- within Corporate/Commercial Law, Tax and Family and Matrimonial topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Retail & Leisure industries

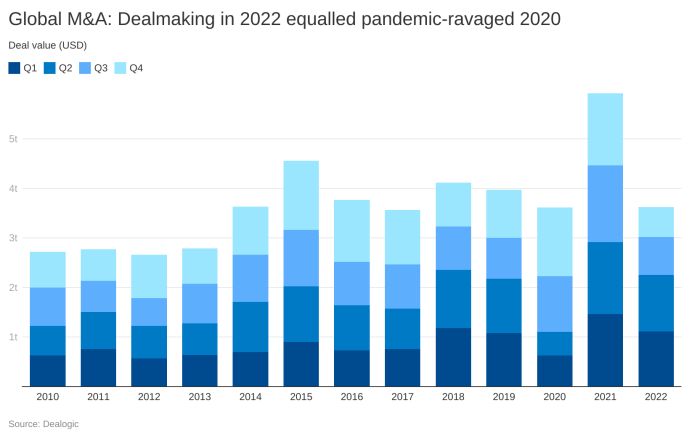

Following a year of unprecedented M&A deal activity, 2022 saw the global M&A market settle back into a more familiar pace. The year finished 38.8% lower than 2021's record level, but only 9.3% lower than 2015-2019 averages, and on par with 2020, according to MergerMarket.

A year of two halves, 2022 deal volume dropped 40% between the first and second halves as rising interest rates, inflation, a war in Europe, and volatile equity markets chipped away at market confidence and lending conditions tightened.

Private equity buyers, buoyed by dry powder, continued to drive market activity. While down from last year's high, 2022 was still the second highest year for private equity activity since 2007.

In this alert, we review the M&A markets in 2022 and major legal and regulatory trends that will impact deal-making in 2023.

Global Activity

In 2022, global M&A reached $3.6 trillion in value. The year started strong, but activity trailed off in Q3, falling below $1 trillion for the first time in eight consecutive quarters. Deal activity continued, but buyers went small, with megadeals (those valued above $10 billion) dropping 31% compared to 2021, according to Refinitiv.

Looking at markets around the world:

- U.S. - Acquisitions of U.S. targets dropped 38% to $1.5 trillion, but U.S. deal-making kept a similar market share of global activity as compared to prior years (44% in 2021 to 43% in 2022). Spinoffs increased in number despite the drop in deal volume. By contrast, de-SPAC deals, which surged in 2021, fell substantially in response to market pressures and increased SEC regulation.1

- Europe - European M&A totaled $850.7 billion, down 39% from 2021, according to Refinitiv. The war in Ukraine significantly impacted European M&A, with sanctions on Russia and Belarus reducing international trade, disrupting supply chains, and increasing energy costs.

- Asia - Dealmaking in Asia-Pacific totaled $830.7 billion, a 32% decrease and the slowest year for the region since 2019, according to Refinitiv. ESG is increasingly a consideration in Asia, as detailed in our Asia Funds ESG Report.

Tech Activity

Technology continued to be the top industry for acquirers, accounting for 20% of 2022 dealmaking. In our 2022 Tech M&A Survey, respondents named artificial intelligence/machine learning as the first-choice subsector for dealmaking opportunities in 2023 by a wide margin (22%), followed by e-commerce and robotic process automation, each receiving 13% of the vote.

Private Equity

Private equity acquirers continued to transact in record numbers. Though activity was down from 2021's records, buyouts were 50% higher and exits were 43% higher than 2015-2019 numbers, according to MergerMarket. Technology was the top sector for sponsors, accounting for nearly 30% of all deals. Our annual Global PE Trends and Outlook report details these and other themes.

Looking Forward

Despite the macro headwinds, the strategic goals supported by well-planned M&A, including diversification (or, conversely, focusing on core businesses or separating unrelated businesses), achieving scale, and entry into new markets, remain. The trend toward digitalization continues to push tech M&A, and the volatility (and sometimes freeze) in equity markets will increase the interest in M&A of companies and investors searching for liquidity. Buyers (both private equity and corporate) have plenty of dry powder. Savvy buyers will take advantage of current pricing and, conversely, companies need to be ready to respond to unwanted advances. Changes in currency exchange rates, such as the weakened Euro, pound and yen, may attract some buyers. Companies also may consider other forms of transformations, such as spinoffs and carve-outs, as they seek to increase efficiencies of operating units and foster growth and investment. However, given the potential risks, buyers likely will review potential target companies and transactions carefully, doing more diligence and adjusting deal structures and terms in response to continued and new risks.

Learn more about Morrison & Foerster's Global M&A Practice.

1. Antitrust Agencies Continue Aggressive Enforcement, with Mixed Trial Outcomes

In 2022, antitrust scrutiny of acquisitions continued to increase, with U.S. and global antitrust agencies coalescing around broader investigations and more aggressive enforcement. Some transactions were blocked or abandoned, and U.S. agencies, despite losing a few merger challenges in court, remained resolved to challenge more deals.

