- within Insolvency/Bankruptcy/Re-Structuring, Law Department Performance, Litigation and Mediation & Arbitration topic(s)

History doesn't have to repeat itself

Traditionally, higher education leaders seem to have accepted that barely breaking-even and "manageable" deficits are the norm. Sub-optimal assumptions persist - "spending decisions are best managed locally"; "every unit deserves its share of operating and turn at capital"; and "we should (or must) consume what we have available now". Laissez-faire financial management capabilities create and exacerbate a series of issues, even in environments of fiscal abundance. Some common challenge areas include:

- Schools and units may not have a clear sense of their financial performance and impact on the institution as a whole

- Schools and units may not be challenged to measure the value of their spending or "standard budget" increases funded without adequate scrutiny (e.g., material business changes, unspent prior year funds)

- Program and project agendas may be generated "bottom-up" without institutional context – investments suboptimized, synergies lost, results untracked

- Local leaders may be "territorial," unaware of institutional priorities and may lack data, skills and resources to make optimal financial decisions

- Administrative processes may be siloed or duplicated, leading to cost, speed and quality issues – difficulty achieving cost management efforts, missed opportunities for scaled improvement, abundance of "customer" service shortcomings

Institutions often avoid changing financial management practices due to concerns about scrutiny and criticism from trustees and stakeholders, resistance from faculty and staff or, drawn-out consulting engagements promising unachievable savings. Furthermore, institutions may anticipate sacred cows mustered against impacts to treasured program offerings and orthodox business practices. However, based on our experience with top universities, these challenges can be overcome.

Financial management transformation — top-down and bottom-up value creation

Based on courageous financial leadership, strengthened financial management can deliver extraordinary benefits, including refocusing leaders on the big picture, optimizing funding for the mission, improving "customer service" for many constituencies and generally addressing endemic fiscal problems.

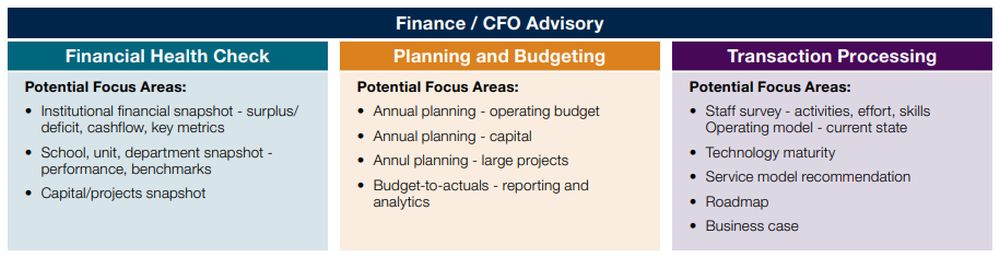

A&M has outlined an approach for assessing financial health and financial management practices, rapidly diagnosing current state and positioning institutions to take steps toward improved practices and results. Our approach blends financial, operational and organizational analysis, and delivers data-driven recommendations spanning financial management processes like capital planning and budgeting (top-down opportunities), as well financial transactions like check requests and expense reports (bottom-up opportunities). The end goal of the assessment is to highlight potential financial problems, improve control over critical financial management processes and understand operating model options.

Sample First Project Approach

Conviction and Commitment – How A&M is Different

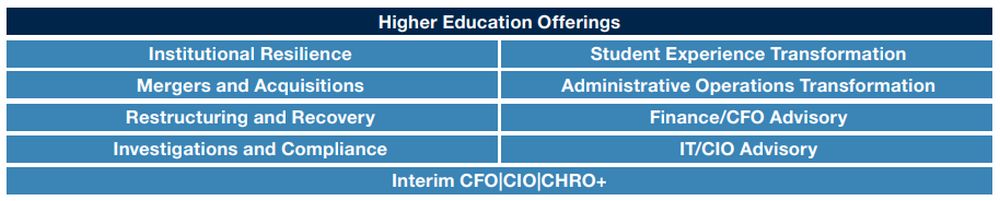

A&M's culture stems from decades of support for complex, urgent, "make or break" deals, transactions and projects. The higher education practice is driven by the intensity in our DNA to provide a differentiated, focused set of services in higher education. The core services A&M provides to the sector are:

A&M Higher Education Offerings

A&M's higher education team is senior and partners with institutional leaders according to A&M's intensive collaboration model, providing end-to-end hands support in project planning, problem-solving, implementation and governance. A&M's practitioners have pioneered transformational changes with large and small, traditional and online, public and private, "rich and poor" institutions, as both higher education executives and management consultants.

Originally published by 15 October, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.