Labuan International Business and Financial Centre (Labuan IBFC) is at the forefront of international cross-jurisdictional wealth planning, offering high-net-worth individuals a plethora of wealth creation and wealth preservation structures in both conventional and Islamic forms.

High-net-worth individuals will find a comprehensive stable of private wealth management vehicles on offer in Labuan IBFC ranging from common law trusts to civil law foundations. Labuan IBFC is the only jurisdiction in Asia that offers private foundations as a wealth management solution.

WHAT ARE FOUNDATIONS?

A Labuan foundation, as provided by the Labuan Foundations Act 2010, is a corporate body with a separate legal entity, established to manage its own property for any lawful purpose, be it for charitable or non-charitable purposes.

Established by a founder, a typical structure for a Labuan foundation is depicted below:

Foundations provide a conduit for dynamic wealth transfer, dynastic planning and inheritance management protected within a tax-efficient legal entity.

In the case of a Labuan Islamic foundation, objectives and operations shall comply with Shariah principles, as enshrined in its incorporation charter and guided by Labuan IBFC's Islamic omnibus legislation (Labuan Islamic Financial Services and Securities Act 2010).

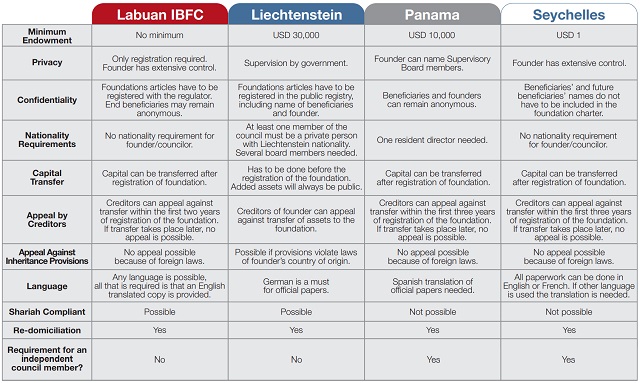

COMPARISON WITH OTHER JURISDICTIONS

GROWTH OF FOUNDATIONS IN LABUAN IBFC

INTERESTING FACTS ABOUT LABUAN FOUNDATIONS

- A foundation is a registered legal entity

- As a legal entity, a foundation offers legal certainty

- May be re-domiciled to other jurisdictions

- May be re-domiciled from other jurisdictions

- Provides for unenforceability of foreign claim or judgment

- No minimum initial asset is required to set up

- The rights and powers of a founder can be enshrined via the charters

- Charitable and non-charitable foundations may hold Malaysian assets, with Labuan FSA's approval

- Arbitration is allowed

- A corporate body is allowed to be appointed as council and officer

- May exist in fixed or perpetual duration

- May be dissolved with assets returned to a designated party

- Protected by confidentiality

- Allows reserved power by the founder

- Allows the appointment of a supervisory person

- Short clawback period of 2 years

- Flexibility to evolve according to circumstances, by issuing articles to reflect changes

- Need not have an independent party in the council

- 'Ownership' may be transferred with protection intact

- Beneficiary has no legal or beneficiary ownership over the foundation's asset

FREQUENTLY ASKED QUESTIONS

Q: Can Malaysians set up a foundation?

Yes.

Q: Are there any other countries in Asia with foundations, which act as a wealth management tool?

No, there is no other country in Asia that offers foundations as a wealth management tool. The foundations in other Asian jurisdictions are limited to charitable purposes, with detailed reporting requirements.

Q: Are there any insurance-related wealth structures?

Yes, protected cell companies and limited liability partnerships may also be used either in conjunction with a foundation or independently as a wealth management tool.

Q: Are foundations required to be registered?

Yes, foundations must be registered with the regulator, Labuan FSA.

Q: Is a foundation registered in Labuan required to have an office in Labuan?

A Labuan foundation must maintain a registered office in Labuan. Its address shall be the address of the secretary to the foundation, which is a Labuan trust company.

Q: Must the council meeting be held in Labuan?

No.

Q: Would it be possible to combine a foundation and a trust?

Yes, one can own the other.

Q: What is the taxation rate of a Labuan foundation?

All non-trading income which includes investment holding income is not taxable. Any trading income is taxed at 3% as provided by the Labuan Business Activity Tax Act 1990.

Q: What is the tax implication on distributions by a Labuan foundation?

The distributions by a Labuan foundation to its beneficiaries are tax exempt in Labuan. The beneficiaries of the foundation will need to satisfy their own tax liabilities in their respective jurisdictions of tax residence.

Q: Are foundations flexible?

Yes, any changes may be incorporated in the charter to allow for flexibility.

Q: Can a Muslim use a foundation to manage their estate while alive?

Yes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.