In 2023, merger agreements should proactively address increased agency review and prolonged investigatory timelines, the low probability of the agencies accepting a settlement, and the heightened possibility of protracted litigation. By anticipating new enforcement rules and policies, such as the updated merger guidelines and potential FTC rulemaking, dealmakers can limit, or at least address, delays caused by merger review.

Despite Losses, Agencies Won't Back Down. In 2022, DOJ lost three merger challenges in federal district court (U.S. Sugar/Imperial, Booz Allen Hamilton/EverWatch, and United/Change) and is appealing two of those (U.S. Sugar and United). The FTC lost its administrative challenge to Illumina/Grail, and is appealing to the full Commission. Despite these losses, the agencies maintained a busy docket - DOJ went to trial with American Airlines and JetBlue over a joint operating alliance and sued to block a merger in the door locks industry, ASSA Abloy/Spectrum.

- DOJ is applying increased scrutiny during the investigation phase in key industries, such as digital platforms, agriculture, retail supply chain, and healthcare.

- DOJ has not been willing to engage in detailed settlement negotiations. This trend will likely continue into 2023, with more parties offering settlement packages, being turned down, and then "litigating the fix" in federal court-as was the case with United/Change.

- Private equity roll-ups, where multiple smaller businesses in the same industry are merged into one larger consolidated company, is another area of focus.

- Labor is an area of keen interest: DOJ blocked Penguin Random House's acquisition of Simon & Schuster based on a monopsony theory of harm to authors.

FTC Sets a More Aggressive Enforcement Policy. The FTC likewise has trended toward more aggressive enforcement and reliance on non-traditional theories of liability.

- The FTC's new strategic plan changes the FTC's focus from "harms to consumers" to "harms to the public" and removes a reference that enforcement will not unduly burden legitimate business activity.

- The FTC issued a new policy statement concerning unfair methods of competition, setting out a new framework that adopts a broader view of FTC authority under Section 5 of the FTC Act. Under Section 5, the FTC also proposed a general ban on employee non-competes as an unfair method of competition, as described below in the employee non-competes section.

- The FTC has been active in merger challenges, with a heavy focus on vertical and nascent competition theories in the digital platforms and life sciences spaces. In addition to Illumina/Grail, the FTC sued to block Meta's proposed acquisition of Within and challenged Microsoft's proposed acquisition of Activision.

Legislative Developments. Many observers expected comprehensive antitrust legislation in 2022, but action is still pending. Proposed bills include calls to prohibit Big Tech companies from prioritizing their own products on their platforms over those of competitors, open app stores to rival marketplaces, and promote interoperability between platforms.

The recent spending bill increased funding for DOJ and FTC and implemented some potentially significant changes:

- preventing litigation brought by state attorneys general under the federal antitrust laws from being consolidated in multidistrict litigation ("MDL"), allowing state AGs greater ability to keep such litigation in a favored venue even if there is an active MDL,

- increasing HSR filing fees for high-value deals, and

- requiring disclosure in HSR filings of subsidies received from "foreign entit[ies] of concern," including entities owned or controlled by, or subject to the jurisdiction or direction of, China, Russia, Iran, or North Korea.

International Enforcement. International developments have paralleled the more aggressive approach to antitrust in the U.S. and in some instances have gone even further.

- The European Parliament passed the Digital Markets Act, intended to prevent digital platform "gatekeepers" from abusing their market power and to allow new players to enter the market.

- International agencies have been active in enforcement, notably with the European Commission deciding to try to prevent Illumina's acquisition of Grail, after the deal had been greenlighted by the FTC's administrative judge. Also, the UK's Competition and Markets Authority and the U.S. DOJ announced their investigation into the Cargotec and Konecranes merger, resulting in the parties abandoning their deal.

On the Horizon. With both U.S. agencies rounding out their leadership teams in 2022, 2023 likely will continue the trend of aggressive enforcement actions. The agencies will adopt new merger guidelines that include new, more expansive thinking about potential harms to competition and liability. Mergers will likely be scrutinized under the new merger guidelines. DOJ's pending appeals in U.S. Sugar and United, trials in ASSA Abloy/Spectrum and Microsoft/Activision, and the conduct litigations involving Google and Meta, will provide more instances to observe whether courts are sympathetic to increased enforcement efforts or continue to reject this approach, as largely seen in 2022. Additionally, Republican control of the House will result in new priorities and likely increased scrutiny of ESG and antitrust.

2. Employee Non-Competes: Politicians Limit and Courts Enforce with Increasing Scrutiny

In 2022, legislatures continued to narrow the permissible scope of employee non-competition agreements, at least outside the context of the sale of a business, while courts enforced them, albeit with increasing scrutiny. Dealmakers will need to review the scope of a target company's non-competes, including those in existence prior to a transaction as well as those entered into in connection with a transaction, and consider whether other protections, such as an NDA or other long-term employment incentives, may be necessary or appropriate.

