- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Advertising & Public Relations industries

M&A MARKET PERSPECTIVE: Opportunity Amidst Uncertainty

We closed out last quarter with cautious optimism, underscoring the importance of favorable exit conditions to reinvigorate fundraising—a multi-year challenge made more complex by a substantial backlog, with 3,800 portfolio companies held for five to twelve years. Overall market sentiment was positive, with the election behind us and expectations that deregulation would create conditions for managers to capitalize on improved selling opportunities in 2025. However, Q1 introduced volatility in the public markets, tempering expectations as uncertainties around tariffs, U.S. policy changes, and steady interest rates heightened overall risk perception and prompted caution.

Q1 may signal a slower than expected start for M&A, but we anticipate a late-year rebound in deal activity. In this quarter's update, we explore which deals are moving forward, which are not, and the underlying factors shaping our outlook.

WHERE AND WHY DEALS AREN'T GETTING DONE: The chaos and uncertainty streaming through news sources adds to volatility and increases risk perception1 . Tariffs themselves create questions around supply chains, future pricing, and company financial forecasts. However, it is the instability itself that is presenting the true challenge, as interest rates and inflation are critical factors in company valuations2. Without the ability to price in these factors, managers are often unable to model future economic conditions and are, in many cases, choosing to delay dealmaking. This is reflected in the slowdown of platform deals—many paused due to perceived market risks and reluctance to commit significant capital to new strategies in the current environment. Platform activity in Q1 fell sharply from the brief rebound in Q4 2024—when deal volume reached a three-year high of nearly 500 – to a 19-quarter low of just over 300 deals. We also anticipate continued declines in deals involving businesses that rely on imports and offshore manufacturing. Conversely, businesses that utilize U.S.-based sourcing and manufacturing may see an increase in value due to their lack of disruption from tariffs.

AND WHERE AND WHY SOME DEALS ARE STILL HAPPENING: Not all activity is on pause. Q1 2025 data indicates that GPs are adapting and seizing opportunities as they emerge. Smaller buyouts and roll-up deals continue to move forward, just as they did throughout the challenges of 2023 and 2024, largely because they demand less cash and are easier to finance3. Sectors like technology and healthcare remain resilient, supported by a backdrop of easing regulatory pressures.

A CASE FOR OPTIMISM: If history has taught us anything, it's that private equity is remarkably resilient. With a 10-year rolling IRR of around 15%, PE has consistently demonstrated its ability to navigate uncertainty and uncover opportunities. Unlike public markets, its longer investment horizons allow for greater flexibility in managing short-term disruptions. Today's environment—marked by market dislocations, increasingly motivated sellers, and rising consumer and business loan delinquencies—presents new avenues for capital deployment. Combined with over $1 trillion in dry powder and the expertise to drive operational transformation, these conditions suggest that PE could uncover more opportunities in 2025 than initially expected, albeit against a very different backdrop.

DEAL METRICS UPDATE: Deals Move Sideways while Expectations Drop

After the ground that was made up in 2024, market sentiment was that we 'found the bottom' and were headed back up. And while Q1 2025 moved largely sideways, 2024 may prove to be hard to repeat or beat given today's environment.

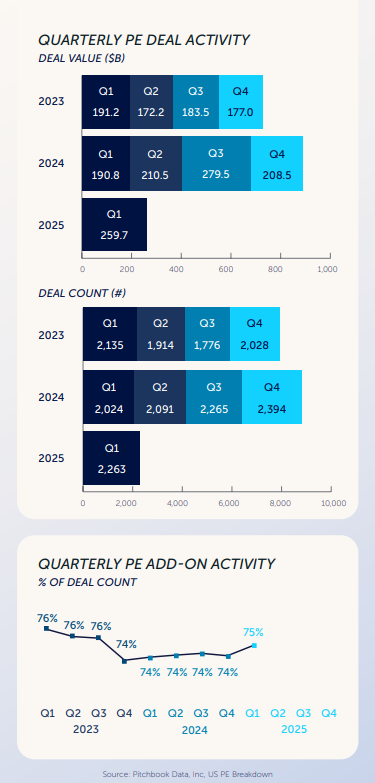

Q1 2025 activity could have been worse, and no one would have been surprised. But instead, deal count moved largely sideways, down 5.5% QoQ and up almost 12% YoY. Deal value, a less meaningful indicator, was also up – almost 25% QoQ and 36% YoY, bolstered largely by one material take-private.

