Context

Our client is operating in India since 1964, has a well- established track record in the local financial markets. Incorporated in the US, the bank offers a comprehensive suite of financial products including lending, working capital, treasury and trade services, foreign exchange, and interest rates to leading Indian corporates, financial institutions, multinationals, and foreign government entities.

Our client wanted to seek professional assistance in handling Account Payable (AP) process and stay compliant with the GST - Input Tax Credit (ITC) regulations defined by the revenue authorities.

Case Highlights

- Processing of AP transactions with highest level of accuracy i.e., 99.7%

- Standardization of process through designing of standard operating procedures and customized checklist for each activity to ensure complete review of transactions

- Identification of cash-flow impact due to non-availment of GST input credit.

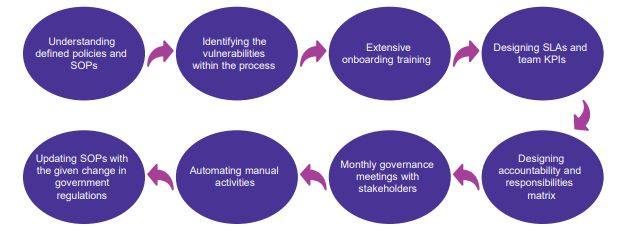

Approach

Case Study - A Leading MNC Bank

The Challenges

- Voluminous AP invoices to be processed daily

- Increased error rate while processing invoices and vendor payments

- Complex framework comprising of multiple applications for payment processing

- Client's lack of adequate knowledge of GST regulations with regards to input credit and GST audit.

The Solution

- We supported the organization in handling the entire AP process, wherein the team has remediated the vulnerabilities within the process, thereby reducing the errors substantially.

- We analyzed the existing process they followed and identified the loopholes in it. A checklist was designed for each activity to ensure a thorough review is being conducted.

- We designed a KPI at each level to ensure clear visibility of responsibilities and also mapped SOP procedures for GST Input tax credit to maintain compliance in accordance with the regulatory requirements.

- Furthermore, we supported in the completion of GST audit within timelines and created awareness within the stakeholders to reduce rejection rate while processing invoices.

Impact

- Reduction in error rate and achieved accuracy level of 99.7%

- Input credit that was not claimed earlier; is now availed by the client contributing additional cash-flow

- Operational weaknesses were identified and strengthened by plugging the gaps

- Automation of processes resulted in increased efficiency and effectiveness.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.