- within Antitrust/Competition Law and Compliance topic(s)

Between 2023 and 2030, the ambulatory surgery market in the U.S. is expected to grow by nearly 50%, increasing from a market value of $40 billion to over $60 billion in just seven years. Many factors will drive this growth, including new technology, patient preference, lower cost, and more. As providers evaluate entry or expansion in this space, we are highlighting key tactics to ensure U.S. Ambulatory Surgery Centers (ASCs) succeed and thrive in this growing industry.

Crafting Your Ambulatory Strategy to Differentiate Your ASC In an Increasingly Crowded Market

The strongest players in this space have a well-defined ambulatory strategy. We all know that care is shifting to the outpatient setting, but a thoughtful ambulatory strategy will identify your organization's approach to this shift.

- Will you invest in being the high-acuity player in your market?

- The most affordable and accessible?

- Will your organization use ambulatory sites to extend into new markets, or increase capture locally?

Knowing answers to these and similar questions will allow your organization to act efficiently and ensure consistency in ambulatory processes and programming. In whichever direction you choose to take, remember the objective is to differentiate yourself in the market from a patient's perspective; adopting a retail mindset of convenience, high quality, and value (cost).

Example of different players coexisting in the same market:

| Basic Diagnostic Colonoscopy in Charlotte, NC | |

| Independent Physician Group Practice A | $553.67 low |

| Independent Physician Group Practice B | $929.00 |

| Independent Physician Group Practice C | $553.67 |

| Independent Physician Group Practice D | $880.00 |

| HOPD | $1,845.58 high |

| Independent Physician Group Practice E | $645.95 |

| Independent Physician Group Practice F | $937.00 |

A Broader Perspective on Calculating Anticipated ROI

Financial considerations abound in the development of ambulatory surgery centers, but a few surfaces as the primary financial drivers.

First, determine which funding mechanism will be viable for your organization. Leveraging a developer to construct the facility can circumvent substantial capital investment but may represent a higher operating expense via rent. Alternatively, the acquisition of existing facilities will require capital but typically at substantially lower cost than new construction.

Second, ownership and management models represent key financial factors that impact both profitability and alignment. Invest the time into thoughtful scenario modeling to evaluate the potential impacts of various models.

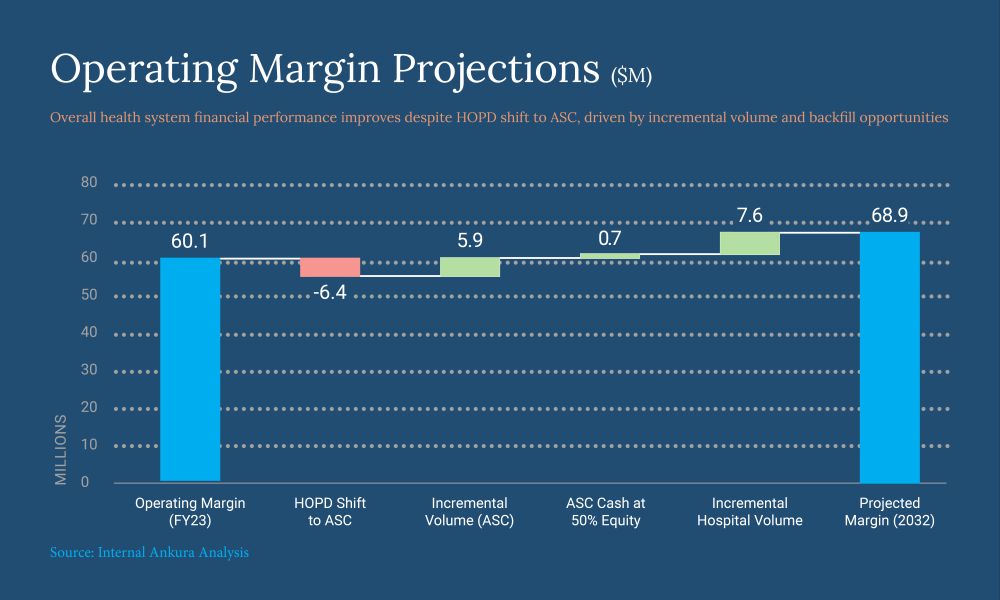

Finally, the operating performance of the ASC will

be propelled by case mix and volumes, while incremental margin is

created through cost reduction and

standardization.

