Constant connectivity through smartphones has ushered in a new way for small businesses to connect with potential customers and gig workers looking for flexible employment. The emergence of companies like Uber, GrubHub, AirBnB, DoorDash, TaskRabbit, and Angie's List has allowed for greater participation in today's booming gig economy, with 16% of all U.S. adults having reported earning money through an online gig platform in a 2021 survey.

But as more customers, small businesses, and workers rely on these platforms, scrutiny from regulators has also increased. For years, this scrutiny has been focused on how to legally classify workers participating in these platforms and whether the services being performed by gig workers should be subject to the same regulatory and licensing requirements as traditional businesses. More recently, however, the Federal Trade Commission (FTC) and state attorneys general have set their sights on the gig economy and practices they view as deceptive and unfair, which should put all gig platforms on high alert.

In Part I, we provide an overview of the gig economy's legal landscape. In Parts II to IV, we discuss the agencies' priorities in this area.

Part I – Legal Landscape

Section 5(a) of the Federal Trade Commission Act provides the FTC with the authority to protect consumers from "unfair or deceptive" acts or practices. This includes protecting both individual consumers and small businesses. The FTC has the power to issue regulations defining what is an unfair or deceptive practice and to challenge business practices in federal court or administrative court.

With respect to the gig economy, the FTC has pursued both strategies. In February 2022, the FTC announced an Advanced Notice of Proposed Rulemaking (ANPR) for a potential rule concerning deceptive or misleading earnings claims. One rationale the ANPR lists for promulgating the proposed rule is the prevalence of misleading earnings claims used to offer "work-from-home, 'gig' work, and other job opportunities[.]" Although in the early stages of FTC rulemaking, such a regulation could require companies making earnings claims to give recipients specific information about potential earnings.

In the meantime, the FTC has brought several enforcement actions against gig platforms, discussed below, and has taken a significant step toward bringing more. On October 26, 2021, it issued notices to over 1,100 companies, including gig platforms Amazon, Uber, GrubHub, DoorDash, and Lyft, to name a few, putting them on notice that if they deceive or mislead consumers about potential earnings, they could be subject to civil penalties of up to $43,792 per violation.

Many states also have "little FTC Acts," authorizing states' attorneys general to address similar unfair or deceptive behavior. Frequently, the FTC will coordinate with various states in an effort to stop acts or practices it views as deceptive, and will utilize the various states' authority to return money to consumers. As discussed below, the attorney general of the District of Columbia has been particularly active in bringing cases against gig platforms.

Part II – Earnings Claims to Recruit Gig Workers and Small Businesses Must Be Truthful and Substantiated

An earnings claim is a representation of how much money a person will make or the level of success he or she will achieve by purchasing or participating in a program or service. The FTC has long used its enforcement power to go after companies promoting business opportunities or money-making ventures that make earnings claims that are false, unsubstantiated, or otherwise misleading.

In 2021, one of the world's largest e-commerce marketplace companies settled with the FTC for $61.7 million to resolve allegations that it failed to pay its contracted delivery drivers the full amount of tips the drivers received from customers, despite representing to its drivers and customers that the drivers would receive 100% of the tips earned. According to the FTC, the company's advertisements, website, and app, including in the app's FAQs and in the terms of service that drivers had to accept upon enrollment, all contained the representation that drivers would receive 100% of their tips.

In addition to making truthful statements, an advertiser must have a "reasonable basis" for making any claim before it is disseminated. The FTC's idea of what constitutes a "reasonable basis" depends on several factors, including the type of claim, the product, and the consequences of a false claim, among others. By finalizing a rule on earnings claims, the FTC hopes to clarify what level of substantiation is needed to make such claims.

In a 2017 settlement, Uber agreed to pay $20 million to drivers after the FTC charged the ride-hailing app with misleading prospective drivers about their earnings potential and the cost of financing a car through Uber. Specifically, as the FTC alleged, Uber advertised that the median income of its UberX drivers was $90,000 per year in New York and $74,000 in San Francisco, which was later changed to say that the "potential income" a driver could make annually was "more than $90,000 in New York and more than $74,000 in San Francisco." However, as the FTC asserted, when adjusted to a 40-hour workweek, UberX drivers' median income in New York and San Francisco was actually $61,000 and $53,000, respectively, and less than 10 percent of all drivers in those cities had earned the income claimed by Uber.

More recently, in March 2022, the FTC initiated an administrative proceeding against HomeAdvisor, Inc., which connects service providers with consumers seeking home improvements, for allegedly making unsubstantiated claims about the quality and source of leads it sells to service providers and about the likelihood that the leads would result in jobs.

