- in Asia

- with readers working within the Retail & Leisure industries

- within Strategy and Accounting and Audit topic(s)

On May 3, 2023, the Securities and Exchange Commission adopted final rules regarding public company issuers' share repurchases and Rule 10b5-1 trading plans. Although the final rules are in certain respects not quite as burdensome as the proposed rules, the final rules will nevertheless significantly heighten issuers' disclosure obligations.

On a quarterly basis, an issuer must disclose: quantitative information about its own daily share repurchase activity; whether its directors and officers bought or sold shares within four business days of the issuer's announcement of a new, or an increase to an existing, share repurchase program; and for domestic issuers, the adoption or termination of Rule 10b5-1 plans and the material terms of such plans.

The final rules also require an issuer to provide enhanced disclosure of its repurchase programs and practices generally, including policies and procedures relating to share trading by directors and officers (or senior management for foreign private issuers) during the life of a repurchase program.

Noting a desire that investors be better able to "assess the efficiency of, and motives behind, issuer repurchases," the Securities and Exchange Commission ("SEC") adopted final rules that require enhanced periodic disclosure about issuer share repurchases, issuer Rule 10b5-1 trading plans, and trading by directors and officers around the time of repurchase program announcements. The final rules should be viewed alongside the SEC's final rules regarding Rule 10b5-1 trading plans and related disclosure adopted in December 2022, as discussed in our December 2022 Commentary, "SEC Adopts Final Rules Regarding Rule 10b5-1 Trading Plans and Related Disclosures." Both sets of rules seek to cast light on the timing and circumstances around trading by persons and entities presumed to have inside information. Although the adopting release notes that "repurchases are often employed in a manner that may be aligned with shareholder value maximization," the tone of the adopting release and the final rules underscore the SEC's and other constituents' skepticism around issuer share repurchases.

The final rules apply to all issuers, including most foreign private issuers ("FPIs"),1 that purchase equity securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 (generally those that have common equity securities listed on the NYSE or Nasdaq). The final rules include several significant modifications to the SEC's original proposed rules in response to comments on the proposed rules, including those submitted by Jones Day.

WHAT IS REQUIRED?

The final rules require issuers to disclose the following on a quarterly basis:

- Quantitative information about an issuer's daily share repurchase activity;

- Whether directors and Section 16 officers (or senior management for FPIs) traded within four business days of the announcement of a new, or an increase to an existing, repurchase program;

- Narrative information about an issuer's repurchase programs and practices, including policies and procedures relating to share trading by directors and Section 16 officers (or senior management for FPIs) during the life of a repurchase program; and

- Adoption and termination of Rule 10b5-1 trading arrangements and, for domestic filers, certain information about such arrangements.

The SEC also introduced new Form F-SR, which, in a departure from the typical semi-annual periodic reporting calendar for FPIs, will require FPIs to disclose repurchase information within 45 days of quarter end.

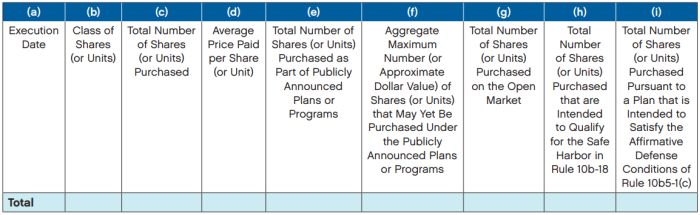

New Tabular Disclosure of Daily Share Repurchase Activity

The final rules require an issuer to provide tabular disclosure of quantitative information, on a quarterly basis as part of a Form 10-Q or Form 10-K filing, about its daily share repurchase activity.2 This marks a noteworthy change from the proposed rules, which would have required disclosure of share repurchases on reports furnished, not filed, within one business day of the issuer's share repurchase order.

Tabular Disclosure.

Issuers must disclose the following information in the following format for each execution date:

To avoid redundancy, the final rules eliminate the previously existing SEC disclosure requirements regarding monthly repurchase data in periodic reports.

Frequency and Manner of Disclosure. Issuers must include the table above:

- On a quarterly basis in a new Exhibit 26 to their Form 10-Q and Form 10-K pursuant to new Item 601(b)(26) of Regulation S-K for domestic issuers; and

- On a quarterly basis in a new Form F-SR (to be filed within 45 days after the end of an FPI's fiscal quarter) for FPIs filing on FPI forms.

Footnote Disclosure. In a footnote to column (i) of the table above, issuers must include the adoption or termination date of any plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) for the shares disclosed in column (i). Note that this disclosure may overlap with the disclosure required by new Item 408(d) of Regulation S-K for domestic issuers; under Item 408(d), domestic issuers must disclose whether, during the last fiscal quarter, the issuer adopted or terminated any Rule 10b5-1 arrangement and provide a description of the material terms of any such arrangement.

Checkbox Requirement. Issuers filing new Exhibit 26 or Form F-SR must include a checkbox preceding the repurchase table indicating whether directors or Section 16 officers (or, for FPIs, directors and members of senior management who would be identified pursuant to Item 1 of Form 20-F) purchased or sold shares that are the subject of an issuer share repurchase plan or program within four business days before or after the announcement of a new, or an increase to an existing, plan or program. This would include shares that directors and officers purchase or sell pursuant to Rule 10b5-1 plans. Provided that reliance is reasonable, domestic issuers may rely on Section 16 filings, and FPIs may rely on written representations from directors and senior management, to determine whether to check the box.

Filed, Not Furnished. The information included in Form 10-Q, Form 10-K, Form 20-F, and Form F-SR will be treated as filed, instead of furnished. This subjects issuers to liability under Section 18 of the Exchange Act, as well as Section 11 liability to the extent such reports are incorporated into registration statements or other filings under the Securities Act of 1933.