- Lawmakers Limit Non-Competes. Colorado, the District of Columbia, and Illinois are among the jurisdictions that narrowed the reach of non-competes for employees during 2022. For example, Colorado, among other things, now bars non-competes for employees earning less than $101,250 and requires employers to give a non-competition agreement to an employee before starting employment or, for current employees, at least 14 days before going into effect. Each of these jurisdictions will apply its law to a non-compete entered into by an employee who lives or works in the jurisdiction, regardless of any choice of law provision to the contrary. Non-competes entered into in exchange for the sale of a business continue to be enforceable in each of these jurisdictions despite these new laws.2

- FTC Proposes Ban on Employee Non-Competes. The FTC started the new year by proposing a new rule that would impose a general ban on employee non-competes as an unfair method of competition. The FTC is taking public comment, including on various alternatives short of a complete ban. As currently proposed, the ban would not apply to non-competes in the context of the sale of a business by a "substantial" (i.e., at least 25%) owner, member, or partner.3

- Delaware Chancery Court Refuses to Enforce or Blue-Pencil Overbroad Deal Non-Compete. The Delaware Chancery Court struck down a sale of business non-compete that barred the seller from competing not only with the business it sold, but also the buyer's other businesses.4 The court also declined to blue-pencil the non-compete to an enforceable scope.

- California Courts Enforce Sale of Business Non-Compete Against Seller Tied to Termination of Employment (Not Closing Date). Ten years ago, a California appellate court refused to enforce a sale of business non-compete that defined the duration as the longer of X years from closing or Y years from the seller's termination of employment. In 2022, however, two California state and federal court judges enforced sale of business non-competes where the seller was barred from competing with the buyer for Y years from the seller's termination of employment.5

- Courts Provide More Clarity on California Labor Code Section 925(e)'s Potential Application to Silicon Valley and Other California Non-Competes. California Labor Code Section 925 requires any agreements signed as a condition of employment in California to be governed by California law. However, Section 925 includes an exception, subsection (e), which on its face allows an employee who was represented by counsel to select another state's law, which, in 47 of the remaining 49 states, would allow for greater enforceability.

-

- In 2018, the Delaware Chancery Court invoked Section 925(e) to enforce a non-compete against a California executive on the basis of a Delaware choice of law provision, although the court reversed its decision after the executive presented evidence that he had not been represented by legal counsel.6

- In 2021, the federal court for the Southern District of New York applied a Delaware choice of law provision over the objection of a California executive, where the court found the executive had been represented by legal counsel. 7

- While they did not actually apply a non-California state's law to enforce the non-compete under Section 925(e), at least two California courts in 2022 issued rulings indicating they may have done so if the evidence that the California executive was represented by counsel had been more persuasive. One of those courts, the Ninth Circuit Court of Appeals, found that a California employee who is represented by legal counsel, "is free to negotiate whatever forum-selection clause they want."8

3. Tax Law Changes Affecting M&A

Corporate M&A dealmakers have been particularly interested in two provisions of the August 2022 Inflation Reduction Act (or "IRA"):

Excise Tax on Corporate Stock Buybacks

The IRA imposes a 1% excise tax on stock repurchases by certain publicly traded U.S. corporations and, in some cases, U.S. subsidiaries of non-U.S. corporations. Under a "netting" rule, the excise tax generally does not apply to the extent a corporation also issues stock during the same tax year, including most stock issued in connection with an acquisition or to employees as compensation or pursuant to option exercises, but not including stock dividends or stock splits.

The tax goes well beyond conventional share buybacks and must be considered in many common M&A transactions involving public companies. The Department of Treasury has provided some relief from the tax in specific instances, while generally confirming its broad scope. More specifically, under Notice 2023-2:

- Cash Purchase. The excise tax will apply to a leveraged buyout or other purchase for cash (outside of the "reorganization" context discussed below) to the extent cash used to purchase target shares is sourced to the target, including the proceeds of a loan that is assumed by or deemed made to the target company.

- "Boot" in Reorganizations. Acquisitive reorganizations, recapitalizations, and other same-company reorganizations are effectively exempted from the tax, but only to the extent the consideration issued in the transaction consists of stock eligible for nonrecognition treatment. Shares repurchased or deemed repurchased for cash or other property in such a reorganization are potentially subject to the tax, regardless of whether the consideration is appropriately viewed as provided by the target or the acquiror.

- Relief for SPACs. Most complete liquidations are exempted from the tax, as are redemptions made during the same tax year as an exempt liquidation. This narrowing of the potential scope should provide considerable relief for SPAC market participants. Although other SPAC redemptions are potentially subject to the tax if there has not been a complete liquidation, as a practical matter many such redemptions may be zeroed out of the excise tax base due to the application of the netting rule to an associated "PIPE" or other equity fundraising during the same tax year.