This includes cases that may shift from a hospital-based setting to

the ASC and the impact of that shift on all involved entities. As

depicted in the example below, one client experienced a $6 million

reduction to the hospital's bottom line when shifting

outpatient surgeries to an on-campus syndicated ASC. However, this

shift freed up operating room capacity, allowing for higher

revenue-generating inpatient cases, resulting in a system net

gain.

Balancing volume projections, equipment investment, site of care shifts, and service offerings in financial models can rationalize the most effective programming for the ASC.

Understanding Your Market Beyond Traditional Data

While hospitals have a tried-and-true primary and secondary service area that defines their market, many new ASC entrants will need to think differently about their potential market capture. Traditional data sources, like outpatient surgical market data, remain the gold standard for planning – but outpatient market data is not always available, and many regions do not have historical experience with ASCs.

In many cases, we blend population-based procedural use rates, historical provider data, traffic and commuting patterns, and regional payer dynamics to define a meaningful ambulatory market. These ambulatory market definitions subsequently inform service line-specific estimates of surgical volumes and use rates. Understanding the true magnitude of the ASC market will ensure a right-sized facility and realistic projections of program performance.

Clarify the Site-Specific Value Proposition

Broadly, health systems elect to pursue ASC development for a few key reasons:

- To address competitive market pressures;

- To prepare for alternative payment models; and/or

- To facilitate entry into new markets.

By far, we see most clients developing ASCs in response to market pressures from payers and other providers. Insurance providers, for example, have increased transparency on their websites by providing search engines that allow plan members to research all providers in their geographic area and compare procedure costs and patient ratings. The rise of healthcare consumerism means patients are more informed and selective about their care options, favoring ASCs for their convenience, lower costs, and quicker recovery times. These economic pressures drive the growth of ASCs as payers seek to reduce healthcare costs through lower-cost sites of care than traditional hospital-based surgical platforms.

In markets with many independent providers and specialists, ASCs can drive alignment between physicians and health systems. When physicians buy into an ASC, they gain equity, aligning incentives and fostering collaboration. In markets with flat or declining populations, this is critical to move and keep market share. Health systems often see ASCs as an opportunity to offer competitive sites of care and alignment models for these independent providers.

In other instances, health systems might identify ASCs as a way to increase their capabilities in alternative payment models and align with value-based imperatives. We have seen growing, bipartisan support for site neutral payments, suggesting that health systems may need to get leaner in service provision. With CMS's launch of the AHEAD model, we are also seeing an expanding appetite for total cost of care (TCOC) models. In the state of Maryland, where the most recent iteration of an innovative TCOC model launched in 2014, global budgets are set at the beginning of the year to hold fixed the hospital's total revenue for the year. Not coincidentally, Maryland is the country's leader in ambulatory surgery rates – driven by efforts to increase overall margins through lower-cost, non-hospital care.

Following suit, commercial payers are also driving health systems to bear greater risk, which can be managed more effectively in lower cost-of-care environments like ASCs. While health systems today may not require a complete value-based infrastructure to remain viable, some may develop ASCs to expand a competence that will be increasingly needed.

Finally, health systems may consider ASC development as an entry into a new market. Growing suburban markets can present strong opportunities for new locations. For example, in Charlotte, North Carolina's northern suburbs, Atrium Health has operated an ambulatory surgery center since 2021. It recently received a certificate of need approval to further develop a 30-bed hospital in the region and broke ground on the facility in 2023. This strategy – running offense rather than defense – has substantial appeal for growing, desirable markets where the system wishes to make inroads.

Building the Future: Executing ASC Projects from Vision to Occupancy with Data-Driven Trust

With a well-defined value proposition for the ASC, execution can be tailored to achieve the goals of the owners. In all scenarios, execution of the building from vision to occupancy must reinforce the brand's credibility and understanding of owner interests.

Credibility is foundational to trust and alignment. Organizations that consistently provide reliable data, demonstrate an understanding of the nuances of the ASC market, and deliver projects on time and on budget will build a foundation of trust and credibility with their partners.

In recent work we developed with a client, a group of potential equity partner providers noted that the data our client was able to provide during preliminary discussions was more than they had seen in years of work with the client's competitor. Reinforcing this capability is a powerful tool for marketing and demonstrating everyone's commitment to success.