Revisions to and Expansions of Existing Narrative Periodic Disclosure Requirements

The final rules revise and significantly expand existing disclosure requirements set forth in Item 703 of Regulation S-K (applicable to Form 10-K and Form 10-Q) and Form 20-F. Specifically, the new rules require narrative disclosure of:

- Objectives or rationales for each repurchase plan or program, and the process or criteria used to determine the amount of repurchases.

- Any policies and procedures relating to purchases and sales of the issuer's securities by its directors and officers (or senior management for FPIs) during a repurchase program, including any restrictions on such transactions.

- The number of shares (or units) purchased other than through a publicly announced plan or program, and the nature of any such transaction.

- For publicly announced repurchase plans or programs, the date each plan or program was announced, the dollar amount (or share or unit amount) approved, expiration dates (if any), early terminations, and expirations of publicly announced repurchase plans or programs during the period.

Note: The narrative disclosure must include tailored references to the specific repurchases disclosed in the tabular disclosure, as applicable.

The final two bullets above correlate with disclosure currently required in a footnote to the monthly quantitative share repurchase table; the final rules move this disclosure to the main narrative discussion. The final rules caution against using boilerplate disclosure language and provide suggested topics for the objectives and rationale discussion, including: alternative uses of funds allocated for share repurchases; comparisons to other investment opportunities; expected impact on the value of the issuer's remaining shares; specific factors driving the repurchases, such as undervaluation of the shares or limited internal growth potential or acquisition targets; and sources of funding for the share repurchases.

New Disclosure of an Issuer's Use of Rule 10b5-1 Plans

New Item 408(d) of Regulation S-K requires domestic issuers to disclose the adoption and termination of issuer Rule 10b5-1 trading plans, including the material terms of those plans, on a quarterly basis in their periodic reports. Material terms include the date of adoption or termination, the duration and the aggregate number of securities to be purchased or sold pursuant to the Rule 10b5-1 trading arrangement (but not the price). Where disclosure would be duplicative of disclosure required by Item 703, a cross reference to that disclosure will satisfy the new Item 408(d)(1) requirement. FPIs will also be required to include in Form F-SR the adoption or termination date of any plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1 for shares listed in column (i) of the table included with the Form F-SR filing.

IXBRL TAGGING

Issuers must tag disclosures pursuant to the new rules in Inline XBRL ("iXBRL") in accordance with Regulation S-T and the EDGAR Filer Manual.

COMPLIANCE DATES

Domestic issuers will be required to comply with the new disclosure and tagging requirements in the filing that covers the first full fiscal quarter that begins on or after October 1, 2023 (for issuers with a December 31 fiscal year end, this will be the Form 10-K for fiscal year 2023). FPIs that file on FPI forms will be required to comply with the new requirements in new Form F-SR beginning with the Form F-SR that covers the first full fiscal quarter that begins on or after April 1, 2024, and with the Form 20-F narrative disclosure in the first Form 20-F filed thereafter.

The full release detailing the new rules can be found on the SEC's website.

KEY TAKEAWAYS

Establish Processes and Controls for Daily Share Tracking

Issuers will need to establish new processes and controls to track: (i) daily share repurchase activity and (ii) for FPIs, director or senior management trades made within four business days of an announcement (domestic issuers likely already have the necessary processes and controls in place in connection with existing Section 16 reporting requirements).

Review Insider Trading Policies

In light of the new rules, issuers should consider revisiting their insider trading plans and policies around the ability of insiders to execute trades in the issuer's securities during the pendency of repurchase programs and/or within four business days of program announcements. For example, issuers with robust insider trading policies may find that they already are positioned to utilize features like pre-clearance procedures and blackout windows to provide sufficient protection without blanket bans on trading around announcements.

Solidify Structure and Rationale for Repurchase Programs

As part of the discussions leading up to implementing a share repurchase program, issuers should ensure that the objectives and rationales for share repurchases are thoroughly reviewed and subject to disclosure controls, and that there is an established process or criteria used to determine the amount and timing of repurchases. Issuers should be mindful that the rule cautions against the use of boilerplate in the narrative disclosure, which it requires to be "sufficiently detailed" and to be "appropriately tailored to an issuer's particular facts and circumstances."

Enforcement and Litigation Action

In light of the perceived abuses highlighted in the adopting release and the heightened liability standards accompanying "filed" disclosure, issuers and individuals should expect to see continued enforcement attention and litigation in this area. For a discussion of recent significant developments and emerging trends in the enforcement of insider trading laws and regulations, see our April 2023 White Paper.

The U.S. Chamber of Commerce, the Longview Chamber of Commerce, and the Texas Association of Business (the "Petitioners"), represented by Jones Day, have filed a petition for review of the final rules in the U.S. Court of Appeals for the Fifth Circuit. In particular, the Petitioners challenge the requirements to disclose daily repurchase data and the objective or rationale for repurchase plans. The petition claims that the SEC violated the Administrative Procedure Act in promulgating these requirements and that the requirements violate the First Amendment's prohibition on compelled speech.

Footnotes

1. The final rules do not impose the amended repurchase disclosure requirements on Canadian issuers that file using the Multijurisdictional Disclosure System because those issuers are subject to a separate reporting regime.

2. The SEC has not yet provided clarity on how to disclose repurchase activity under accelerated share repurchases ("ASRs") or other structured share buyback transactions. While the final rules mention comments on the proposed rules requesting clarity on how repurchase activity under structured transactions should be disclosed, uncertainty remains on how and when repurchase activity should be disclosed (e.g., both at the outset on initial settlement of the transaction and at final settlement). Developments and market practice with respect to disclosures around these types of transactions should be monitored.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.