While Q1 2025 platform activity declined, take-privates pose opportunities for PE, particularly with underwriting amid a foreshadowing of deteriorating credit quality among banks.

Add-ons hold their share of activity for another quarter, with a 150-basis point increase QoQ. There's likely limited potential for that percent to continue to grow given expectations of platform deals rebounding. However, given that add-ons continue to provide an opportunity for deals to get done, even amid the tumult of the current market, add-ons may hold onto their share longer than expected when we began 2025.

At a time when PE firms and add-on strategies are a dime a dozen and differentiation is critical, the recent challenges posed by an intensified tariff environment create new opportunity – PE firms that are able to innovate in their transfer pricing and supply chain strategies could gain a competitive advantage that's critical in today's saturated market.

DEAL METRICS UPDATE: As Expected: Exits and Fundraising Drop

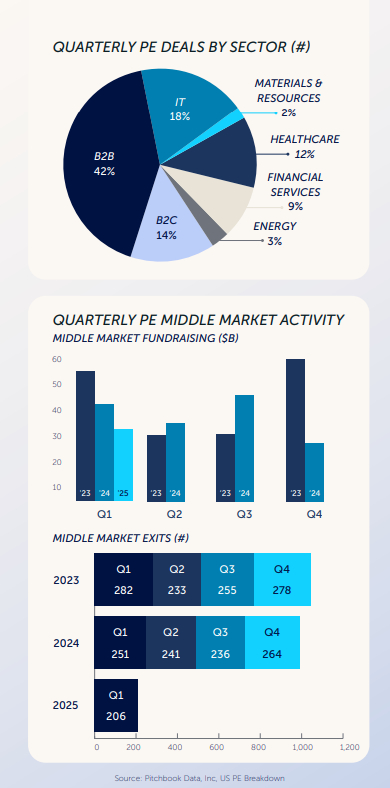

Discussions surrounding exit activity took a backseat amid the new headlines of Q1. However, exits are still not trending high enough to make up for the slowdown of recent years. Q1 2025 exit count was down almost 9% QoQ, and exit value declined slightly QoQ, after excluding the impact of one outsized IPO. Zooming into middle market exit, exit flow was down 28% YoY and 20% from Q4 2024.

Pitchbook estimates that at the current exit rate, PE firms are holding seven-to-eight years of inventory based on 2024 or Q1 2025's exit run rate. It's important that the exit market improve to coax out lesser quality assets into the market, but it will take more market predictability to support valuations and promote near-term exits.

As we've discussed, exits are a critical step in the private equity lifecycle. They provide distributions to LPs, who, in turn, reinvest, contributing to new rounds of fundraising.

As expected, middle market fundraising in Q1 2025 came in 21% less than Q1 2024. Wrapping up Q4 2024, we expected a trending decline in middle market fundraising as dollars went to larger funds in support of larger deals. But total PE capital raised has followed the same downward trend as middle market fundraising (seeing a 26% decline compared to Q1 2024). Dry powder is also at an all-time low, making up just 28% of total AUM compared to a 10-year average of 36%. Essentially, capital deployment is outpacing fundraising. In a market which may be ripe with opportunity, having the dollars to invest will be critical to keep the deal cycle turning

STATE OF THE ECONOMY: The Whiplash of Global Trade Policy Disruption

The first few months of 2025 was a period when economic data seemed inconsequential to financial markets and to Main Street. From the declaration of the new tariff policy on April 2nd to the ninety-day pause announcement on April 9th, world leaders scrambled to negotiate with the United States. For now, we have a broad 10% tariffs on all imports and a 145% tariff on Chinese goods. This policy introduces a seismic shift in global relationships that carries numerous implications for international trade. As we look ahead, we must consider the potential ripple effects of retaliation, global supply chain disruption, and price increases, all of which render the future highly uncertain.

AN INDICTMENT OF GLOBALIZATION: The use of steep tariffs is a definitive step away from the norm of the last several decades. They symbolize a deglobalization zeitgeist that gained momentum in recent years and highlights a complex set of frustrations. In particular, trade with China has been a source of grievance for American companies, and the supply chain disruption during the COVID-19 pandemic shed light on the downside of globalization. Finally, the formula used by the Trump administration to calculate the "reciprocal" tariffs reveals that the real objection is not any tariff levied on U.S. goods; rather, it is the U.S.'s consistent trade deficit with many nations, a side effect of a globalized trading platform and of the U.S. dollar dominance.

