- within Insurance, Finance and Banking and Privacy topic(s)

- with readers working within the Banking & Credit, Insurance and Metals & Mining industries

Section 48 of the Internal Revenue Code of 1986 provides for a credit equal to a percentage of the cost of new equipment for the generation of renewable energy, including solar energy used to produce electricity or to heat or cool a structure. For solar energy projects, the construction of which commences in 2021 or 2022 and which are placed in service prior to January 1, 2026, the credit rate is 26%. For projects commencing construction during 2023 but are placed in service before 2026, the credit rate is 22%. Projects beginning construction in 2024 or after or placed in service after December 31, 2025, the credit rate is 10%. Such credit is available to the taxpayer claiming the credit in the year in which the property is placed in service. No credit will be allowed for property which is tax-exempt use property. For this purpose, tax-exempt use property is property owned by or leased to a tax-exempt entity. Tax-exempt entities include: (i) a governmental entity; (ii) any entity exempt from Federal income tax; (iii) a foreign person or entity; or (iv) a tribal government.

A few points to remember regarding energy credits:

- A basis reduction is required in the amount of one-half of the credit allowable under Section 48;

- The remaining cost of the solar energy equipment may be recovered using accelerated depreciation over a five year period;

- For projects placed in service prior to January 1, 2023 bonus depreciation may be available;

- The Section 48 credit may be claimed in conjunction with other federal tax credit subsidies such as the New Markets Tax Credits; and

- Restrictions regarding tax-exempt use property may be avoided by causing the taxpayer to sell energy to a tax-exempt person in lieu of leasing the property to such person.

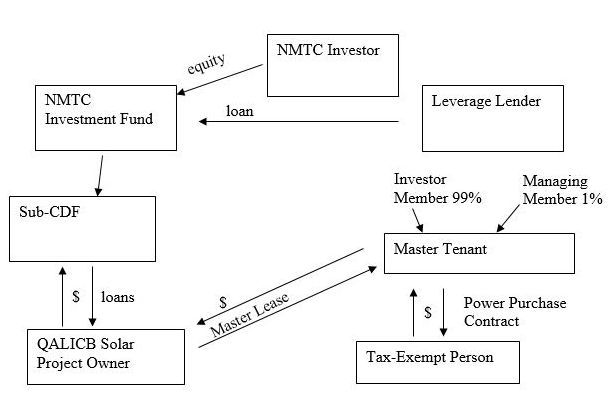

The following structure chart illustrates the principles in the context of a project funded by both New Markets Tax Credits and the Section 48 credit. In this case, the owner of the project will elect to pass through the energy credits to a master tenant entity, which will master lease the energy property. The master tenant will then enter into power purchase agreements with a utility or other energy provider. The energy credits are then allocated 99% to the energy credit investor, which invests a fixed amount per credit in the master tenant. The proceeds of the investment can be used to reimburse the Owner the costs of the energy property, repay bridge loans, or for other approved uses. Like the historic rehabilitation credit, combining the energy credit with New Markets Tax Credits can provide a substantial third party subsidy for a project.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.