- within Real Estate and Construction topic(s)

THE STATE OF CLEAN ENERGY AFTER THE 2024 ELECTION

Recent U.S. election results introduce new challenges and opportunities for a clean energy sector heavily influenced by the political climate, regulatory shifts, and financial markets. As myriad fundamentals -- including the cost of capital and policy – evolve, so too will the sector's growth prospects.

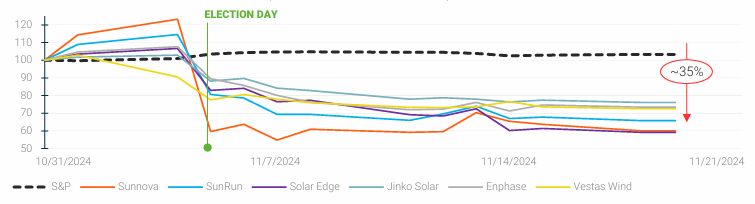

Investors seem to be extremely cautious about the potential impact on the renewable sector. A representative set of publicly traded industry leaders are underperforming the broader market in response to the election.

AlixPartners Power & Renewables Team offers a subjective view on changes to come and how to best prepare business for the shift of power in Washington.

REPRESENTATIVE PRICE RETURN (INDEXED FROM 31-OCT)

SIX KEY IMPACTS ON THE RENEWABLES INDUSTRY

1. HIGHER RISK PREMIUM DRIVEN BY POLICY UNCERTAINTY

Clean energy projects are capital-intensive, and this changing of the guard may result in slower-than-expected interest rate declines. At the same time, potential policy shifts could drive up borrowing costs for renewable investments. Even though the Inflation Reduction Act may not be fully repealed, there is still considerable legislative risk to clean energy programs in the wake of the election.

Any changes to the IRA provisions could disrupt the flow of subsidies and tax credits, making it harder for companies to access capital. Smaller clean energy firms are especially vulnerable to financial difficulties if government loans or subsidies are delayed investors should be prepared for disruption across the renewable supply chain.

With possible higher risk premiums driven by uncertainty ahead, companies should immediately explore alternative funding strategies, tighten cash management, and scrutinize capital projects. Companies dependent on federal loan commitments or subsidies should prepare for potential setbacks, while larger firms may need to focus on accelerating projects before funding sources dry up.

2. SHORT-TERM SCRAMBLE FOR KEY COMPONENTS

Those anticipating higher tariffs and a tougher regulatory climate may rush to start clean energy projects before changes to subsidies and credits take effect, or deadlines for existing tax incentives are accelerated. A short-term demand surge would further pressure supply chains, creating near-term upward pressure on prices for key components.

Swift action is required to secure supplies and meet deadlines tied to current incentives before new tariffs take effect.

3. ONSHORING AND NEARSHORING MAY INTENSIFY

Trade policies are in flux, with tariffs and geopolitical tension affecting Asian supply chains and potentially fueling a more aggressive shift to nearshoring. Focus may shift to building resilient production closer to home or within allied nations, helping avoid disruptions and ensure stability.

This significant shift in supply chain and potential need to develop new manufacturing capacity requires a deep review of internal capabilities resulting in realignment of the operating model to enable success.

4. SUBSIDY AND LOAN DELAY, CHANGES IN IRS GUIDELINES

Election results are stoking concern about potential delays in grants, loans, and tax credits. The processing of support from the Department of Energy's Loan Programs Office may slow down, for instance, impacting firms dependent on government assistance.

The Trump administration's approach to the Waste Emissions Charge – the source of revenue for the IRA tax credits – should be closely watched. Changes to IRS guidelines on tax credit rules would make it harder for companies and consumers to claim credits for renewable energy technologies like solar and electric vehicles. This could dampen the growth of these markets, slowing investment and reducing the attractiveness of clean energy projects for consumers.

Business models heavily dependent on governmental programs may want to reassess economic viability of their projects, revise growth plans and profitability assumptions in the business plan. Organizational rightsizing may be required to adjust cost base to the new normal.

5. RE-ALIGNMENT TO LOCAL INCENTIVES

While the federal government has clout via many general tax credits, each state will work to fortify their own energy policies. The already significant divide for ISOs deploying more renewable generation (CAISO; SPP, ISO-NE) may further deepen driven by local incentives and weakened federal policy. States pushing more renewables will shore up local incentives to meet the energy transition targets.

Regionalization of incentives will widen the gap in energy deployment, perhaps causing more shift in business footprints over the next four years. Companies must rethink its go-to-market strategies to best position their businesses to capitalize on local incentives. This shift may add further complexity to the business and drive short-term uncertainty. True winners will be able to re-align their geographic focus and accelerate growth through selective M&A.

6. DEREGULATION OPPORTUNITIES

Deregulation is likely to continue, potentially including repeal of environmental reviews and attempted dismantling of the EPA. Improved economics for fossil fuels may not be enough to attract more investments as clean energy already competes without subsidies in many markets. Historical EPA regulations (Clean Air Act and Clean Water Act) will be difficult to dismantle due to history and entrenched processes and will likely remain intact.

If certain environmental protections are rolled back, however, this could streamline project approval timelines and reduce bureaucratic hurdles, allowing companies to bring products to market faster. For clean energy projects like solar farms and energy storage systems, shorter approval timelines could significantly speed up deployment and reduce costs.

Companies should explore opportunities to capitalize on less strict regulatory environment. As the economics of many businesses shift, legal, regulatory and permitting may be areas of substantial savings if managed properly. New, possibly compressed timelines and lower third-party spend may offer much needed tailwind to the already challenged capital projects in renewable space.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.