Today, the U.S. Department of the Treasury ("Treasury") published an interim rule (the "Interim Rule") implementing the filing fee provisions of the Foreign Investment Risk Review Modernization Act ("FIRRMA") along the lines set out in Treasury's proposal of March 9. 1 The Committee on Foreign Investment in the United States ("CFIUS") will assess tiered filing fees for all final notifications filed on or after May 1 (whether or not a draft notification was filed before May 1). 2 The Interim Rule is open for public comment until June 1, 2020.3

I. Key Takeaways

Beginning on May 1, 2020, CFIUS will:

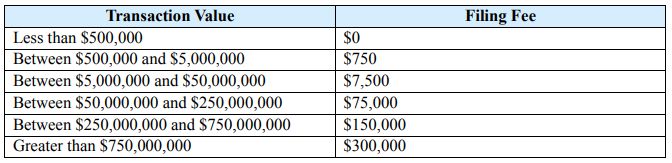

- assess fees for notifications based on the value of the transaction, ranging from no fees for transactions valued at less than $500,000 to a fee of $300,000 for transactions valued at greater than $750 million;

- base the fee on the value of the U.S. business rather than the total transaction value in the case of mergers or contributions of U.S. businesses to joint ventures (but not other transactions);

- cap the fee at $750 where the value of the U.S. business is less than $5 million; and

- expand the required content of notifications to include a certification as to the transaction value and an explanation of the valuation methodology.

Payment must be received by Treasury before CFIUS accepts a notification for review. CFIUS has not imposed (and lacks statutory authority to impose) filing fees for the short-form declarations authorized by FIRRMA. 4

II. Filing Fee Structure

As authorized by FIRRMA, the Interim Rule amends CFIUS's regulations to require filing fees for full notifications relating to "covered transactions" under 31 CFR Part 800 and "covered real estate transactions" under 31 CFR Part 802 (effectively, all transactions over which CFIUS has jurisdiction). The Interim Rule outlines a tiered filing fee structure based on the value of the notified transaction, as summarized below:

The Interim Rule provides for a single fee for each transaction regardless of the number of parties and does not address how it is to be divided among the parties.

Submission of a short-form declaration-either in response to CFIUS's new mandatory notification requirements or voluntarily-will not require payment of the above filing fee. (Parties may now choose to submit an abbreviated declaration for any transaction, although they may not receive a clearance providing a safe harbor from future CFIUS review in response.) Payment will be required if parties submit a full notification upon request from CFIUS or after CFIUS declines to clear a transaction following review of a short-form declaration. Payment will also be required where notification is mandatory and the parties choose to submit a full notification instead of a short-form declaration. No additional fees will apply where CFIUS permits parties to withdraw and re-file a notification (absent a material change to the transaction or a material inaccuracy or omission in the filing). No exception is provided where CFIUS "invites" the parties to make a notification-parties to such transactions will be required to pay the applicable fee.

III. Valuation

Under the Interim Rule, in most cases the value of a transaction will be the sum of all consideration of any kind that is paid by or on behalf of the foreign party to the transaction.5 For multi-phase transactions, the value of the transaction includes the total value across all phases (as may be reasonably determined as of the date of the filing). CFIUS will not be bound by the parties' characterization of the transaction and its value, though in most cases categorization should be relatively straightforward.

The Interim Rule provides guidance on calculating the value of any non-cash consideration:

- Securities. The relevant value of securities traded on a national securities exchange will be their last closing price before the date of the parties' notice.

- Other non-cash assets, services, interests, or in-kind contributions. These types of consideration will be valued based on their fair market value as of the date of the parties' notice.

- Lending transactions. The relevant value will be the cash value of the loan or similar financing arrangement provided by or made available by or on behalf of the foreign party.

- Conversion of a contingent equity interest. If the transaction results from converting a previously acquired contingent equity interest, the value will be the consideration paid to acquire that interest plus any additional consideration paid for conversion.

The transaction is valued as a whole, with two exceptions:

- In the case of a merger or contribution of a business to a joint venture, only the value of the U.S. business is included in the valuation. If more than one U.S. business is contributed to the joint venture, the transaction value is the combined value of the contributed U.S. businesses (but Treasury is considering alternative approaches and welcomes comments on this point).

- In any transaction, if the value of the interest being acquired in the U.S. business of the target is less than $5 million, the filing fee is capped at $750 regardless of the total value of the transaction.

For real estate transactions within the jurisdiction of CFIUS that do not constitute a "U.S. business" (e.g., raw land or leases, but not, for example, the acquisition of operating commercial real estates, which would be evaluated under the rules above), the Interim Rule provides the following valuation guidance:

- Purchase transactions. The value will be the sum of all consideration provided by or on behalf of the foreign purchaser, including cash.

- Lease transactions. The value will be the sum of any (i) fixed payments, (ii) variable payments depending on an index or rate (such as a market interest rate), and (iii) non-cash or in-kind consideration from the foreign lessee to the lessor over the term of the lease.

- Concession transactions. The value will be the sum of all rent, fees, and charges along with any non-cash or in-kind contributions from the foreign person to the grantor over the term of the concession.

If the consideration has yet to be determined or cannot be determined as of the filing date, the value of the transaction will be the fair market value of the acquired assets as of the day of the parties' filing.6 Parties can rely on a current (within two quarters) valuation made following GAAP or IFRS or on a valuation from an independent appraiser (unless there has been a significant change); otherwise, they may provide a good faith estimate and its basis. For covered real estate transactions, if the parties cannot reasonably determine the value of a lease or concession, the filing fee is set at $750.

IV. Timing, Manner of Payment, and Refunds

Under the Interim Rule, filing fees will be due at the time of filing a notification (but not at the time of submitting the pre-filing draft). CFIUS will not accept a notification-and thus will not begin the review period-until payment is made. Where CFIUS accepts a notice but later finds the payment was insufficient (e.g., CFIUS reaches an alternate value determination that pushes a notified transactions into the next tier of fees), the parties will have three business days to make the additional payment before the notification is rejected. No process for appealing the determination is provided in the Interim Rule.

The Interim Rule permits parties to seek a partial fee refund if they can demonstrate overpayment at the time of filing. The Interim Rule also directs Treasury to issue a refund if CFIUS determines that a notified transaction is not within its jurisdiction (as CFIUS would then have no authority to assess a fee).

CFIUS will require filing fees to be paid electronically in U.S. dollars through Pay.gov by one payor per notice. 7

V. Additional Notification Contents

The Interim Rule amends the notification requirements to require parties to a notification to provide information regarding the value of the transaction and an explanation of the methodology used to determine such valuation.

VI. Conclusion

Beginning on May 1, 2020, parties that file a notification with CFIUS must pay a filing fee generally based on the value of their transaction. Although filing fees are modest (no more than 0.15% of transaction value), it is possible to avoid them with a short-form declaration (though there is no guarantee that CFIUS will clear the transaction based only on a declaration or will not request a notification, which is difficult to refuse).

Treasury has invited public comment on the Interim Rule through June 1, 2020. Comments are to be submitted electronically through the Federal Government's eRulemaking Portal at https://www.regulations.gov or by mailing comments to: U.S. Department of the Treasury, Attention: Laura Black, Director of Investment Security Policy and International Relations, 1500 Pennsylvania Avenue, NW, Washington, DC 20220.

Footnotes

1. 85 Fed. Reg. 23736 (Apr. 29, 2020). The Interim Rule is available at https://www.federalregister.gov/documents/2020/04/29/ 2020-08916/filing-fees-for-notices-of-certain-investments-in-the-united-states-by-foreign-persons-and-certain. See our prior blog post at https://www.clearytradewatch.com/2020/03/cfius-releases-proposed-rule-on-filing-fees/.

2. There is nothing on the face of the Interim Rule indicating that the final notification must be accepted by the CFIUS Staff Chairperson before May 1; the term used is "filed."

3. Comments to that proposed rule were due April 8, 2020. CFIUS noted that it only received five comment letters during the comment period, which may have been influenced by the coronavirus pandemic, and believes that it would benefit the public to receive additional comments before the interim rule is made final.

4. To learn more about the regulations implementing FIRRMA, please see our alert memorandum, CFIUS Releases Final FIRRMA Regulations (Jan. 22, 2020).

5. This includes cash, assets, shares or other ownership interest, debt forgiveness, services, or other in-kind consideration.

6. The Interim Rule notes that the consideration amount may be determined "notwithstanding minor standard adjustments that are to be made at closing."

7. Payment instructions are available on Treasury's website at https://home.treasury.gov/system/files/206/CFIUS-Filing-FeePayment-Instructions.pdf.

To view original article, please click here.

Originally published 29 April, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.