- Valuation Timing. Excise tax base computations generally are based on the fair market value of the shares on the date repurchased or (in the case of the netting rule) the issue date. This timing and potential valuation disparity introduces complexity in applying the netting rule, for example, in the case of corporations that repurchase shares to offset the dilutive effect of an acquisition or equity compensation program.

The above is a simplified description of certain excise tax provisions of greatest potential relevance to M&A transactions.

Alternative Minimum Tax on Large Corporations

The IRA imposes a new 15% minimum tax on certain large corporations, effective for tax years beginning after December 31, 2022. Specifically, the corporate alternative minimum tax ("Minimum Tax") generally applies to U.S. corporations (other than RICs, REITs, and S corporations) that have average annual "adjusted financial statement income" ("AFSI") in excess of $1 billion over a rolling three-year test period.

A corporation's AFSI is the net income or loss reported on its applicable financial statement (AFS, generally prepared under U.S. GAAP or IFRS standards), adjusted in various ways. The potential 15% minimum tax is reduced by the amount of regular corporate income tax and "base erosion and anti-abuse tax" otherwise payable by the corporation for such tax year. Special rules apply for U.S. corporations owned by non-U.S. parent companies. Once a corporation has become subject to the Minimum Tax, there is no clear path for that corporation to cease being subject to the tax in subsequent years, absent an exercise of Treasury discretion.

Treasury has provided initial guidance of interest to M&A dealmakers:

- Notice 2023-7 effectively exempts from the Minimum Tax many typical M&A structures that qualify for tax deferral, including acquisitive reorganizations, spin-offs and split-offs, holding company formations, and partnership contributions. Under the Notice, any financial accounting income associated with such a transaction is excluded from the Minimum Tax base. Conforming adjustments are made to the basis of the assets for financial accounting purposes (generally preserving the deferred gain for both accounting and tax purposes, potentially to be recognized upon a later transaction).

- The relief provided by the Notice is limited. For example, the Notice only exempts transactions in which no gain or loss is recognized for tax purposes. In addition, it appears the Notice's "tax trumps financial accounting" approach to nonrecognition transactions might be limited to corporations that are direct parties to the transaction (and not, for example, a corporation that might be affected in its capacity as a shareholder in a corporate party to the transaction).

Treasury has indicated it will provide additional guidance on these and other provisions of the IRA during 2023.

4. Increased National Security Considerations

2022 continued the trend of increasing national security-related regulatory procedures and concerns for dealmakers.

Comprehensive Russia Sanctions. Russia's February 2022 invasion of Ukraine ushered in unprecedented sanctions from the United States, European Union, United Kingdom, and other allied countries, causing dealmakers to expand their diligence and mitigation plans. Examples of the new sanctions include:

- Comprehensive sanctions on the People's Republic of Donetsk and the People's Republic of Luhansk regions of Ukraine;

- Blocking sanctions against major Russian companies and banks, major state-owned television stations, and entities critical to Russia's defense sector, as well as President Putin, political figures, and Russian oligarchs and elites and their family members;

- Correspondent account sanctions prohibiting U.S. financial institutions from opening or maintaining correspondent or payable-through accounts for or on behalf of identified Russian financial institutions;

- Certain restrictions on transactions with Russia's Central Bank, limiting its ability to draw on U.S. dollar foreign reserves, as well as on transactions with Russia's Ministry of Finance and National Wealth Fund;

- Ban on U.S. imports of Russian goods, including energy products, seafood, spirits, non-industrial diamonds, and gold;

- Ban on new U.S. person investment in Russia and U.S. provision of accounting, trust and corporate formation, and management consulting services to Russia; and

- Removal of select Russian and Belarusian banks from the SWIFT network, essentially disconnecting such banks from the international financial system.

U.S. Foreign Investment Review. In November 2022, the U.S. Department of the Treasury published its first ever CFIUS Enforcement and Penalty Guidelines ("Guidelines"). The Guidelines lay out the following factors in determining whether to impose penalties for CFIUS non-compliance:

- Harm: The extent to which the conduct impaired or threatened to impair U.S. national security.

- Intent: The extent to which the conduct was the result of simple negligence, gross negligence, intentional action, or willfulness, or any effort to conceal or delay the sharing of relevant information with CFIUS.

- Persistence: The frequency and duration of the conduct.

- Remediation: Whether the violation was self-disclosed, the promptness of remediation of the conduct, and whether there was an internal review of the conduct to prevent its reoccurrence.

The Guidelines are the latest example of increased attention to, and resources for, CFIUS monitoring and enforcement since the enactment of the Foreign Investment Risk Review Modernization Act of 2018, including, among other things, CFIUS's enhanced efforts to identify and pursue non-notified transactions.9

Global Foreign Investment Review. The trend toward greater regulatory scrutiny of foreign direct investment continues globally as well.

- The European Union adopted an FDI screening mechanism to ensure cooperation and information sharing across its member states.

