- within Food, Drugs, Healthcare and Life Sciences topic(s)

- with readers working within the Retail & Leisure industries

- within Food, Drugs, Healthcare and Life Sciences topic(s)

- with readers working within the Advertising & Public Relations, Banking & Credit and Retail & Leisure industries

The PBM regulatory landscape is rapidly evolving at both federal and state levels, making it critical for our clients involved in the PBM space to stay apprised of developments in the industry as they happen. Our team actively monitors these developments to provide you with this quarterly PBM Policy and Legislative Update. This update builds on prior issues and highlights federal and state activity from October, November, and December 2024.

FEDERAL LEGISLATIVE ACTIVITY AND OVERSIGHT

Federal Legislative Activity

Four more bills were introduced during the last quarter of 2024, for a total of nine federal legislative initiatives directly targeting the PBM industry and PBM-related practices introduced in 2024. Of course, the big news from 2024 relates to the proposed continuing resolution that included most of the federal PBM reform initiatives that have been introduced during the last Congress. Please see our summary on page 5 for more details.

Bipartisan Patients Before Monopolies Act (PBM Act). On December 11, 2024, Senators Elizabeth Warren (D-MA) and Josh Hawley (R-MO) introduced the Patients Before Monopolies Act (PBM Act), while Representatives Diana Harshbarger (R-TN) and Jake Auchincloss (D-MA) introduced a companion bill in the House. The proposed legislation would prohibit joint ownership of PBMs and pharmacies — which Rep. Harshbarger (a former practicing pharmacist) called "a gross conflict of interest" that "enables these companies to enrich themselves at the expense of patients and independent pharmacies."

The legislation proposes to address this conflict of interest by (i) prohibiting a parent company of a PBM or a health insurer from owning a pharmacy business, and (ii) requiring that a parent company in violation of the PBM Act divest its pharmacy business within three years. Practically, if passed as currently written, the Act would require major insurers to divest of any pharmacy business, often seen as a key component of the vertically integrated pharmaceutical supply chain. The proposed legislation delegates most enforcement authority to the Federal Trade Commission (FTC), requiring impacted companies to submit mandatory reporting to the FTC, among other requirements. The legislation would also give the FTC the authority to "review all divestitures and subsequent acquisitions to protect competition, financial viability, and the public interest." Alongside the FTC, the US Department of Health and Human Services (HHS), the Department of Justice (DOJ), and state attorney generals would also provide enforcement oversight of the PBM Act requiring violators to not only divest their pharmacy business but also disgorge any revenue received during the period of such violation.

The proposed legislation is currently pending before the respective House and Senate committees. Initial market reactions were mixed — shares dipped among major investors in vertically integrated health insurance and pharmacy benefit management companies in reaction to the news, although some suggest low odds of the legislation passing in its current form.

Study on PBM Audit Practices (H.R. 10050). On October 25, 2024, Representative Celeste Maloy (RUT) introduced H.R. 10050, which would require the Secretary of HHS to conduct a study with input from independent pharmacists, PBMs, health care providers, and appropriate agencies and submit a report to Congress on PBM audit practices related to drugs dispensed under Medicare, Medicaid, group health plans, and group or individual health insurance coverage. The report would assess the financial and operational impacts of current PBM audit requirements on pharmacies and the transparency of current and historic PBM audit requirements. It would also provide recommendations on how to make PBM audit requirements for pharmacies more transparent and less burdensome on pharmacists and best practices for PBM audit processes that ensure fairness and ease burdens on pharmacists without compromising audit integrity. On December 17, 2024, the bill was referred to the Subcommittee on Health.

Lowest Price for Patients Act of 2024 (H.R. 8987). On July 10, 2024, Representative Katie Porter (D-CA) introduced the Lowest Price for Patients Act of 2024, which would require that a group health plan not impose cost-sharing (including deductibles, coinsurance, and copayments) on a plan-covered outpatient drug dispensed by an in-network pharmacy in an amount that exceeds the nationwide average of consumer purchase prices for such drug for the one-year period ending on the first day of the plan year (as determined using information from the survey described in section 1927(f)(1)(A)(i) of the Social Security Act). A group health plan would be responsible for ensuring that any PBM providing services under the plan complies with the requirement. On December 17, 2024, the bill was referred to the Subcommittee on Health.

