- with readers working within the Securities & Investment industries

- within Wealth Management and Law Practice Management topic(s)

The Securities and Exchange Commission's Office of the Advocate for Small Business Capital Formation issued on December 16, 2022 its 2022 Annual Report to the U.S. Congress and to the SEC detailing how entrepreneurs, investors, and private and smaller public companies are engaging in capital raising. The Report provides a wealth of data from the SEC's Division of Economic and Risk Analysis (DERA) and other sources.

Based on DERA data, from July 1, 2021 to June 30, 2022, for example, companies raised $1.1 trillion in SEC registered offerings (and $126 billion in IPOs), and $2.3 trillion in Rule 506(b) private placements and $2.0 trillion in other exempt offerings. Companies raised $148 billion in Rule 506(c) offerings, $624 million in Rule 504 offerings, $1.8 billion in Regulation A offerings and $368 million in crowdfunding. The Report provides interesting data on the capital raising methodology relied upon by companies in different sectors, as well as a geographic analysis of where companies are raising capital (by state) within the United States. Pooled fund account for over 85% of the funds raised under Regulation D. Excluding pooled funds, technology companies rely most on raising capital through Regulation D offerings. The amounts sought to be raised by companies undertaking Regulation A offerings has declined (despite the rules now allowing companies to raise more capital in reliance on Regulation A). Real estate companies are the most frequent users of Regulation A. The Report also addresses early stage funding—noting that in recent years, the number of seed rounds and seed firms have increased. The Report also contains a detailed review of VC activity.

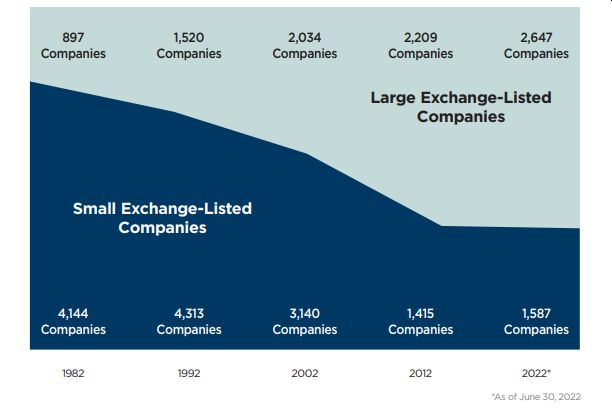

Finally, the Report examines trends affecting small public companies. The number of small, exchange-listed companies has declined drastically, as shown in this image from the Report.

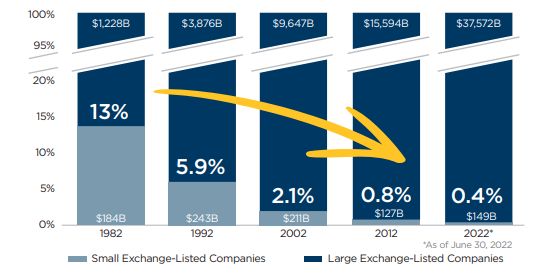

In addition, the aggregate market capitalization of small, exchange-listed companies has declined significantly, as illustrated by the image below.

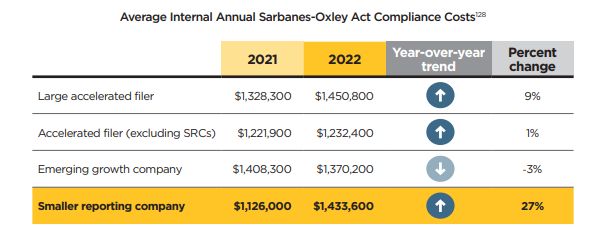

This is also evidenced in reviewing IPO trends. There are very few smaller companies undertaking IPOs. The Report demonstrates that compliance costs generally are fixed and not scalable and have disproportionally increased for smaller reporting companies.

In addition, as the Report demonstrates, most smaller public companies do not benefit from one of the more important aspects associated with being public—research analyst coverage. On average, small public companies are only covered by two analyst firms, compared to an average of nine for large public companies. This directly affects liquidity in their stocks. Small public companies with limited research coverage have lower levels of institutional ownership. The Report indicates that only 47% of small public companies have institutional investor holdings, compared to 66% for large public company peers. All of this suggests that, if the United States would like to preserve smaller public companies, it ought to review the regulatory scheme and market environment affecting these companies.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.