- The United Kingdom's new National Security and Investment Act allows the UK government to scrutinize a wide range of deals for national security concerns; previously, UK regulators could only review such transactions on public interest grounds.

Outbound Investment Review. The concept of an outbound investment review mechanism continues to gain traction in Washington.10 Requirements likely will come in the form of executive action requiring prior notification and review of outbound transactions in certain sectors (such as semiconductor development) to certain destinations. The mechanism may also include required notices of certain outbound capital investments.

Export Controls. 2022 also featured significant updates to U.S. export controls.

- Most notably, the U.S. Department of Commerce significantly expanded U.S. export controls on semiconductors to limit China's access to sensitive technologies with potential military capabilities. The controls include restrictions on U.S. persons who "support" semiconductor manufacturing and related activities in China.

- The United States, European Union, United Kingdom, and other allies responded to Russia's invasion of Ukraine with expansive export controls; for example, the Department of Commerce imposed a license requirement on exporting all items subject to the Commerce Control List to Russia as well as all luxury goods to Russia, and added well over 300 entities to its Entity List (thereby effectively cutting them off from any U.S. exports) for their involvement in Russia's invasion of Ukraine.

5. Delaware Developments

Delaware Allows Corporations to Act to Provide Exculpation for Corporate Officers

In August, Delaware amended its corporate statute to allow corporations to provide in their charters for exculpation of certain senior corporate officers for breaches of the duty of care.11 Previously, the statute allowed corporations to provide exculpation only for directors. Corporations that wish to provide such exculpation to applicable officers will need to amend their charters, requiring stockholder approval.

As with directors, the statute does not extend to breaches of the duty of loyalty or to "acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law." Unlike the protections afforded to directors, the statute does not allow officers to be exculpated for stockholder derivative claims brought on behalf of the corporation.

Companies should consider the potential reaction of stockholders before asking for approval of such provisions in their charters. Proxy advisors have indicated they will review such provisions on a case-by-case basis, and in 2022 generally recommended in favor of such proposals, noting, for example, the need for officers to "remain free of the risk of financial ruin as a result of an unintentional misstep." Assuming more companies implement the amendment, CEOs, CFOs, and other affected officers may see the risk of liability, and claims made, reduced for certain corporate transactions and actions, such as their involvement in preparing proxy statements.

Courts May Not Distinguish "Commercially Best Efforts" From "Best Efforts" Without a Defined Yardstick

In ConMed, a seller challenged a buyer's decision not to pay earn-out payments under a stock purchase agreement, despite the agreement's requirement that the defendant use "commercially best efforts" to maximize payments. The court interpreted "commercially best efforts" as akin to "best efforts," and concluded that the buyer's decision to discontinue payments was "commercially reasonable" in light of, among other things, the buyer's efforts to resolve the underlying safety concerns of the target's medical product.12

Of more general significance to acquisition agreement drafters, the court noted that, while parties use a range of efforts standards, including "best efforts," "reasonable best efforts," "reasonable efforts," "commercially reasonable efforts" and "good faith efforts," courts "have struggled to discern daylight between" the various standards; in particular, in prior opinions the court had found "'best efforts' obligations as on par with 'commercially reasonable efforts'." The court noted that while courts have interpreted efforts clauses in some merger agreements, such agreements have included a "yardstick" to determine whether a party complied with an efforts clause.

Deal practitioners may consider defining the "yardstick" used to determine whether a party satisfies an efforts clause, particularly in agreements governed by Delaware law.

Overcoming Entire Fairness Review in Delaware

2022 brought several victories for defendants despite the invocation of the entire fairness standard of review-one of the most rigorous standards applied in the Delaware Court of Chancery. These cases remind dealmakers involved in controller transactions that the application of entire fairness may still allow defense-side victories, and that they can consider paths other than the MFW combination of an "ab initio" special committee and non-waivable disinterested shareholders' vote.

In one such case, the court concluded that, despite some hiccups in the process with the interested party initiating the deal and identifying special committee advisors, the special committee process was sufficiently robust, even without a stockholder vote, to prevail despite entire fairness review.13 In reaching its conclusion, the court focused on, among other things, that the majority of the special committee was independent, the special committee engaged independent advisors, the interested party ultimately removed himself from the committee's deliberations, and the special committee was fully empowered and did, in fact, push back at critical moments. The court also noted favorably that the agreed-upon price was consistent with what the independent financial advisor deemed fair.

6. Shareholder Activism Continues to be a Central Consideration

We see little to suggest that shareholder activism will diminish in 2023, although several prominent activists lost shareholder votes in 2022. A few trends have emerged:

- "Occasional activists," including individual shareholders such as founders and current or former officers and directors, have become more common.

- Activists continue to use ESG considerations as wedge issues in advancing their campaigns. However, the growing opposition to the overall ESG movement may impact the ability to leverage ESG themes going forward.

