- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

For decades attorneys for insurance companies and insureds have debated the discoverability of documents contained in the insurer's claims file. Frequently, the debate concerns when an insurer will be required to produce documents prepared in anticipation of litigation. An increasing number of courts are addressing whether claims notes prepared in anticipation in cases must be produced in cases involving bad faith claims. Judge Tilman Self with the Middle District of Georgia ruled in 2018 that such claims notes are discoverable for a bad faith claim, but not for a breach of contract claim, resulting in the bifurcation of the two claims.

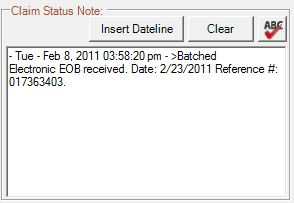

Judge Self issued the ruling in Omni Health Solutions, LLC v. Zurich American Insurance Co, 2018 WL 4701791 (DC Ga. October 1, 2018), a case in which Zurich and the insured disputed the extent of the covered hail damage to the insured's roof. During discovery, the insured requested Zurich "'identify all documents created by each of Zurich's agents in adjusting or inspecting the property'" and produce "'[c]opies of all adjuster logs, internal communications, taped or recorded statements, engineering reports and other documents and records relating to the Property.'" Zurich responded advising that it possessed claims notes, but refused to produce them, claiming in its motion for a protective order that the claims notes were protected by the work-product doctrine. Zurich argued that claims notes created after it believed there was a strong possibility of litigation were notes created in "anticipation of litigation." The insured demanded production on the grounds that the claims notes were created in the ordinary course of business, and thus were not prepared in anticipation of litigation. The insured further argued that only those created "because of the litigation" were prepared in anticipation of litigation.

In light of the parties' positions, Judge Self held that the Court must determine "whether (and which of) [Zurich's] claims note were prepared in anticipation of litigation. If any of the claims notes were prepared in anticipation of litigation, the Court must then determine whether [the insured] has a substantial need for the claim notes and cannot, without undue hardship, obtain the information within those documents from some other source. If so, the Court must finally determine which claims notes – if any – contain mental impressions, conclusions, opinions, or legal theories, all of which are undiscoverable."

As Judge Self noted, whether a document is prepared in anticipation of litigation is a complicated issue in the insurance disputes. In Underwriters Ins. Co. v. Atlanta Gas Light Co., 248 F.R.D. 663 (N.D. Ga. 2008), the District Court found that insurance claim files:

generally do not constitute work product in the early states of investigation, when the insurance company is primarily concerned with deciding whether to resist the claim, to reimburse the insured and seek subrogation ... or to reimburse the insured and forget about the claim thereafter. Once the litigation is imminent, however, the claims investigation file is maintained in anticipation of litigation and its contents are protected by the work product doctrine.

Id. at 667. According to Judge Self, "the true, objective determination is at what point litigation [becomes] "imminent" as opposed to merely possible or part of the abstract atmosphere.

With regard to Zurich's claims notes, Judge Self held that the "objective date" that Zurich had a reasonable anticipation of litigation was the date on which the insured invoked the approval provision of the policy. It was that date in which the insured "formally acknowledged that he wished to dispute the claim ... and [the parties'] joint efforts to resolve the claim were indeed at an impasse." The Court held that when the insured invoked appraisal, Zurich was "primarily" concerned with either resisting the claim, reimbursing the insured and seeking subrogation or reimbursing the insured and forgetting about the claim. According, Judge Self ordered Zurich to produce all claims notes prepared prior to the date the insured invoked appraisal.

The Court then considered whether the insured had a substantial need for the post-appraisal invocation claims notes because to prepare its case, the insured could not without, "undue hardship, obtain their substantial equivalent by other means" citing Rule 26(b)(3)(A)(ii) of the Federal Rules of Civil Procedure. Zurich contended the insured could obtain the substantial equivalent by the voluminous documents produced as well as in certain testimony provided by company representatives. The insured disagreed, noting that one of the company representatives repeatedly testified that he could not recall "most of the information" regarding the insured's claim.

Judge Self held that there was a substantial need for the claims notes, but only to the insured's claim for bad faith, not to the claim for breach of contract. The judge followed the rationale applied by the court in Underwriters that bad faith claims can only be proved by discovering how an insurer handled the claim, and therefore, the information in claims files is "not only substantial, but overwhelming." Underwriters Ins. Co, supra at 668. As a result, Judge Self ordered bifurcation of the breach of contract claim and the bad faith claim. Once the breach of contract claim is resolved, "and not before that time" Judge Self ordered that the claims notes created after appraisal, which were created in anticipation of litigation, but would not be produced until the parties proceed with the bad faith claim.

Judge Self's decision does not put the nail in the coffin on an insurer's objections to producing documents prepared in anticipation of litigation. The decision merely provides an opening for insureds to overcome some insurer's objections based on the work doctrine privilege. Despite that opening, an insurer can delay production by seeking bifurcation of the bad faith claim and withholding discovery of documents prepared in anticipation of litigation until if, and when, the bad faith claim proceeds following the resolution of the breach of contract claim.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.