House Investigates CVS Caremark for Alleged Anti-Competitive Behavior Regarding Patient Support Hubs. The House Judiciary Committee is investigating whether CVS Caremark violated federal antitrust laws by limiting independent pharmacies' access to pharmaceutical hubs. On December 12, 2024, Representative Jim Jordan (ROH), Chairman of the House Judiciary Committee, and Representative Thomas Massie (R-KY), Chairman of the Subcommittee on the Administrative State, Regulatory Reform, and Antitrust, sent a letter to CVS Health President and CEO David Joyner requesting documents and information related to CVS Caremark's practices that limit the ability of patients to access services through some independent pharmacies (the December 12, 2024 Letter). Reps. Jordan and Massie are particularly focused on independent pharmacy access to pharmaceutical hubs, which are a therapy management tool for patients. The Representatives focus follows expert testimony during the House Judiciary's September 2024 hearing regarding the role of PBMs in the health care industry, in which it was noted that one way PBMs could "choke off" potential competitors in the pharmaceutical marketplace is by limiting access to the hubs.

The December 12, 2024 Letter clarifies that the Committee seeks information to investigate whether "CVS Caremark is engaged in activities that harm competition, stifle innovation, and may violate the antitrust laws" and seeks information regarding CVS Caremark's pharmaceutical hub practices. The Committee further states that it will use this information to "conduct oversight of this issue to inform potential legislative reforms."

Senate Field Hearing Considers Pharma Pricing. In October 2024, The Senate Judiciary Committee held a field hearing in Chicago regarding reducing the cost of prescription drugs. Led by Committee Chair Senator Dick Durbin (D-IL), who was joined by Illinois lawmakers, including Illinois Attorney General Kwame Raoul, the two-part Committee hearing addressed alleged patent "schemes," including a "patent thicket," in which a company obtains the intellectual property rights to a series of (often duplicative) patents around one drug. Sen. Durbin stated that patent thickets "block competition and create windfall profits" for manufacturers. Illinois AG Raoul highlighted statelevel efforts to curb drug pricing, stating that his bureau is working "with nearly all other states on litigation against the generic drug industry for engaging in price-fixing conspiracies involving hundreds of generic drugs." Illinois Attorney General Raoul also highlighted PBMs' role in increasing drug costs, stating: "PBMs have made the pharmaceutical market more opaque and have driven up prescription drug pricing."

Senate Finance Committee to Continue its Focus on PBMs. Senator Mike Crapo (R-ID) will prioritize PBM reform, among other issues, as the Chairman of the Senate Finance Committee. On January 7, 2025, following his official appointment as Chairman of the Committee, the Committee released a statement outlining Sen. Crapo's priorities, including "efforts to enact much-needed PBM reform [...], as certain problematic practices jeopardize the viability and financial stability of pharmacies, driving up costs for consumers." In light of his previous bipartisan efforts to enact a PBM reform package, policy analysts suggest that Sen. Crapo may follow through on his commitment to enact PBM reforms.

PhRMA Lobbying Efforts Point to PBMs in New Ad Campaign. In November 2024, Pharmaceutical Research and Manufacturers of America (PhRMA) launched a targeted advertising campaign "urging Congress to make sure savings on medicines go to patients, not middlemen." The advertising campaign builds on PhRMA'S previous advertisement, casting PBMs as the pharmaceutical supply chain "middlemen," driving up patient health care costs while providing little clinical value to overall patient wellness and care. PhRMA notes that its campaign "adds to the growing chorus of voices, including pharmacies, providers, employers, AARP and others, calling on policymakers to help patients by pushing these critical PBM reforms over the finish line."

FTC Oversight

FTC Asks Court to Dismiss ESI's Defamation Suit. As we have discussed, Express Scripts, Inc. (ESI) sued the FTC for its publication of an interim report, alleging that, in addition to factual errors and misrepresentations, the report is defamatory, unlawful, and violates ESI's statutory and constitutional rights. The FTC responded by requesting the Missouri federal court dismiss the lawsuit, arguing that the FTC's interim report presented only "qualified conclusions" about the practices of the PBMs involved. The FTC countered that ESI's defamation claims lack merit both procedurally and substantively, arguing further that ESI failed to prove the report deprived it of "life, liberty, or property." The FTC contended that the agency has the authority to publish its findings from industry studies when the findings are "in the public interest." ESI continues to challenge the FTC's actions, maintaining that the FTC fundamentally misunderstands the PBM industry and overlooks PBMs' efforts to lower drug costs.

PBMs Issue Industry Report in Response to FTC's Interim Report. CVS Caremark, ESI, and OptumRx released a report challenging the FTC's findings that PBM practices inflate drug prices. This report, commissioned and funded by the PBMs, explains that PBMs operate within thin margins, largely pass rebates to plan sponsors, do not restrict access to generics, and do not drive independent pharmacies out of business.

FTC Likely to Continue PBM Scrutiny Under Trump Administration. The incoming Trump administration is expected to continue antitrust enforcement efforts related to PBMs, as concern over rising prescription drug prices and PBM practices remains a bipartisan issue. The new administration's antitrust team, including leadership changes at the DOJ and FTC, will inherit the ongoing cases against PBMs. Antitrust experts predict that the administration will focus on traditional legal frameworks and consumer welfare standards when approaching health care competition rules.

