On June 29, 2021, the US Internal Revenue Service (the "IRS") released Notice 2021-41 (the "Notice"), extending and enhancing previous relief given by the IRS pursuant to Notice 2020-41 (the "Previous Notice") on the start-of-construction rules for the production tax credit ("PTC") and energy investment tax credit ("ITC"). The Notice extends the continuity safe harbor for projects that began construction in calendar years 2016 through 2020 and relaxes the continuity requirement for projects that do not satisfy the continuity safe harbor.1

The Previous Notice, released on May 27, 2020, had extended the continuity safe harbor for projects that began construction in either calendar year 2016 or 2017.2 Additionally, the Previous Notice provided relief under the so-called 3 ½ month rule where payments were made on or after September 16, 2019, but the services or property were not expected to be provided until 2020, as long as they were actually received by October 15, 2020.

As with the Previous Notice, the Notice provides significant comfort to developers who have suffered disruptions as a result of COVID-19 and substantially reduces the risk of COVID-19-related delays preventing a project from qualifying for the ITC or PTC.

Continuity Safe Harbor

Under IRS guidance, a taxpayer is able to demonstrate the start of construction of a project through satisfaction of either the "physical work test" or the "five percent safe harbor" and, thereafter, meeting a continuity requirement. The physical work test generally requires that the taxpayer maintain a continuous program of physical work of a significant nature, while the five percent safe harbor requires that the taxpayer maintain continuous efforts to advance toward completion of the facility. This can be demonstrated by facts and circumstances demonstrating that the taxpayer has made such efforts. Under this facts-and-circumstances approach, delays beyond a taxpayer's control generally do not cause a taxpayer to be treated as not meeting the continuity requirement. Delays resulting from COVID-19 might very well be treated as outside the control of the taxpayer for purposes of the facts and circumstances test, but developers and financers have been wary of relying on the facts and circumstances test to satisfy the continuity requirement due to its subjectivity.

In response to taxpayers' requests for more certainty, the IRS provided a continuity safe harbor for each of these tests, allowing a project to be deemed to satisfy the continuity requirement of either test so long as the project is placed into service by the end of the fourth year after the year in which construction starts. However, unlike the facts and circumstances test, delays beyond a taxpayer's control are not excused under the continuity safe harbor.

Accordingly, prior to the issuance of the Previous Notice, a facility whose construction began in 2016 would have needed to be placed into service by the end of 2020, and a facility whose construction began in 2017 would have needed to be placed into service by the end of 2021. As a result of COVID-19 and related construction delays, this placed-in-service deadline had become particularly problematic for wind projects, as 2016 was the last year that a wind facility could begin construction and still receive the full amount of PTCs.

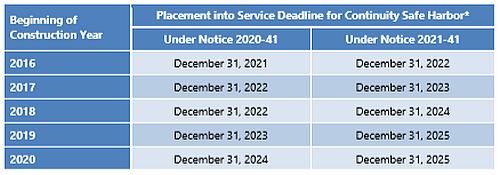

The Previous Notice extended the continuity safe harbor period from four years to five years for projects whose construction began in 2016 or 2017. The Notice extends the continuity safe harbor to six years for projects whose construction began in 2016, 2017, 2018 or 2019 and to five years for projects whose construction began in 2020.

Here is a table setting forth the date by which a project must be placed in service in order to qualify for the continuity safe harbor, depending on the year in which construction began on such project. Beginning

* In the case of solar projects claiming the ITC, projects must be placed into service by December 31, 2025, or they will only be eligible for a 10 percent credit. In the case of fuel cell and small wind projects claiming the ITC, projects must be placed into service by December 31, 2025, or they will be ineligible for the ITC.

Additionally, in the case of projects that do not satisfy the continuity safe harbor, the Notice allows satisfaction of the continuity requirement under either the continuous construction test or the continuous efforts test, regardless of whether the physical work test or the five percent safe harbor was used to establish the beginning of construction.

Conclusion

The Notice provides critical relief to the renewables industry and reflects the IRS' recognition that COVID-19 continues to affect developers' ability to construct and place projects into service.

Footnotes

1 The full text of IRS Notice 2021-41 is available here: https://www.irs.gov/pub/irs-drop/n-21-41.pdf

2 Our coverage of the Previous Notice is available here: https://www.mayerbrown.com/en/perspectivesevents/publications/2020/05/irs-provides-start-of-construction-relief-for-renewables-in-light-of-covid19

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.