Delivering projects on time and within budget is no easy task in today's environment; 70% of health systems report that more than half of their construction projects have experienced unexpected cost increases in the last three years. Starting with realistic (and holistic) project budgets and active project management are key to managing expectations and driving project performance.

Health systems must evaluate a range of project delivery models for ASCs, such as design-bid-build versus at-risk versus integrated project delivery. Without experience in considering these options, it can be difficult to determine which scenario will best serve the interests of the ASC. The Ankura team often serves as the ultimate guide for clients in navigating these complexities, facilitating decision-making, securing competitive financing, and coordinating the essential parties to bring in projects on time and below budget.

For potential equity partners, the ASC facility will represent an expensive financial investment. Ensuring effective project management can demonstrate appreciation for partner investments and maintain the developing confidence between all owners.

In addition to trust and credibility, equity and partnership discussions are a crucial mechanism through which a system can demonstrate alignment of interests and goals. Systems must bring a well-rounded, national perspective to these conversations to ensure providers feel that structures are fair and equitable. We leverage extensive market intelligence, detailed scenario development of potential partnership models, and thoughtful consideration of Stark and anti-kickback statutes in recommending effective equity and compensation arrangements.

We strongly recommend that systems leverage a third-party partner to ensure statutory compliance by providing independent perspectives regarding considerations such as fair market valuation, articulation of viable LLC structures, and vetting of lease agreements.

Systems looking to expand into new markets may approach shared equity decisions through a slightly different lens. Rather than align closely with a provider or group, these systems may wish to open ASC utilization to a broader array of providers in a market as an entrée to their network and organization.

Alternatively, they may use equity models similar to those described above, targeting provider "influencers" in the new market. Regardless of intent, thoroughly vetting potential providers to ensure a strong match of expectations and culture will create a smoother path for effective ASC operations.

Finally, systems that wish to develop the infrastructure for lower-cost care may focus less on equity and more on efficiency.

How Service Mix Informs the Layout: Why You Do Not Want a "One Size Fits All" Design

Ensuring that the ASC is efficiently utilized will be essential to profitability. Effective planning begins by evaluating existing surgical locations among stakeholders (if applicable) and ensuring maximized use of those assets. Once this "baseline" is better understood, and any performance improvement targets have been identified, planning an ASC can reflect these operational changes.

When considering the optimal ASC layout, we evaluate the service mix to determine the appropriateness of lower-cost procedure rooms as well as operating rooms. Service mix also drives planning of pre-and post-operative spaces to avoid bottlenecks and maximize volumes –plans should avoid a "one-size-fits-all" benchmark relative to operating rooms (ORs) and instead account for differences in procedures and types of anesthesia.

Conversely, when possible, developing shared, "flex" space that can be used by multiple specialties also drives economies of scale for the facility. Although prudent investment in square footage yields the greatest gains, planners must not be overly conservative – space must also offer room to grow as the outpatient market continues to boom.

Ensuring That ASCs Run Leaner Than Hospital-Based Surgical Departments

Square footage is just one aspect of ASC operations that must be optimized for value – given that ASCs receive lower reimbursement rates than the hospital setting, all ASC expenses must be approached through a lens of efficiency to ensure positive margins. Staffing makes up a substantial proportion of ASC costs, so cross-training and flexible scheduling practices can offer important expense levers. In addition, because procedures are more routine, scheduled, and non-emergent, staffing can be planned to allow for minimal downtime and maximum efficiency.

Achieving practitioner alignment around supplies – often through equity ownership – will reduce variation and facilitate reduced supply costs. Other key opportunities to generate efficiencies can include electronic medical record (EMR) tools, management structure, and billing services. The facility will require a steady operator with reliable and consistent cost evaluation and benchmarking to maintain its competitiveness in the market.

Your Strategic Partner

The ability to expediently evaluate opportunities to enter or expand your footprint in the fast-growing ASC market can serve as a key differentiator against competitors. Our Ankura team includes experts in all steps of the ASC process – from valuation and due diligence to governance and by-laws to execution and Day 1 implementation – who will work to achieve the best interests of your organization. We are here to help your organization build and implement a proactive, patient-centric ambulatory strategy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.