2024 Federal Legislative Activity

SPECIAL FEATURE: Continuing Resolution

On December 17, 2024, Congress formally introduced a continuing resolution (CR) in an effort to stave off the impending government shutdown. This CR included many long-percolating initiatives seeking to regulate PBM activities. The proposed CR text included a broad definition of PBM, defining the targeted entities to include those that act as a price negotiator, a group purchaser, or manager of prescription drug benefits, regardless of whether the entity calls itself a PBM.

Upon introduction, the CR received swift pushback from PBM industry groups, including the Pharmaceutical Care Management Association (PCMA), which stated that the reforms included in the CR would risk "increasing costs for health plan sponsors," "undermine the role that PBMs play in lowering costs and providing choices for employers in the prescription drug marketplace," and, among other things, increase Part D premiums. Following public criticism from then-President-elect Trump and allies, the version of the CR introduced on December 17, 2024, was scrapped entirely. The funding proposal passed by Congress on December 20, 2024, did not include any PBM-related provisions.

Summary of PBM Reform Proposals

The original CR sought to regulate PBMs through a variety of mechanisms: prohibiting spread pricing in Medicaid; reducing PBM service fees and de-linking PBM compensation and size of negotiated discounts for Medicare Part D Plans; requiring PBMs to pass through rebates to group health plans and health plan sponsors; and requiring PBMs to provide detailed reporting to plan sponsors and government entities. Among other requirements, the CR included the following provisions of note for PBMs and health plans:

Medicare

PBMs contracting with prescription drug plan (PDP) Sponsors would be required to, among other things, agree to the following requirements:

- PBMs may not receive any income other than bona fide service fees. The CR defines a bona fide service fee (BFSF) as a (i) flat fee, (ii) consistent with fair market value ("FMV"), (iii) for services actually performed by the PBM or its affiliate on behalf of the PDP Sponsor that the PDP Sponsor would otherwise perform itself if not for the arrangement with the PBM, (iv) not based or contingent upon drug price, remuneration (such as rebates, discounts, and other fees), coverage decisions, formulary placement, the volume or value of referrals or business generated between the PBM and PDP Sponsor, or other criteria prohibited by the Secretary, and (v) not passed on to a client or customer (regardless of who takes title to the drug). This definition of BFSF differs from the definition used in Medicare Part D and Medicaid and creates immediate tension by requiring that the fee be flat while at the same time being fair market value when the volume of services to be provided is often unknown. Further, the CR indicates that "incentive payments" paid by PDP Sponsors to PBMs will be deemed BFSF so long as they meet the relevant BFSF requirements. Rebates, discounts, and other price concessions received by a PBM from manufacturers, even if calculated as a percentage of a drug's price, would not be in violation of this provision if such amounts are fully passed through to the PDP Sponsor and reported in accordance with applicable DIR requirements. PBMs would be required to pass through to the PDP Sponsor any remuneration in violation of the BFSF requirements; and further, PBMs would be required to enter into written agreements with their affiliates to require such affiliates to identify and pass through to the PDP Sponsor any remuneration beyond payments as described above (e.g., BFSF, permitted incentive payments and rebates, discounts, and price concessions). Finally, agreements between PBMs and PDP Sponsors would be subject to review by the Secretary of HHS for determination of FMV of remuneration.

- Transparency Requirements. PBMs would be required to consistently and transparently define, interpret, and apply terms related to their performance of pricing guarantees or similar costperformance measurements related to rebates, discounts, price concessions, or net costs set forth in agreements between PDP Sponsors and PBMs. Additionally, PBMs would be required to annually report to HHS and the PDP Sponsor detailed information related to dispensed drugs, including, but not limited to, rebates received by manufacturers, and total manufacturer-derived revenue (including BFSF retained by PBM and PBM affiliates).

Medicaid

Contracts between the state and (i) a PBM, or (ii) a Medicaid managed care entity (MCO) that includes drug coverage, would be based on a pass-through pricing model prohibiting spread pricing, under which:

- Payments to pharmacies for drugs must be:

- limited to the ingredient cost of the drug and a professional dispensing fee that is not less than the professional dispensing fee a state would pay if the state were making the payment directly in accordance with the state Medicaid plan;

- equivalent to the amounts that the PBM charges the state or MCO for the drug such that the full amount of the payment to the PBM is "passed through" to the pharmacy dispensing the drug (with exceptions for state laws and regulations in response to FWA); and

- in a manner consistent with federal regulations specifying upper payment limits CMS will pay for drugs under the state Medicaid program.

