- within Transport and Strategy topic(s)

Following the recent changes made to the UK Listing Rules that require Main Market–listed companies to comply with or explain against target board diversity disclosure and diversity data-reporting requirements, London is leading the way internationally in promoting diversity on boards. With 350 publicly listed companies and almost 3,000 board seats in scope, the UK outruns most of its international counterparts in both progress and scale.

Reports published by the FTSE Women Leaders Review in February 20241 and the Parker Review Committee in March 20242 demonstrate that significant progress has been made since both reviews were initially set up. But there is more work to do, particularly at the senior management level.

With these reporting requirements now hard-wired as comply or explain obligations in the UK's Listing Rules, it is more imperative than ever that in any journey toward the UK public markets, companies give board diversity due consideration as they prepare for an initial public offering (IPO).

FTSE Women Leaders Review

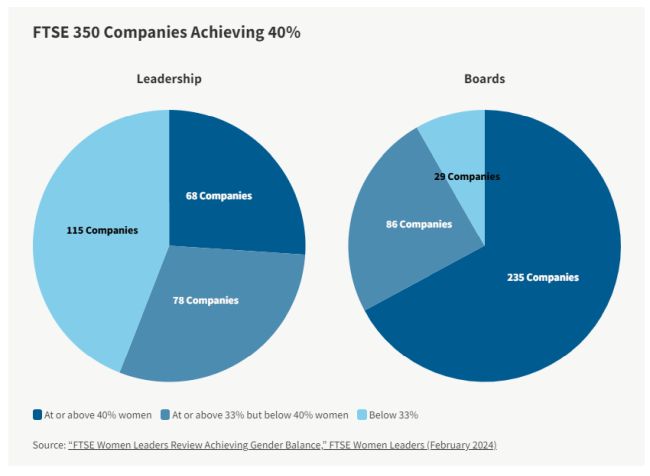

In 2022, the FTSE Women Leaders Review set a target of 40% women in leadership teams and on boards of FTSE 350 companies by the end of 2025 (increased from an original target of 33%). Another goal was that each FTSE 350 company would have at least one woman in a key role — CEO, senior independent director (SID), finance director, or chair. The FTSE Women Leaders Review report published in February 2022 revealed that FTSE 350 companies met the 40% target for women on boards three years early, with overall representation of women on FTSE 350 boards standing at 40.2%, and that almost half of FTSE 350 boards have a woman chair or SID. The February 2024 report reveals that the rate of appointments for women remained the same in 2023 as in 2022, with 41% of available leadership roles (positions on the board or two senior management layers below the board) going to women. Continued progress was seen across the FTSE 100 and FTSE 250, where the representation of women on FTSE 100 executive committees reached 30% for the first time.

This is also the second year that the review includes data from the 50 largest private companies,3 46 of which provided data. While data at the board level for private companies is more limited and harder to track given the multitude of board structures available to private companies, women's representation in leadership positions has increased slightly, from 34.3% in 2022 to 35.2% in 2023.

Overall, the FTSE 350 currently ranks second worldwide at 42.1% female board representation, with France at the top and Norway in third position after the UK. There are 1,243 women on FTSE 350 boards, a significant increase from 289 in 2011, when the FTSE Women Leaders Review (then called the Hampton-Alexander Review) was established. Both France and Norway operate quota systems, whereas the UK has a voluntary system and a comply or explain disclosure regime in the UK Listing Rules.

Areas For Improvement

However, 29 FTSE 350 companies have yet to meet the original 2020 33% target for women on boards, and 115 FTSE 350 companies have not met the 33% target for women in leadership roles set by the original Hampton-Alexander Review in November 2016.4 Continued efforts are also required to increase the number of women who have access to the four biggest roles, especially the CEO role (the numbers show flat or minimal improvement, even though there has been an increase in the number of women undertaking the role of finance director and chief information officer, both of which are routes to becoming CEO) and to executive committee positions (women currently make up only 28.2% of FTSE 350 executive committee members).

In addition, about a third of the top 50 private companies have 40% women on their boards, but more than half are trailing well below 33%.

Parker Review

The Parker Review Committee, established in 2015 to promote ethnic diversity in UK businesses, published its latest report in March 2024. The targets set for ethnic minorities on FTSE 100 boards were "at least one by 2021" and "one by 2024" for FTSE 250 boards. For the first time last year, these targets were extended to the UK's largest 50 private companies.

The table below shows the mixed progress made between 2022 and 2023:

| As of December 2022 | As of December 2023 | |

| FTSE 100 companies with at least one ethnic-minority director | 96 | 96 |

| FTSE 250 companies with at least one ethnic-minority director | 149 companies out of 224 respondent companies (67% of respondents) | 175 companies out of 222 respondent companies (79% of respondents) |

As a proportion of all board directorships, ethnic-minority

directors represented 19% of FTSE 100 boards and 13.5% of FTSE 250

boards as of December 2023.

The March 2024 report in particular reveals an increase in the most senior roles. There are now 12 ethnic-minority CEOs in the FTSE 100, an increase from seven in 2022, and seven ethnic-minority chairs, an increase from six in 2022. However, 85% of ethnic minorities in board positions are non-executive directors as opposed to executive directors, and none of the 12 ethnic-minority CEOs are Black.

Practical Tips

Companies in the Tech and Life Sciences sectors in particular depend on a large, deep pool of talent to fund their growth and continued innovation. For example, one of the recommendations in the 2021 Kalifa Review of UK Fintech was to grow the pipeline of fintech talent in the UK.5 Diversity plays a key role in broadening that pool of talent and strengthening the talent pipeline to help the UK maintain a competitive edge in these highly competitive sectors. In recognising the important role of diversity, equity, and inclusion in harnessing, nurturing, and growing talent, the UK is leading the way globally in incorporating such standards in its listing rules for public companies and extending these targets to large private companies whose businesses have a significant impact on the UK economy more broadly.

Here are a few tips to help you meet board diversity targets in the UK as you prepare for an IPO:

- Conduct an analysis of your board and senior management composition at least 12 to 18 months before IPO — identifying where more diversity of skill sets, public company experience and background may be required.

- Identify any new potential candidates six to 12 months before IPO — it takes time to find the well-suited candidates for your board and help them get to know your company.

- Ensure that diversity is considered as part of succession planning and as part of both internal and external board evaluations.

- Consider ways you are nurturing and supporting diversity amongst senior management as a way of building a stronger pipeline of potential future board candidates (both for your organisation as well as others in the industry).

If you would like to discuss any of the topics raised in this alert or have any queries about diversity on boards or the UK corporate governance framework and trends in this regard, please reach out to the Goodwin team members listed below.

Footnotes

1. FTSE Women Leaders Review, "Achieving Gender Balance" (February 2024).

2. The Parker Review Committee, "Improving the Ethnic Diversity of UK Business" (March 2024).

3. FTSE Women Leaders Review, "Achieving Gender Balance" (February 2024).

4. FTSE Women Leaders, "Hampton-Alexander Review" (November 2016).

5. Kalifa Review of UK Fintech, 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.