- within Litigation and Mediation & Arbitration topic(s)

- in United States

Across the nation, the delivery of health care services is undergoing a period of transformation. Much of this change is being driven by The Affordable Care Act signed into law in 2010.

Many hospital facilities in California are aging and need to be renovated or replaced in order to address the evolving regulatory and insurance environment, seismic upgrades for acute care facilities required under California law or other needs in the community. Health care districts in California are authorized to incur various types of debt, including general obligation bonds that are paid from ad valorem property taxes levied on property within the district, as well as debt secured by district revenues. The issuance of bonds or incurrence of other debt by health care districts involves the interplay of a number of laws, including California statutes, the California Constitution, federal securities laws and federal tax laws.

General Obligation Bonds

General obligation bonds are voter-approved long-term debt instruments which are secured by the legal obligation to levy and collect ad valorem property taxes sufficient to pay annual debt service on the bonds. Because general obligation bonds are secured by the taxing power of the health care district, they are considered to pose the lowest risk to the investor and, therefore, provide the lowest borrowing cost to the health care district when compared to any of the other types of debt financing that a health care district is authorized to use under California law.

By voting to approve a general obligation bond measure, voters are also approving an increase in ad valorem property taxes sufficient to pay the debt service on the bonds. Thus, this financing technique incorporates the means for its own repayment, and general obligation bonds should not cause any reduction in other health care district financial resources. However, voter approval must be obtained and, with the rise of scrutiny over municipal finance practices, it is essential to have a defendable bond program to gain such approval. Components of a defendable program include a clear need to build, expand or modernize facilities, a specific project list to be financed and accountability measures (e.g., independent audits and citizen oversight).

Voter approval of a bond measure creates what has sometimes been called a "contract" between the health care district and the voters. While this "contract" is not a separate document of the financing, it nevertheless limits the health care district's authority with respect to the bonds. This agreement with the voters consists of the constitutional and statutory law authorizing the election and the issuance of the bonds, the resolution calling the election and the specific language contained in the ballot measure itself. The assenting vote of the electorate completes the agreement.

If a ballot measure is too specific with regard to the projects to be financed (e.g., "construction of a hospital on Jefferson Street"), the health care district board may be bound to build what it has promised to the voters and may not be able to change its plans (e.g., "construction of a hospital on Main Street") in the future despite changes in health care district priorities or circumstances. Accordingly, when drafting a ballot measure and resolution calling an election, health care districts must carefully balance the need for specificity and the desire for flexibility to ensure that the measure is specific enough to permit the bond proceeds to be used for their intended purposes without eliminating all flexibility of the health care district to handle changing priorities or circumstances.

Accordingly, the preparation of a bond measure requires a deliberate balancing of a number of important factors to help the likelihood that the measure attracts sufficient votes to pass while preserving flexibility for the health care district to handle changing circumstances. It is critical that a health care district review its various options and any proposed bond with competent counsel and other advisors prior to placing a measure on the ballot.

Debt Secured By District Revenues

Health care districts are also authorized by California law to incur various forms of debt that are payable from revenues of the district. These revenue-based forms of debt carry a higher interest rate than general obligation bonds, but do not require voter approval. In addition, the specific statutes authorizing debt secured by district revenues can limit the borrowing size and the term of the debt.

Federal Tax-Exemption

While the issuance of bonds or incurrence of debt by health care districts is a matter of California law, the exclusion of interest on such obligations from income for purposes of federal income taxation is governed by federal tax law. The Internal Revenue Code of 1986, and the regulations thereunder, contain an intricate set of requirements that must be complied with in order for a health care district to issue bonds or other debt that are tax-exempt. Additionally, in order for the bonds or other debt to retain their tax-exemption, the health care district must continue to comply with certain requirements after the bonds or other debt are issued or incurred.

The benefit of issuing tax-exempt debt is that tax-exempt financing offers lower interest rates than taxable debt. Because interest paid on tax-exempt debt is exempt from federal income tax (and the income tax of California), the investor requires less interest to produce the same after-tax return as taxable debt would produce. The difference varies from time to time based on market factors but is usually 2 to 4 percentage points less than comparable taxable debt. Given the current low interest rate environment, the difference between tax-exempt and taxable rates is smaller, around 1 to 2 percentage points. In any event, lower interest rates reduce the debt service payments to be made by the health care district.

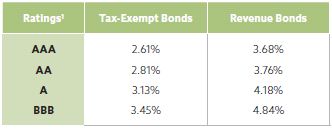

For example, interest rates on 30-year general obligation bonds sold around May 1, 2016 were roughly as follows:

Federal Securities Law

The offering and sale of securities is regulated by federal laws codified primarily in the Securities Act of 1933 (the "Securities Act") and the Securities and Exchange Act of 1934 (the "Exchange Act"). Health care district general obligation bonds and revenue bonds constitute "securities" for purposes of the Securities Act and the Exchange Act. For most corporate securities, a public offering must be preceded by filing a registration statement with the SEC pursuant to the Securities Act, and the corporation is required to make periodic reports to the SEC pursuant to the Exchange Act. Municipal securities, on the other hand, including those of health care districts, are exempt from the registration requirements of the Securities Act and from the reporting requirements of the Exchange Act. However, the offering and sale of health care district securities is not exempt from the anti-fraud provisions of the Securities Act or the Exchange Act. In addition, the SEC's rules governing underwriters of municipal bonds effectively require health care districts to make periodic disclosure of certain information relevant to the security of their bonds unless certain exemptions apply. In contrast, if the form of debt incurred by the health care district does not constitute a security, but instead is treated as a loan, then the requirements of the Securities Act and the Exchange Act, as well as the rules of the Municipal Securities Rulemaking Board of the SEC, do not apply.

Summary Comparison of Health Care District Financing Techniques

The following table illustrates the main financing techniques available to California health care districts as of May 2016. Nothing in this table should be construed or relied upon as legal advice. Instead, this chart is intended to serve as an overview of the financing options applicable to California health care districts, from which better informed requests for advice, legal and financial, can be formulated. Advice from competent counsel can help districts analyze which financing technique best suits the needs of the district.

Footnote

1 Ratings refer to independent appraisals of the credit quality of the bonds and the likelihood of their repayment performed by one or more of the credit rating agencies: Standard & Poor's Rating Services, Moody's Investors Service or Fitch. The ratings are expressed as letter grades AAA, AA, A, BBB (expressed as Aaa, Aa, A and Baa by Moody's) from highest to lowest investment grade ratings, with +/- or numerical subcategories. Ratings are considered very important by investors in determining what interest rates will induce them to purchase the bonds. Bonds may be sold with or without a rating, although usually at materially higher interest rates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.