in the name and on behalf of their clients;

- trustees are defined as persons acting on a commercial basis who, based on an instrument creating a trust in the meaning of the Hague Convention of 1 July 1985 on the Law Applicable to Trusts and on their Recognition, manage or have the power to dispose over assets for the benefit of beneficiaries or for a specific purpose. It will therefore apply to trustees, but neither to protectors unless they have the power to dispose over assets, nor to directors or officers of companies held by a trust; and

- managers of collective assets are defined as persons acting on a commercial basis who manage the assets in the name and on behalf of collective investment schemes or occupational pension funds. The FinIA extends, in principle, the current regulatory regime applicable for managers of collective investment schemes to managers of occupational pension schemes. However, the FinIA provides for de minimis exemptions allowing managers of collective assets to be licensed as a portfolio manager if they manage assets of collective investment schemes for qualified investors below certain thresholds or occupational pension schemes without exceeding certain thresholds.

FinIA provides for a number of exemptions and does not apply, among others, to:

- persons who manage the assets of persons with whom they have business or family ties;

- occupational pension funds and employer-sponsored funds, as well as employers who manage their pension funds. In this context, according to the explanatory report on the draft implementing ordinances, group companies managing the assets of occupational pension schemes of employees of other group companies will be exempted from FinIA;

- lawyers and notaries carrying out typical activities under the applicable legislation;

- persons acting on the basis of a statutory mandate.

The FinIA introduces a regulatory cascade: managers of collective assets will be automatically authorised to act as a portfolio manager or as a trustee without a specific licence. Similarly, fund management companies and securities firms (the new designation of securities dealers) will be allowed to act as a manager of collective assets, a portfolio manager and a trustee. Furthermore, banks, who are expressly allowed to carry out the activities of a securities firm, and insurance companies, will continue to be subject to their own regulatory framework and will not be subject to the FinIA.

FINMA Authorisation of Portfolio Managers and Trustees

The FinIA provides for a two-tiered supervisory model for portfolio managers and trustees: on the one hand, FINMA will have the responsibility to grant them their licence and take formal enforcement action against them, if they breach their prudential obligations. On the other hand, portfolio managers and trustees will not be directly supervised by FINMA, but by dedicated, FINMA licensed supervisory organisations, who will be responsible for the ongoing prudential supervision as described in further detail below. However, FINMA may decide to supervise portfolio managers and trustees that are a part of a financial group subject to its consolidated supervision directly, as part of such consolidated supervision.

Portfolio managers and trustees will need to satisfy in particular the following conditions to obtain and maintain their licence:

- affiliation with a supervisory organisation licensed by FINMA;

- the financial institution as well as its directors and senior management must satisfy the fit and proper requirement and ensure an irreproachable conduct of business;

- the qualified shareholders, including shareholders holding more than 10% of the capital or the votes, must also have a good reputation and ensure that their influence will not be exercised at the expense of prudent and reliable management;

- a management body consisting of at least two persons who are duly qualified for their task. The management may have only one duly qualified person provided that business continuity is guaranteed;

- an appropriate organisation, including an appropriate risk management system as well as an effective internal control structure to ensure, in particular, compliance with legal and internal provisions and, especially, more stringent outsourcing requirements;

- the financial institution must be effectively managed from Switzerland, subject, for entities that are part of a financial group subject to appropriate financial supervision, to instructions it may receive in connection with the consolidated oversight;

- a fully paid-in share capital of CHF 100,000 plus adequate collateral or professional liability insurance coverage; and

- an appropriate level of own funds. In order to limit the compliance burden, the regulatory capital requirements for portfolio managers and trustees will be set at a quarter of the fixed costs as reported in the last annual financial statements, up to a maximum of CHF 10 million. Moreover, under the draft implementing ordinance, professional liability insurances may be considered to calculate the own funds and an appropriate level of own funds will be deemed adequate collateral.

Supervision of Portfolio Managers and Trustees

An important feature of the new regulatory framework for portfolio managers and trustees is the direct supervision by supervisory organisations. Supervisory organisations will be private organisations, which will be licensed by FINMA. Supervisory Organisation will also be allowed to act as a self-regulatory organisation (SRO) for the purpose of monitoring compliance with anti-money laundering duties provided they have been recognised as such.

