Originally Published September 15, 2011

Keywords: Renewable Auction Mechanism, RAM Resolution, renewable energy, IOUs,

On August 18, 2011, the California Public Utilities Commission (CPUC) adopted a resolution (the RAM Resolution) implementing program details and bidding protocols for California's Renewable Auction Mechanism (RAM). The resolution also approved standard form purchase contracts for use by each of California's three investor-owned utilities (the IOUs) in the RAM program.

Adopted in late 2010, RAM is a procurement process for renewable energy projects up to 20 MW that meet the eligibility requirements for California's Renewables Portfolio Standard (RPS) Program. CPUC developed and adopted RAM as an evolution and expansion of the feedin tariff program that is currently used to incorporate smaller renewable energy projects into California's Renewables Portfolio Standard program.1 Participation by the IOUs is mandatory, but the IOUs are not limited to RAM for project procurement. The IOUs may also use annual RPS solicitations or other CPUCapproved programs to develop projects up to 20 MW, but they may no longer use bilateral negotiations or voluntary programs. RAM's initial target capacity is 1,000 MW over the first two years, adjustable by CPUC at any time.

CPUC expects to increase that capacity, pending review of the RAM program generally.

The RAM Resolution revised and clarified several elements of the RAM auction process, including:

- The IOUs must hold RAM auctions every six months, with the first auction to close no later than November 15, 2011, and the second auction to close no later than May 31, 2012. The IOUs must hold their respective auctions simultaneously.

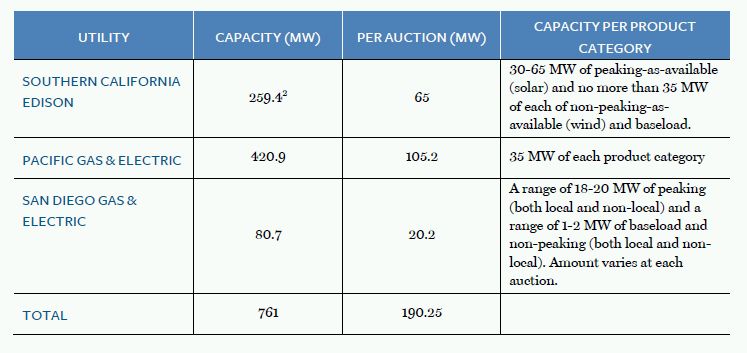

- Each IOU is allocated a percentage of the total RAM capacity of 1,000 MW and must seek to contract one quarter of that capacity at each auction. The IOUs' respective allocations of RAM capacity are set forth below. The RAM Resolution clarified that the IOUs may procure their respective capacity targets plus or minus 20 MW in each product category (baseload, peaking-as-available and nonpeaking- as-available) at each auction, as long as the total capacity procured in each auction does not exceed plus or minus 20 MW. The RAM resolution also clarified that each IOU can revise the amount of its capacity allocated to each product category with CPUC approval.

- Bids must be for a minimum of one MW, but projects of at least 500 kW may aggregate for purposes of submitting a bid, subject to an aggregation cap of five MW.

- Winning bids at each RAM auction will be selected based on price, least expensive first, until the capacity limit for that auction is reached. The RAM Resolution clarified that the IOUs must add the estimated transmission network upgrade costs resulting from the most recent interconnection study to the bidding project's price when ranking bids.

- In addition to price, IOUs may use evaluation or selection criteria that CPUC has approved or approves in the future and are authorized to use supplier diversity as a secondary project selection criterion. Further, the IOUs are authorized to use a seller concentration limit. PG&E approved a seller concentration limit of 20 MW in its advice letter and was the only IOU to do so.

- RAM contract terms can be for 10, 15 or 20 years.

The RAM Resolution approved the standard form contracts to be used by each of the IOUs in the RAM program. A comparison of each IOU's forms is beyond the scope of this alert, but each form is required to include the following:

- An 18-month time frame for project completion, beginning at the time of contract execution. This period may be extended one time, for a period of six months, for projects that have paid fees and filed applications in a timely fashion upon a showing that there are regulatory delays outside of the developer's control. The RAM Resolution clarified that the 18-month deadline begins from the date of CPUC's approval of a RAM contract, not from the time of the contract's execution.

- A development deposit in the amount of $20/kW for projects five MW and smaller and $60/kW and $90/kW for intermittent and baseload resources, respectively, for projects greater than five MW. The development deposit requirement expires on project completion, but a performance deposit is also required following completion and through the expiration of the power purchase agreement. For projects less than five MW, the development deposit will convert into the performance deposit, and for projects greater than five MW, the performance deposit is equal to 5 percent of expected total project revenues.

- A requirement that projects operate in accordance with good utility (or prudent electric) practices and maintain liability insurance.

- Uncapped liability for the IOU's direct, actual losses.

- Standard force majeure clauses that must protect both the buyer and the seller.

- Events of default provisions.

- Solar quantity should account for module manufacturers' annual degradation factors.

The RAM Resolution also revised certain project eligibility criteria, which include:

- Bidding projects must demonstrate site control upon submitting bids.

- Bidding projects must demonstrate developer experience (at least one member of the development team must have at least begun construction on a similar project).

- Bidding projects must use a commercialized technology.

- Bidding projects must have completed a System Impact Study, a Phase I interconnection study, or have passed the Wholesale Distribution Access Tariff or Generator Interconnection Procedures Fast Track screens to participate in a RAM auction. Bidding projects are not required to have obtained full-capacity deliverability status from the California Independent System Operator to bid or to execute a RAM contract.

- New and existing projects are eligible to participate in the RAM auctions.

Learn more about our Energy practice.

Visit us at mayerbrown.com

Footnotes

1 The existing feed-in tariff program is in place for projects up to 1.5 MW and uses a fixed price set by CPUC equal to the market price referent and stated publicly. The existing feed-in tariff program continues to apply independent of the RAM.

2 The revision of SCE's obligation downward from 498.4 MW is contingent upon CPUC approval of the 21 contracts executed from the 2010 Renewables Standard Contract solicitation. CPUC has not yet approved those contracts.

Visit us at mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2011. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.