In Texas, sales of alcoholic beverages can give rise to two types of taxes: Mixed Beverage Gross Receipts Tax, and Mixed Beverage Sales Tax. There are several complexities in how these are computed and how they interact with other state taxes, including the normal Sales and Use Tax. Additionally, the Comptroller's audit methodology for these taxes often creates problems for taxpayers. Below is a brief summary of these taxes and some of the more prevalent issues they present.

Mixed Beverage Gross Receipts Tax

Texas Tax Code § 183.021 provides that a 6.7% tax is imposed on "the gross receipts of a permittee received from the sale, preparation, or service of mixed beverages or from the sale, preparation, or service of ice or nonalcoholic beverages that are sold, prepared, or served for the purpose of being mixed with an alcoholic beverage and consumed on the premises of the permittee." 1

In turn, the term "mixed beverage" is defined to mean:

"One or more servings of a beverage composed in whole or part of an alcoholic beverage in a sealed or unsealed container of any legal size for consumption on the premises where served or sold by the holder of a mixed beverage permit, the holder of certain nonprofit entity temporary event permits, the holder of a private club registration permit, or the holder of certain retailer late hours certificates." 2

This generally includes three primary categories of drinks: liquor (including mixed drinks), beer, and wine.

As noted, the 6.7% tax applies to the "gross receipts" of a permittee. This term is not defined by statute or by regulation, but the Comptroller's regulations do provide some insight by stating "[t]he tax may not be separately charged to or paid for by the customer and cannot be considered included in the gross receipts amount." 3 This language suggests the amount must be computed as 6.7% of the total amount charged to the customer, and must be paid separately by the permittee to the Comptroller.

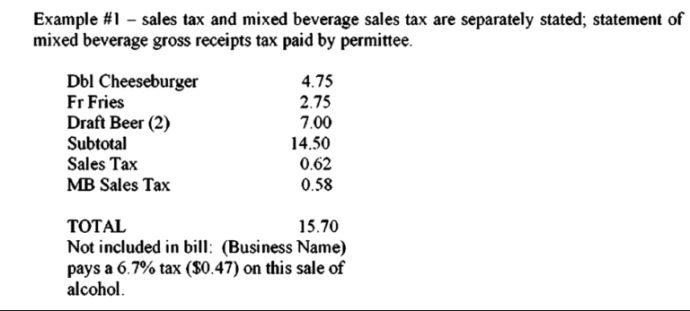

It is also important to note that the "gross receipts" on which the 6.7% tax is computed does not include other taxes, such as sales tax or mixed beverage sales tax. This is made clear by the examples provided in Comptroller Rule 3.1001(b)(4). The first example 4 is copied below:

As is relevant to the mixed beverage gross receipts tax, the example invoice includes a $7.00 charge for beer, separate line items for sales tax and mixed beverage sales tax, and a "tax disclosure statement" for the mixed beverage gross receipts tax. The mixed beverage gross receipts tax on the invoice is $0.47, which equates to 6.7% of the $7.00 beer charge and thus does not include any other items.

Mixed Beverage Sales Tax

Texas Tax Code § 183.041 provides that an 8.25% tax is imposed on "each mixed beverage sold, prepared, or served by a permittee in this state and on ice and each nonalcoholic beverage sold, prepared, or served by a permittee in this state for the purpose of being mixed with an alcoholic beverage and consumed on the premises of the permittee." 5

Although the plain language of the Tax Code appears to suggest that sales of mixed beverages are subject to both the mixed beverage sales tax and the normal sales tax, this is not the case. Texas Tax Code § 151.308(a)(5) provides that sales subject to the mixed beverage sales tax are exempt from the normal sales tax. 6 Thus, permittees who sell mixed beverages would only be responsible for collecting mixed beverage sales tax on those items. However, permittees who sell non-mixed beverage items would still likely be responsible for collecting the normal sales tax on those items.

Mixed Beverage Audits

Mixed beverage gross receipts and sales tax audits can be incredibly frustrating and penalizing for taxpayers. As an initial matter, errors in one of these taxes are often accompanied by errors in the other. Because the Comptroller generally audits taxpayers for both of these taxes simultaneously, taxpayers will often feel as if they're being doubly penalized for errors.

Additionally, the Comptroller's audit methodology may poorly represent the taxpayer's business. The standard methodology currently used by the Comptroller's office often oversimplifies the taxpayer's business by analyzing an entire audit period (which may include up to four years of sales) using data points from just a few days. The methodology may also fail to properly account for the realities of alcoholic beverage-related businesses, such as inconsistent pour sizes, theft and spillage, and seasonal fluctuation in purchase and sales prices.

Footnotes

1 Tex. Tax Code § 183.021.

2 Tex. Alc. Bev. Code § 1.04(13).

3 34 Tex. Admin. Code § 3.1001(b)(1).

4 34 Tex. Admin. Code § 3.1001(b)(4), Example 1.

5 Tex. Tax Code § 183.041.

6 Tex. Tax Code § 151.308(a)(5).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.