The first fraternal benefit society in America, the Ancient Order of United Workmen, was founded in 1868 following the Civil War and pioneered the concept of affordable life insurance for working-class families at a time when commercial insurance was largely unavailable to them.

Member-based insurance companies are some of the oldest carriers in the industry. For the purposes of this article, we define member-based insurance companies as either:

While premium growth continues to matter to member-driven carriers, the primary growth metrics for member-based carriers will always include member growth and member satisfaction. In this way, member-driven organizations must understand their customer segments with an increasingly sophisticated level of detail, not only attract members into their ranks, but also to offer a compelling value proposition compared with both member-driven and true commercial insurance carriers.

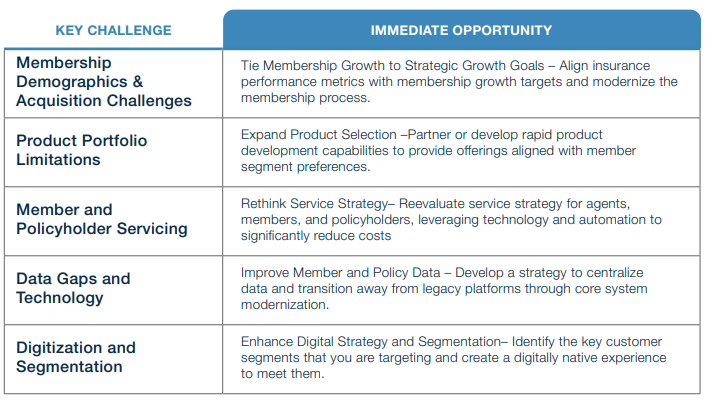

Member-driven carriers are facing unique challenges that often prevent them from achieving key growth targets, both in terms of premium and membership:

1 Membership Demographics & Acquisition

Among member-driven organizations, we have seen the same troubling trend: members are getting older. This is extremely problematic for multiple lines of insurance, where life, annuity, and P&C carriers have members who either no longer can or should buy their insurance products. When unaddressed, this issue compounds, as claims begin to rise relative to new business. The diminishing pool of new business and standard longevity risk faced by all carriers suggests limited growth prospects within current membership. Not only are existing members aging, but carriers are also struggling with recruiting new members. Carriers usually face this challenge in at least one of two ways: a) they struggle to bring in new (often younger) members aligned with the carrier's particular vision and/or b) their membership process is not optimized —it can be difficult to get someone to be a member, communicate the value of membership, and then convert members to insured status. This combination often leads to a disjointed experience at best: it is often unclear who owns membership recruitment and experience (e.g., the fraternal organization, agents, the insurance company).

2 Product Portfolio Limitations

Product shelves tend to be limited. Carrier proprietary products are usually not as robust as their commercial competitors for a variety of reasons. For example, many member-driven carriers have a protection mindset and will not design a product where a member could lose money. Carriers are also focused on meeting noninsurance obligations the organization may have (e.g., charitable causes) or may be prohibited from doing so due to affinity-based agreements (e.g., prohibitions on selling competing products).

3 Member and Policyholder Servicing

Member-driven carriers must provide servicing to multiple constituents: agents, policyholders, and members. Each of these groups has different servicing needs, and the ROI may be difficult to quantify for each. For example, we commonly see an insurance carrier's call center providing service to non-policyholders. If left unmanaged, this creates a complex servicing operation that is typically heavily manual, does not scale, and is inefficient.

4 Data Gaps and Technology Challenges

Member data is often extremely challenging in this environment – it is not uncommon to see multiple, unconnected CRMs housing member and/or customer data. A lack of a true "gold copy" of data usually means carriers cannot perform data migration and technology rationalization effectively, further diminishing profitability. We also tend to see a lack of investment in core systems and platforms. This may be software that requires updating or an antiquated policy admin system that needs to be replaced.

5 Digitization and Personalization

Affinity-based carriers do not exist in a vacuum – they are competing against traditional commercial insurers, and customer expectations are shaped by the broader market. Two major trends are driving future expectations. The first is digitization, where customers expect to be quoted and issued a policy almost exclusively online. This is further complicated by a second trend: increasingly personalized experiences. It is no longer enough to design an experience for the masses – customers now want an experience (and products) that are tailored to them, including interactions on their terms. Many affinity-based carriers will struggle to deliver the desired experience, putting them at risk of losing policyholders.