- Some prominent activists have taken a more low-key approach, exemplified by Pershing Square's announcement that it would cease running public campaigns and focus instead on constructive stakes in well-performing companies.

- Other activists have pursued large acquisitions, often in combination with private equity firms, such as Elliott Management and its Evergreen Coast Capital private equity arm.

M&A Activism Continues to Affect Deal-Making

M&A-focused activism generally falls into two categories: proactive campaigns that put the company into play or promote a break-up, including where the activist makes its own hostile offer, and reactive strategies that oppose an announced deal because the activist prefers a standalone strategy or alternative transaction or seeks to force an enhanced deal (so-called "bumpitrage"). We may see more of the proactive variety given current market conditions, as activists seek to generate opportunities rather than capitalizing on the competitive dynamics (such as potential jumping bidders) of more buoyant equity and M&A markets.

Use of Universal Proxy Card Becomes Mandatory

Historically, in an election contest, the company and dissident shareholder distributed separate proxy cards and shareholders voting by proxy were generally unable to vote for a combination of director nominees from the competing slates. With the SEC's new rule requiring a "universal" proxy card in contested elections, each side will provide a proxy card that includes both sets of nominees and refer shareholders to the other party's proxy statement for information about the other party's nominees. This rule change will likely bring important consequences:

- With shareholders able to "mix-and-match" nominees from competing slates, dissidents may be more likely to win minority representation. Conversely, election of a control slate may be less likely unless shareholders perceive the need for radical change or the dissident is proposing an acquisition favored by the shareholders.

- The enhanced ability to elect a minority slate might be attractive to smaller or occasional activists who might have otherwise shied away from the expense of a proxy contest given the uncertain outcome.

- The ability to choose individual nominees instead of entire slates will likely result in greater focus on individual nominees' skills and credentials. This may encourage companies and dissidents to resort to more personal attacks on the opposition's nominees, making proxy contests even more contentious. Companies may want to reexamine their proxy materials and related disclosures and processes, including director biographies and skill matrices, as well as their standard director nominee questionnaire.

- The influence of proxy advisory firms could increase further, as some shareholders may search for additional guidance in making their voting decisions from among a broad array of choices rather than the previous binary decision.

- The dynamics of, and relative leverage in, settlement negotiations could be affected.

Many companies are amending their bylaws to build in the new rule's requirements. Some are also reevaluating, and potentially revising, their advance notice bylaws, though activist investors, proxy advisory firms and/or shareholders may challenge such bylaws that they believe are too aggressive. For example, an activist investor recently challenged Masimo's advance notice bylaws, which require a dissident shareholder to identify (among other things) the names of the activist's passive limited partners and their families' investment holdings in the company's competitors or litigation counterparties, any plans the dissident has to nominate directors to other public company boards in the next 12 months, and the names of any shareholders who have already expressed any support for the dissident's nominations.

Pending Disclosure Changes Could Impact Activism

In 2022, the SEC proposed amendments to beneficial ownership reporting under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 to accelerate the filing deadlines for Schedules 13D and 13G reports, expand the application of Regulation 13D-G to certain derivative securities and clarify the circumstances under which persons have formed a "group" that is subject to the reporting obligations. While corporations desire some changes to limit what they feel are surprise accumulations of shares, many activists oppose the changes as potentially diminishing their upside opportunity. The amendments are pending and are expected to be considered this fall.

In 2020, the SEC proposed to amend Form 13F to raise the reporting threshold for investment managers from the current $100 million to $3.5 billion, which it estimated would eliminate filings for 90% of current filers. Because companies often learn about an activist through Form 13F filings, the proposed amendment would eliminate a valuable early warning system. The proposed amendments were not mentioned in the SEC's Fall 2022 Regulatory Flexibility Agenda, signaling that the amendments are not a current priority.

The FTC has proposed to exempt acquisitions from reporting under the HSR Act where the acquirer would not own more than 10% of the company's stock, regardless of value, and does not have a competitively significant relationship with the company. The proposal would effectively eliminate the $101 million HSR filing threshold that serves as an early warning system for mid-and large-cap issuers. A final rule is expected to be posted in the Federal Register by this June.

7. Potential Use of Earnouts

Interest in earnouts should continue in the face of 2023's uncertainties. At the beginning of the pandemic, earnouts grew in popularity in private M&A as a method to bridge valuation gaps and mitigate integration risk in an uncertain economic environment. Early-stage or pre-revenue start-up targets or targets that relied heavily on R&D were particularly impacted by this trend. However, the use of earnouts subsided in 2021 and early 2022 as parties grew accustomed to the issues created by the pandemic. Notwithstanding the recent decline, anticipated economic headwinds in 2023 suggest that earnouts may play a material role in private M&A transactions, particularly in transactions involving early-stage targets.

