- within Government, Public Sector, Antitrust/Competition Law and Insurance topic(s)

- in United Kingdom

The Seattle payroll tax, colloquially known as the JumpStart Seattle tax, collected more than $231 million for 2021, exceeding the city's early estimates by more than 15 percent. For 2022, the tax imposes tiered rates based on the company's total annual payroll and is imposed on companies with at least $7.38 million in 2021 annual Seattle payroll expense.1

During a period of remote work triggered by the pandemic, the fact that the Seattle payroll tax exceeded the city's early estimates is surprising. It also begs the question: how do companies determine where employee compensation is paid? Seattle's tax scheme permits two different methods to determine when compensation is attributed to Seattle (and, thereby, taxed) - the "primarily assigned method" and the "hours method."

Both methods require employers to be aware of where their employees are working throughout the year. There are open questions as to what type of documentation the city will accept on audit to support how employers determined where compensation was paid. There are several systems that can streamline this process, such as tracking badge data, IP addresses, hoteling data, and tokens like AirTags and Tile.

Taxpayers must elect which method they will use to determine compensation paid in Seattle on their first return filed for each year. The same method must then be used for the remainder of that tax year. If no election is made, the employer must use the "primarily assigned method" to determine what compensation is paid in Seattle. The first quarter 2022 return is due April 30, 2022.

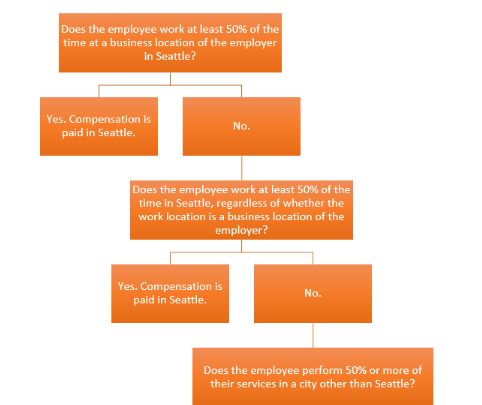

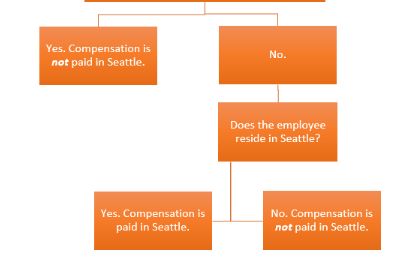

Under the "primarily assigned method," if an employee is "primarily assigned" to Seattle, then 100 percent of that individual's payroll is subject to the Seattle payroll tax. The key here is determining whether or not each employee is primarily assigned to Seattle. As such, the following decision tree provides a starting point for determining where employees are primarily assigned.

The second method, the "hours method," calculates what percent of an employee's total hours were spent working in Seattle and uses that ratio to determine how much of their annual income was earned in Seattle. The tax is paid on the Seattle-based income.

Footnote

1. These tax thresholds increase each year based on the annual Consumer Price Index.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]