Fraternal benefit and member-driven carriers need to address these challenges in two ways. In the near term, there are significant improvement opportunities that can optimize operations and services. In the long term, there are strategic choices that carriers can make to position themselves for growth.

Immediate Improvement Opportunities

Based on a review of the industry, we have identified five unique opportunities that will position member-driven carriers to better compete in the market against both commercial and fraternal organizations:

These improvement opportunities can pay immediate dividends to carriers, but affinity-based carriers have historically struggled with growth in the medium and long term. Fraternal benefit organizations are uniquely sensitive to this – each organization wants to be able to show increased donations to charity, membership growth, and greater service hours in support of their mission. When a carrier increases revenue and/or decreases cost through targeted cost takeouts, there is a direct impact on the organization's ability to serve its mission.

For the organizations to be financially strong in five to ten years, insurance leadership needs to consider where their next growth opportunities are —both as a benefit to the members and as a commitment to their non-profit mission.

The image of fraternal organizations is often a negative one, and there is an ongoing question on the relevance of organizations in the 21st century. But several statistics show reason to believe otherwise —approximately one-third of all Americans between 29 and 44 regularly volunteer in mission-driven activity through organizations, such as charities or religious groups1. In a Havas Media Group study, approximately seventy-seven percent of individual investors expressed interest in aligning their investments with their personal beliefs2. This suggests that there is an appetite for fraternal organizations, but only if they adapt.

Below are five unique strategies we believe fraternal carriers should consider:

1 Reconsider the Fraternal Benefit

Fraternal carriers and organizations can reconsider the benefits offered to members. Fraternal carriers should evaluate their membership benefits through the lens of appealing to new members. For example, virtual networking opportunities and facilitated mentorship relationships are ways that fraternal benefit organizations are actively appealing to younger individuals who want to advance in their careers or gain insights to start their own businesses.

2 Explore Third-Party Distribution

There are two ways that member-driven carriers can differentiate themselves. The first is through shared mission or values (often referred to as a fraternal advantage). The second is through strength of their products. Fraternal members can redefine the membership process (and membership value) by allowing their products to be sold through third-party distribution, even if that means creating a separate legal entity.

3 Expand Lines of Business

As mentioned, carriers can begin looking into an expansion of the product shelf, but member-driven organizations may want to evaluate additional lines of business, particularly those that are aligned with serving their members. Some examples include establishing a bank for members or offering group and voluntary benefits. Carriers must understand their target customers and determine if an expansion in a line of business will provide additional opportunities to grow membership and revenues to support their mission.

4 Develop Digital-Native Solutions

Fraternal benefit organizations have another option – going digital. We have seen some reconsider the entire membership experience as a digital exercise. For example, some carriers have considered the creation of a digital lodge/council that is national and detached from local fraternal offices. While this may initially appear to encourage conflict between the state and local fraternal organizations and the broader insurance company, member-driven organizations must consider the different experience various members will desire and develop a strategy to attract those members to their ranks. But this is different than a simple digital channel —it is a comprehensive rethinking of both the member and policyholder experiences. This may mean separate marketing teams, a different distribution strategy, and a reimagined approach to member engagement.

5 Pursue Consolidation

Many fraternal and member insurance companies have a history of consolidation and acquisition to grow. Overall, there is a challenge to ensure that the missions of each organization align, but affinity-based carriers are under unique pressure to make sure that a potential acquisition is successfully integrated into the organization. A successful acquisition will result in significant membership growth, and gained synergies result in reduced combined costs, contributing greater revenues to support the charitable giving associated with the organization.

An affinity-driven carrier may not be able to tackle all of these – not every trend will be relevant to every carrier. But as carriers engage in strategic planning, their goals will need to address both these challenges and opportunities to continue to thrive over the next five to ten years.

Footnotes

1 "Looking For A Sense Of Purpose," Harvard Business Review

2 "The Truth About Value-Aligned Investing," Abacus Wealth

Originally published 14 July 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.