Revenue and non-financial metrics have become the most common earnout metrics. Revenue-based metrics have emerged as the overall most favored earnout benchmark, though the appropriate metric for any particular deal ultimately is driven by the applicable industry, individual company characteristics and the goals of the parties. In early 2021 and 2020, 41% of earnouts utilized a revenue metric, and only 11% of transactions used an earnings or EBITDA calculation.14 A trend that has continued, particularly for life sciences companies, is the use of non-financial metrics, which tend to be tied to completion of identified projects or more specific development or approval milestones.

Trade-offs in post-closing covenants. Transactions containing an affirmative covenant by the buyer to run the business "consistent with past practice" rose early in the pandemic (to about 21% of 2020 - 1Q2021 deals), although the majority (79% in 2020 - 2021) did not include this covenant at all. Conversely, the use of covenants obligating the buyer to run the acquired company in a manner that would maximize the earnout fell.

Delaware courts read earnout provisions closely. In one recent case, the Delaware Court of Chancery emphasized its reluctance to infer contractual provisions outside of the express language in the agreement. In that case, the court rejected claims of an implied covenant of good faith and fair dealing, which the seller alleged would have obligated the acquiror to act to achieve the earnout milestones, and declined to "rewrite" the agreement to imply provisions that the seller failed to negotiate.15 In another recent case, as noted above, the court found no difference between "commercially best efforts" and "best efforts," in supporting its determination that an acquiror was entitled to stop making earnout payments.16 One takeaway from both cases is that earnout provisions must be drafted carefully to ensure that future interpretation of the provision will be consistent with the parties' intent at the time of drafting and to reduce the likelihood of a distracting and expensive post-closing dispute.

8. European M&A

Regulatory Hurdles for Inbound M&A in Europe

In response to geo-political tensions, the EU and its member states have strengthened their FDI controls, especially regarding investments from China. Since 2020, the EU has set minimum requirements for member states' FDI screening mechanisms and required coordination of their FDI reviews. Member states must consult with other member states and notify the European Commission of any concerns, increasing the duration of FDI review proceedings.

Some large EU member states, such as France and Germany, overhauled their FDI regimes to significantly increase the scope of acquisitions subject to notification and approval requirements. The UK, as noted above, followed the same trend, establishing a broad FDI regime enabling control of investments into sensitive industries.

Trends for M&A Transactions in Europe

- Carve-Outs and Spin-Offs on the Rise. The increasing financing costs and uncertain economic environment, with high energy costs and softening consumer demand, is expected to result in companies revisiting their portfolios. This is likely to result in more carve-out deals and spin-offs.

- Increased Use of Completion Accounts. Locked box arrangements have been popular in auction sales. However, as we move to a more buyer-friendly market, the use of completion accounts mechanisms is increasing. Given the sometimes substantial delays between signing and closing and high market volatility, parties should pay close attention to the contractual provisions providing for the completion accounts and related review mechanism.

- Earn-out Structures. Due to difficulties with

the valuation of assets in a volatile economic climate, earnouts

are increasingly used to bridge valuation gaps. This applies

especially to technology and life sciences/biotech deals, as the

valuation-multiples are high, and a fair valuation of a target

based on current KPIs can be challenging.

In European transactions, the earnout metric most commonly used has been EBITDA. More creative measures may start to also be used, particularly for start-up businesses. Some parties may also allow for an extension of an earn-out period or for adjustment of earn-out calculations, in case of certain external circumstances, such as a new wave of COVID or energy shortages.

- More M&A Disputes. M&A claims in Europe have increased over the past two years, and we expect this to continue given the significant challenges faced by businesses throughout Europe. In particular, disputes over adjustments to the purchase price are expected to rise, as parties are more likely to argue about valuation metrics post-acquisition. Disputes also may rise with any increase in the use of earnout structures.

- VC Consolidation. Venture-backed companies are highly affected by the market uncertainties by way of negative effects on their valuations. This applies to already listed companies and late-stage companies nearing an initial public offering. We expect the VC market to experience an increase in transactions aiming at a consolidation of competing VC business in order to reduce the cash burn.

9. Further Recognition of ESG Considerations, with Some Pushback

2022 saw the continued rise of the attention given to environmental, social and governance ("ESG") issues in M&A, particularly with respect to climate and the environment, employment, talent retention, and, increasingly, data. Dealmakers' concerns are driven by, among other things:

- Perceived Value and Market Demand. Companies and institutional investors tend to focus on the aspects of ESG that drive value for their particular businesses, applying in effect a "materiality screen" to focus on the most important of the many issues that fall under the ESG rubric. Understanding the impact that an acquisition may have, including the differences between a buyer and a target in their approaches to the relevant aspects of ESG, is critical in addressing potential reputational issues and preparing for post-closing integration of the companies. For public companies, activists have sought to leverage ESG concerns, sometimes as the direct object of a campaign and sometimes as a secondary issue; while sometimes successful, such as Engine No. 1's campaign at ExxonMobil, some have failed, such as Carl Icahn's campaign at McDonald's regarding animal security.

