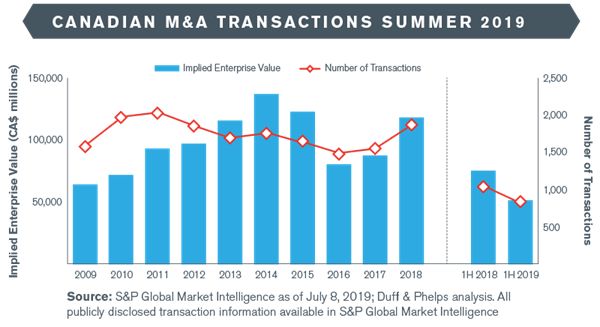

In the first half of 2019, Canadian M&A activity saw a decline in both transaction count and implied enterprise value (EV) compared to the same period last year. The decline was due to increased protectionism worldwide and higher levels of economic uncertainty. During the same period, 832 Canadian companies were sold, representing total disclosed EVs of $52.1 billion. Of the transactions completed, 68% were domestic acquisitions, which is in line with historical averages.1

While the number of transactions announced decreased in 1H 2019

(832 vs. 1,055), the median deal value increased from $6.3 million

to $10.9 million as the market for smaller deals (less than $100

million) declined faster than that of larger deals. Although

megadeals represent only 7% of all transactions, they represented

80% of the total deal value.1

Canada's GDP is expected to grow at 1.4% and 1.8% in 2019 and

2020, respectively, likely slowing down due to a drop in demand in

the housing industry and lower expected consumer spending. As a

result, Canadian companies may continue to look at acquisitions for

growth opportunities. Capital availability remains strong and

interest rates will likely remain low, providing a positive

environment for sellers.2

Canadian M&A Insights – Summer 2019.pdf (0.7) MB

Sources:

1 S&P Global Market Intelligence as of July 8, 2019;

Duff & Phelps analysis. All publicly disclosed transaction

information available in S&P Global Market Intelligence

2 RBC Economics Research – Economic and Financial

Outlook (June 2019)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.