MONETARY POLICY CHALLENGES: Tariffs are effectively a tax burden carried by the buyer of the transaction. Consider the 145% tariffs on Chinese imports. According to the U.S. Census Bureau, the U.S. imported $439 billion worth of goods from China in 2024, with names like Walmart, Amazon, and Apple (maybe Apple is getting an exemption for now) expected to be impacted severely. Now it becomes a business decision for U.S. companies on whether the tax is passed along to buyers. With a draconian tariff rate, price hikes are only a partial worry; final consumers, both institutions and individuals, would be less likely to make the purchases at all. Under these circumstances, the Federal Reserve is staring at slower economic growth, possibly a recession in a higher price regime, where interest rate policy is less straight forward.

FINANCIAL MARKETS IN SEARCH FOR STABILITY: A 90-day extension on the tariff policy implementation only means the postponement of certainty. A significant change in trade policy is disruptive in and of itself, but the uncertainty around that policy is also disorderly for the financial markets. Public equity markets struggled to find stability since "Liberation Day", and for the first time since 2022, credit spreads widened considerably4. The move in the credit markets stresses the cash flow impact of these tariffs on businesses, and the tariff war with China is expected to be reflected in future borrowing costs.

AS THE FIRST 100 DAYS OF THE TRUMP ADMINISTRATION NEARS A CLOSE, WE ARE IN UNCHARTED TERRITORY. The global economy, with its complex web of trade and relationships, is a massive ship and introduction of changes requires gentle and patient maneuvering. Instead, we have implemented a policy shock to an established global system, in some ways similar to the sudden impact of the economic shutdown during the COVID-19 pandemic. Unlike the pandemic, the world could conceptually "negotiate" out of this situation, but even if the U.S. achieves the desired outcome, some things, namely trust, may remain broken. This is the immeasurable cost of a fast-track trade deal, and healing from it may be the longer-term challenge ahead of us.

WHAT'S TRENDING: Dividend Recaps: Another Vehicle to Fight the Exit Stalemate

For over 20 years, private equity sponsors have utilized dividend recaps, also known as leveraged dividends, to enhance investment returns without resorting to a sale or IPO. During the 2010s, these transactions averaged around 200 per year. However, rising interest rates and a booming M&A market recently reduced the popularity of dividend recaps to fewer than 100 transactions in 2023. The stabilization in interest rates, coupled with a competitive lending environment and longer hold periods for PE sponsors, led to a resurgence in dividend recaps in 2024, continuing into 2025.

Dividend recaps allow private equity firms to extract cash from portfolio companies without giving up equity. These one-time cash distributions provide immediate returns to fund investors, enhancing the firm's investment track record.

The cost of borrowing is a critical factor in considering a dividend recap. These transactions are more popular when interest rates are low. When the Federal Reserve raised rates in 2022 and 2023 to combat inflation, the volume of leveraged dividends shrank significantly. However, 2024 saw the volume in dividend recaps more than double as compared to 2023. We attribute this uptick to interest rate stabilization, a more competitive lending environment and continued investor pressure to return capital. With lackluster market conditions to exit, including a dampened IPO market, dividend recaps provided a viable alternative for cash returns, where other avenues are stalled.

Each dividend recap typically involves a solvency opinion, at the insistence of legal counsel. This third-party letter from a financial expert assures that the transaction will not impair the company's ability to meet its obligations as they become due and that its asset value exceeds its liabilities post-dividend. These opinions provide unbiased conclusions on the viability of the proposed recap and are a valuable step in the process.

It is clear that dividend recaps have re-emerged as a vital tool for private equity sponsors to generate returns in a market where exits and IPO activity remain stagnant. Their resurgence highlights yet another way in which PE fund managers have evolved and adapted to changing market conditions and investor pressures. Given the recent stock market volatility and the corresponding speculation of pressure on the Federal Reserve to cut rates in the near future, we suspect that these transactions will continue to ramp up in volume throughout the remainder of the year.

Footnotes

1 Financial Times: US dealmaking suffers worst start to a year in a decade amid Trump volatility

2 Pitchbook: Dealmakers grapple with fresh uncertainty following Trump's 'Liberation Day' tariffs

3 WSJ: The M&A Boom Wall Street Wanted Is Here, if You Know Where to Look Pitchbook Q1 2025 US PE Breakdown

4 Bloomberg. Investment Grade spreads widened to 119 bps as of April 8, 2025; High yield spreads widened to 453 bps. Note: This piece was written as of April 9, 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.