- Legal and Regulatory Environment. Among other things, regulators have strengthened requirements for ESG related disclosures, including:

-

- U.S. In March 2022, the SEC proposed extensive rules requiring disclosure relating to greenhouse gas emissions and other climate-related risks, as well as climate-related governance and risk management. The SEC also has proposed disclosure rules for cybersecurity and stepped up enforcement against greenwashing. The disclosure rules will require covered companies to report not only about themselves but also about companies in their supply chains, While the rules directly address disclosure, they also are likely to drive behavioral change, and even deal activity.

- Europe. European Union, UK, Germany and certain other European countries have issued several ESG related regulations, including the new Corporate Sustainability Reporting Directive requiring annual ESG reports.17

2022 also saw some backlash against ESG investing, particularly in the U.S., on multiple grounds, from allegations of greenwashing to outright bans by certain U.S. states for state pension funds to invest in ESG funds and/or fund managers with an ESG strategy.

ESG-Driven M&A Transactions. Some deals are driven by ESG issues or the desire to improve an ESG reputation. For example, oil and gas companies may divest assets that produce carbon-intensive products, while acquiring assets in areas such as carbon capture, recycling, smart grids, or other clean technologies. Traditional consumer companies may seek to acquire sustainable product lines to capitalize on changing buying patterns and consumer preferences.

ESG Due Diligence. Increasingly, buyers are conducting ESG diligence as part of their standard diligence process, with tailored focuses depending on the acquirors' ESG priorities and reporting and compliance requirements, as well as target companies' nature of business and value propositions.

ESG Specific Deal Terms. In the M&A context, many ESG issues overlap with and are captured generally by the broad representations and warranties traditionally included in M&A transaction documents. However, representations and protective provisions are increasingly added or expanded to address specific ESG issues that could result in significant litigation, regulatory, or reputational risks. For example, compliance with laws and data privacy representations may be expanded to cover industry standards, best practices or other soft laws, or specific representations may be included on sexual harassment or forced labor where such issue might be prevalent in the jurisdictions where the target operates. Buyers also may request representations regarding current compliance, and covenants to take steps to enable compliance after the acquisition, with the increasing ESG disclosure requirements, as noted above, as well as covenants to take steps towards meeting specific ESG metrics to reduce negative impacts or increase positive impacts (or both).

ESG-Linked Acquisition Financings. For M&A transactions that rely on debt financings, ESG factors may also come into play, as acquirors may tap into sustainable financing products that reward positive ESG metrics with lower cost of capital. For example, in August 2022, the Carlyle Group launched a decarbonization-linked financing program, under which borrowers will receive a pricing benefit based on the achievement of decarbonization targets or other climate-related metrics.

Footnotes

1. For a discussion of the SEC's SPAC rules, please see our client alert, SEC Proposes Sweeping Regulations Regarding SPAC and De-SPAC Transactions that Could Have a Chilling Effect on SPACs and Other Market Participants.

2. For further discussion, please see our client alerts, DC Council Waters Down Non-Compete Ban and Illinois Ushers New Restrictions.

3. For further discussion, please see our client alert, FTC Proposes Sweeping Ban of Employee Non-Competes.

4. Kodiak Building Partners, LLC v. Adams (Del. Ch. Oct. 6, 2022); for a discussion, please see our client alert, Delaware Court Refuses to Enforce or Blue Pencil Sale of Business Non-compete.

5. Blue Mountain Enterprises, LLC. v. Owen, 74 Cal. App. 5th 537 (2022) and Arthur J. Gallagher & Co. v. Petree, 2022 WL 1241232 (E.D. Cal. Apr. 27, 2022).

6. Nuvasive, Inc. v. Miles (Del. Ch. 2019).

7. Perry v. Floss Bar, Inc., 2021 U.S. Dist. LEXIS 43429 (S.D. N.Y. 2021).

8. Depuy Synthes Sales, Inc. v. Howmedica Osteonics Corp., 28 F.4th 956 (9th Cir. 2022).

9. For further discussion of the Guidelines, please see our client alert, New CFIUS Enforcement Guidelines Signal Expanded Compliance Focus.

10. For a discussion of potential legislation, please see our client alert, Lawmakers Continue Push for Review of Outbound Investments.

11. See Delaware General Corporations Law Sec.102(b)(7).

12. Menn v. ConMed Corp. (Del. Ch. June 30, 2022).

13. In re BGC Partners, Inc. Deriv. Litig. (Del. Ch. Aug. 19, 2022).

14. ABA M&A Committee Private Target M&A Deal Points Study (2020 - 1Q2021).

15. Pacira Biosciences, Inc. v. Fortis Advisors LLC (Del. Ch. Oct. 25, 2021).

16. Menn v. ConMed Corp. (Del. Ch. June 30, 2022).

17. For more information regarding the CSRD, please see our client alert, Corporate Sustainability: EU to Expand ESG-Related Reporting Obligations.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved