Brief History of Estate Tax

- Stamp Act of 1797

- Revenue Act of 1862

- War Revenue Act of 1898

- Revenue Act of 1916

- Tax Reform Act of 1976

- Economic Recovery Act of 1981

- Omnibus Reconciliation Act of 1993

- Taxpayer Relief Act of 1997

- Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA)

- 2010 Tax Relief Act

- American Taxpayer Relief Act of 2012

- Tax Cuts and Jobs Act of 2017 (TCJA)

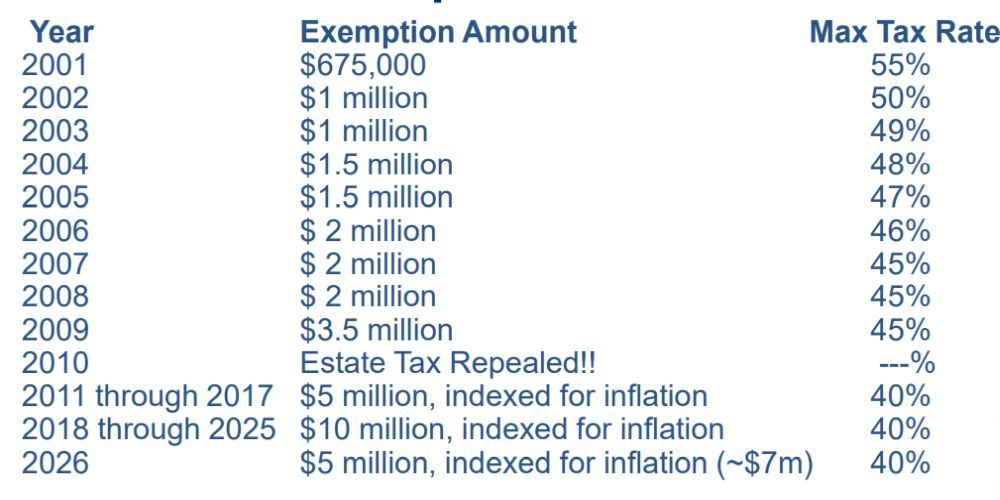

Estate Tax Exemption

Tax Cuts and Jobs Act of 2017 (TCJA)

- 2012:

- The American Taxpayer Relief Act of 2012 was passed on January

1, 2013, avoiding sunsetting exemption Federal Gift and

Estate Tax Exemption:

- $5.12 million

- Implemented spousal portability

- The American Taxpayer Relief Act of 2012 was passed on January

1, 2013, avoiding sunsetting exemption Federal Gift and

Estate Tax Exemption:

- 2018:

- Tax Cuts and Jobs Act became law on December 22, 2017

- Doubled Federal Gift and Estate Tax Exemption:

- $11.18 million

- Continued spousal portability

Federal Estate and Gift Tax

- 2024:

- Annual Exclusion: $18,000

- Federal Gift and Estate Tax Exemption:

- $13.61 million

- Spousal portability

- 2025:

- Annual Exclusion: $19,000

- Federal Gift and Estate Tax Exemption:

- $13.99 million

- Spousal portability

- 2026:

- The 2017 Tax Cuts & Jobs Act expires on December 31, 2025

- Federal Gift & Estate Tax exemptions will drop back down to

$5 million, indexed for inflation, so

approximately $7 million

- (unless Congress takes action before then)

Window of Opportunity for Substantial Gifting Between Now and 2026

- More time to make "use it or lose it" gifting decisions

- Making large gifts now won't harm estates after 2025 84 Fed. Reg. 64,995, (Nov. 26, 2019)

- Risks to further delaying gifts:

- Asset appreciation between now and the date of the gift (future gift of appreciated asset uses more exemption than a gift now)

- Congress could act sooner to reduce exemptions or prohibit common gifting strategies (Grantor Trusts, discount rules)

Gifts Must Be Substantial

- Ms. Doe makes a gift of $2 million in 2024 (when the exemption

amount is $13.61 million) but later passes away in 2026 when the

exemption is $7 million. So, Ms. Doe's applicable exclusion

amount is $5 million (the prior gift reduces exemption).

- $21 million estate

- Less: $ 5 million rem. exemption

- $16 million

- x 40% tax rate

- $6.4 million of estate tax

- Important: To take full advantage of tax savings, gifts must exceed what the exemption will be reduced to!

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.