- Payment for administrative services is limited to an administrative fee that reflects FMV.

- Upon request, the PBM or MCO reports to the state on a drug-level basis all costs and payments related to the covered outpatient drug and the accompanying administrative service fees.

Federal matching Medicaid funds would be conditioned on the prohibition of "spread pricing," in which the amount paid to the pharmacy is less than the amount the PBM or MCO is paid for the covered drug.

Commercial

PBMs would be required to pass through to the group health plan or health insurance issuer offering group health insurance coverage 100% of rebates, fees, alternative discounts, and other remuneration received from any applicable entity. In addition, under certain circumstances, PBMs would be required to make their contracts with rebate aggregators and/or group purchasing organizations (GPOs) available for audit to group health plans or health insurance issuers and/or any associated third-party administrators.

Further, contracts between the group health plan or health insurance issuers and PBMs would require PBMs to provide all information necessary to enable the plan to submit to the Secretary a report containing information that helps identify spread pricing, including the contracted amount paid by the group health plan or health insurance issuer to PBMs and the contracted compensation paid to pharmacies.

The final CR enacted in December will keep the government open through March 14, 2025. Unless Congress chooses to pass a standalone PBM reform bill in the interim, it appears that the next opportunity for Congress to reintroduce the proposed PBM reform package will be this spring when the legislative body convenes to address the impending fiscal cliff. The March deadline opens the possibility for lawmakers and the Trump administration to pursue a different path for potential PBM reform, if not scrap the provisions altogether.

Where Have We Seen the Continuing Resolution Proposals Before?

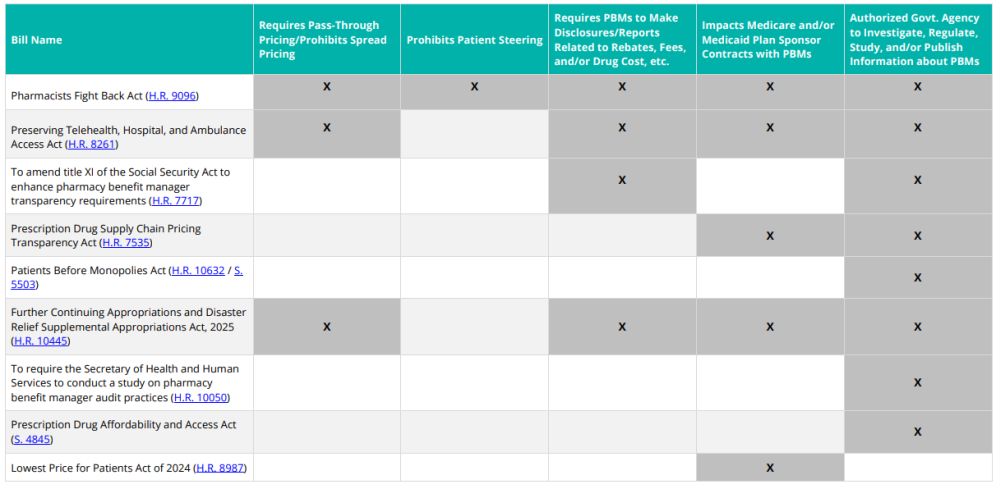

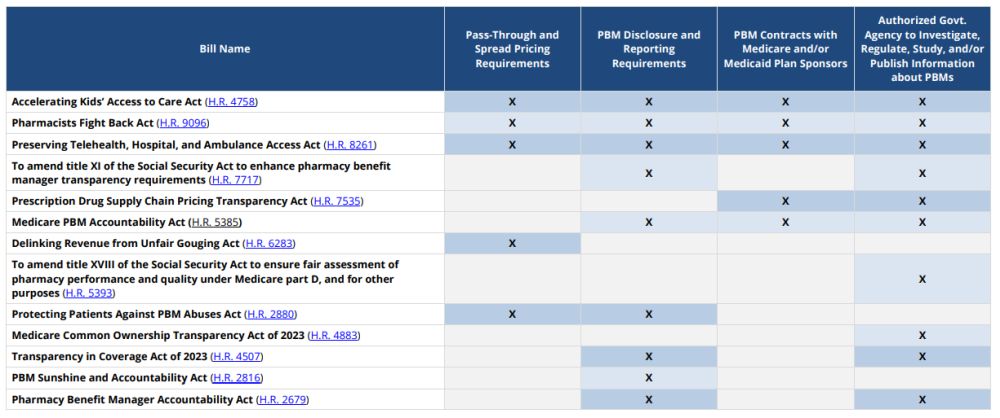

This is not the first time we have seen the reform measures included in the CR. The chart below demonstrates that many of the concepts included in the CR were from previously introduced federal legislation.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]