- with readers working within the Banking & Credit industries

- within Environment and Energy and Natural Resources topic(s)

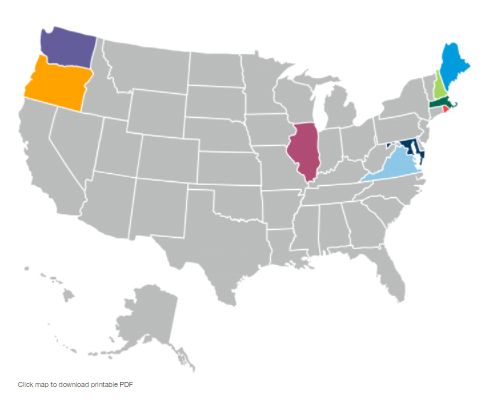

Over the past few years, states across the country have sought to limit or reduce the use of employee non-compete agreements. While some states have imposed outright bans on such agreements, many more have passed laws that narrow the scope or classification of an employee who may be subject to a non-compete.

A common restriction is to prohibit the use of non-competes for employees who earn below a certain threshold - e.g., annual compensation, hourly wage, percentage of poverty level, or FLSA status. Employers operating in multiple states across the country face a patchwork of regulations and need to keep their non-compete thresholds up to date. Setting calendar reminders for the annual wage updates and following the Proskauer Non-Compete and Trade Secrets page ensures that employers keep their agreements compliant with ever changing obligations.

Click map to download printable PDF

Illinois

For agreements executed after January 1, 2022, prohibition on: (i) non-competes for employees who earn less than $75,000; and (ii) non-solicits for employees who earn less than $45,000.

Maine

Prohibition on non-competes for employees earning wages at or below 400 percent of the federal poverty level (2021: $51,520).

Maryland

Prohibition on non-competes for employees who earn equal to or less than: (i) $15 per hour; or (ii) $31,200 per year.

Massachusetts

Prohibition on non-competes for: (i) non-exempt employees; (ii) undergraduate or graduate students participating in internships or short-term employment; (iii) employees that have been terminated without cause or laid off; and (iv) employees under the age of 18.

New Hampshire

For agreements executed on or after September 8, 2019, prohibition on non-competes for employees who earn: (i) an hourly wage less than or equal to 200 percent of federal minimum wage ($14.50 or less per hour or $30,160 annually); or (ii) less than or equal to 200 percent of the tipped minimum wage in state.

Oregon

Effective January 1, 2022, non-competes with employees will be void unless, among other things: (i) the exempt employee's annual salary at the time of termination exceeds $100,533 (adjusted annually for inflation); and (ii) the agreement is limited to a one-year duration.

Rhode Island

Prohibition on non-competes for: (i) non-exempt employees; (ii) undergraduate or graduate students participating in internships or shortterm employment; (iii) employees under the age of 19; and (iv) employees whose average annual earnings (excluding overtime, Sunday, or holiday premiums) are less than 250 percent of the federal poverty level (currently $32,225).

Virginia

Effective July 1, 2020, employers are prohibited from entering into non-competes with employees who earn less than Virginia's average weekly wage (about $1,200 per week or $62,000 per year).

Washington

Prohibition on non-competes for: (i) employees who earn less than $101,390 per year (adjusted annually for inflation); and (ii) independent contractors who earn less than $253,475 per year (adjusted annually for inflation). On January 1, 2022 the thresholds will increase to $107,301.04 and $268,252.59 for employees and independent contractors, respectively.

Low Wage And Employee Classification Limits On Non-Compete Agreements

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]