Under this regime, supervisory organisations will have the responsibility for the ongoing prudential supervision of portfolio managers and trustees. In this context, they will in particular monitor compliance with the licensing requirements under the FinIA and with the rules of conduct under the FinSA.

As part of their ongoing prudential supervision, supervisory organisations will be required to perform a prudential audit of the portfolio manager or the trustee themselves or oversee the prudential audit carried out by a regulatory audit company. In principle, the regulatory audit will take place annually. However, the supervisory organisation may reduce the audit frequency to one audit every four years based on the activity of the portfolio managers/ trustees and the risks associated with it. When no annual audit is carried out, portfolio managers and trustees will have to submit a standardized compliance report to the supervisory organisation.

As part of its supervisory function, the supervisory organisation will also have the power to set deadlines to remedy any irregularity. However, if the supervised institution does not remediate the deficiency, the supervisory organisation will be required to report the matter to FINMA, who can then initiate enforcement action.

Status as Directly Supervised Financial Intermediary Abolished

As a side effect of the prudential supervision of portfolio managers and trustees, the status of directly supervised financial intermediaries under the Anti- Money Laundering Act (AMLA) will be repealed, with the possible exception of Swiss financial intermediaries that are supervised by FINMA as part of the consolidated supervision of the financial group they belong to:

portfolio managers and trustees will be subject, for anti-money laundering purposes, to the supervision of FINMA and the ongoing supervision by a supervisory organisation. Other financial intermediaries, such as consumer credit companies, payment service providers and money changers, will no longer be able to remain subject to the direct supervision by FINMA but will instead need to join an SRO, who will monitor their compliance with anti-money laundering regulations.

Transitional Provisions

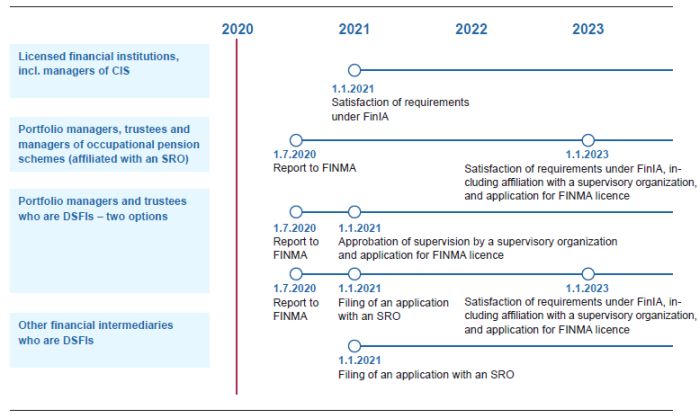

It is currently expected that the FinSA and the FinIA, together with their implementing ordinances, will enter into force on 1 January 2020. To facilitate the transition into the new regulatory regime, the FinIA provides for the following transitional regime:

Managers of collective investment schemes, as well as other financial institutions that are already licensed, must fulfil FinIA's requirements within one year of its entry into force, but are not required to obtain a new authorisation.

By contrast, portfolio managers, trustees and managers of occupational pension schemes, which are newly subject to a licence requirement under FinIA, must: –– report to FINMA within six months after FinIA's entry into force; and

- satisfy FinIA's requirements and submit a licence application within three years of FinIA's entry into force.

If they satisfy these conditions, portfolio managers, trustees and managers of occupational pension schemes may seamlessly pursue their activity until they are notified a decision, provided they are affiliated with an SRO for anti-money laundering purposes.

This last requirement leads to a peculiarity for portfolio managers, trustees and managers of occupational pension schemes who are currently directly supervised by FINMA for anti-money laundering purposes. According to the draft implementing ordinance, portfolio managers and trustees do not have to join an SRO if, within one year of FinIA's entry into force, they are approved by a supervisory organization for prudential purposes and submit a licence application to FINMA. Alternatively, they can, according to the explanatory report on the draft implementing ordinances, apply to join an SRO within a year and satisfy FinIA's requirements and submit a licence application within three years of FinIA's entry into force.

Finally, other financial intermediaries who are directly supervised by FINMA for anti-money laundering purposes will have a year to apply to join an SRO and will be entitled to continue their activity until they are notified of the decision.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.