In sum, companies offering app-based work opportunities must possess a reasonable basis for making the earnings claims, and a substantial percentage of workers should have achieved the income or success being advertised.

Part III – Consumer-Facing Advertising Must Be Carefully Vetted

In a hypercompetitive market, companies may feel intense pressure to distinguish their service from that of their competitors. Overlooking basic truth-in-advertising principles, however, can bring significant reputational and legal risk.

For example, several ride-sharing companies settled lawsuits with the Los Angeles and San Francisco district attorneys for misrepresenting the thoroughness of drivers' background checks. In their complaint against Uber, for example, the district attorneys called out the following representations made by Uber on its website, in the media, and in communications with customers:

- that Uber is the "safest ride on the road";

- that it has the "strictest safety standards possible";

- that it goes "above and beyond local requirements to ensure your comfort and security";

- that it conducts "background checks you can trust" through a "rigorous" screening process; and

- that "every ride on the Uber platform is safer than a taxi."

The district attorneys contended that these representations were problematic because Uber's background checks do not even "use fingerprint identification" like taxi-driver background checks do, and "therefore cannot ensure the information Uber obtains from a background check actually pertains to the applicant."

Part IV – Website and In-App Design Features Must Be Transparent

Over the last two years, there has been increased attention paid to the use of "digital dark patterns," i.e., website and app designs, features, and interfaces allegedly used to deceive, steer, or manipulate users into making a purchase. Although the focus to date has been on features that "trick or trap" consumers into subscriptions, the line between a website/app that is acceptably optimized for conversion and one that is illegally steering users to make purchases remains undefined.

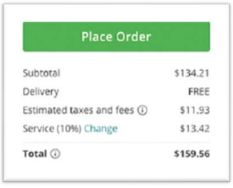

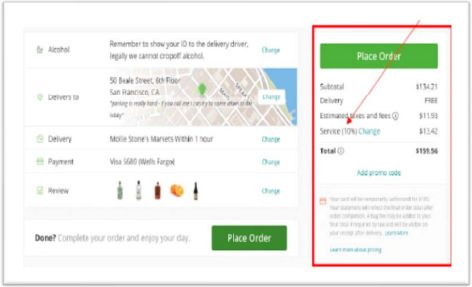

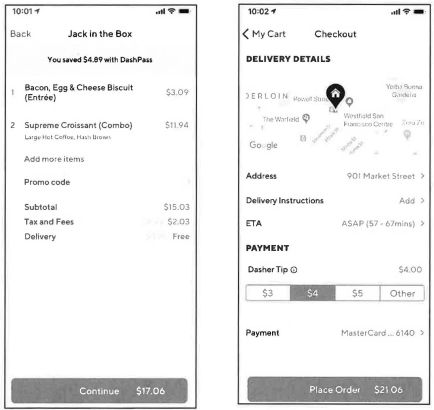

In 2020, the attorney general of DC brought a pair of cases against two gig platforms concerning in-app misrepresentations about tipping workers. The case against Instacart, an app-based platform that allows consumers to order groceries to be delivered to them, is illustrative of the types of design features that can lead to consumer confusion. There, the District alleges that Instacart deceived consumers into believing that service fees were going to delivery workers. Specifically, one of the line items on consumers' checkout page in the Instacart app was labeled "Service," which defaulted to 10% of the subtotal, with the ability to change it.

The District argues that this misled consumers into believing that the service fee was a tip, when in reality the service fee was used to cover Instacart's operating expenses. It further argues that it was deceptive to separate the delivery fee from the service fee, because this gave the false impression that the delivery fee was the basic price of Instacart's delivery services and the optional and variable service fee would be gratuity for the deliverers.

Finally, according to the complaint, Instacart reinforced its deception by removing the tipping option from the main checkout screen and removing the tipping option altogether when it first began collecting a service fee. Even though the option to tip was later reintroduced, the main checkout screen made no reference to tipping, and the option was visible only to consumers who first clicked an "obscure link to change the service fee," which then brought consumers to a screen where the option to tip was presented:

Conclusion

These cumulative actions represent an ongoing tug-of-war between lawmakers, regulators, gig companies, and legal advocates over the competing interests of businesses and gig workers. As the pursuit of an equilibrium continues, gig companies need to be on alert that the industry is under the microscope, and that claims you make to entice service providers and customers to the platform must be truthful, backed up with evidence, and transparent.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.