On Monday, December 21, 2020, the United States Congress passed a second large stimulus bill1 (the "Relief Bill") aimed at curtailing the economic disruptions caused by COVID-19. The Relief Bill, among other things, extends renewable energy tax credits for wind projects, solar projects and carbon capture and sequestration and contains specific provisions addressing offshore wind farms. These extensions include a one-year extension for wind projects, a two-year extension for solar projects and a two-year extension for carbon capture and sequestration projects. President Trump is expected to sign the Relief Bill and has until December 28, 2020 to do so, when the current stopgap funding measure expires.

Wind Tax Credits

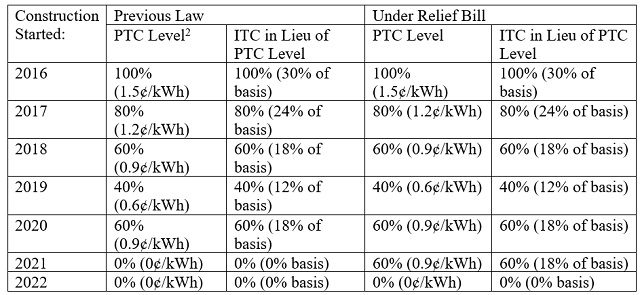

Section 45 of the Internal Revenue Code (the "Code") allows a production tax credit ("PTC") against federal income tax for electricity produced by a taxpayer at a "qualified facility" during the 10-year period beginning on the date such facility is originally placed in service. A "qualified facility" includes wind facilities. The PTC rate is 1.5 cents per kilowatt hour of electricity, adjusted for inflation (2.5 cents per kilowatt hour in 2020). This credit is phased down for a facility using wind to produce electricity, with the PTC reduced by 20% for facilities for which construction began prior to January 1, 2018; 40% for facilities for which construction began prior to January 1, 2019; and 60% for facilities for which construction began prior to January 1, 2020.

The availability of the PTC for wind facilities has been extended several times in previous years, most recently in 2019. On December 20, 2019, President Trump signed into law a package of "tax extenders" (the "Extenders Bill") allowing PTC with a 40% reduction for wind facilities for which construction begins prior to January 1, 2021. The Relief Bill extends this credit at the 2020 rate for one year, such that the PTC for wind will sunset at the end of 2021.

Solar Tax Credits

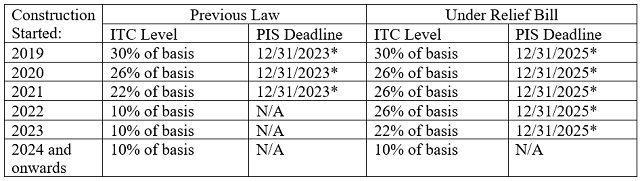

Section 48 of the Code allows an investment tax credit ("ITC") against federal income tax for "energy property" that is placed in service during a taxable year, with the ITC rate being a percentage of the tax basis of that property. Currently, for projects the construction of which began prior to January 1, 2020, the credit is equal to 30%, but it steps down to 26% for projects the construction of which begins prior to January 1, 2021, and to 22% for projects the construction of which begins prior to January 1, 2022 (in each case, as long as the energy property is placed in service prior to January 1, 2024). The ITC drops to 10% where the construction begins after December 31, 2021. Additionally, for a project to be eligible for more than a 10% ITC, it must be placed in service before January 1, 2024. The Relief Bill extends the 26% ITC available for solar projects that begin construction prior to January 1, 2021 by two years, allowing the 26% ITC for projects that begin construction before January 1, 2023. A 22% credit would then be available for projects that begin construction before January 1, 2024, with the credit phased out afterwards. The placed-in-service deadline was similarly pushed back, with an ITC greater than 10% only available for projects that are placed in service before January 1, 2026. Note this statutory outside placed-in-service date is distinct from IRS guidance that generally requires a wind or solar project to be placed-in-service within four calendar years after the date upon which construction of such project began (the so-called "Continuity Safe Harbor") in order to be within an IRS safe harbor for determining the start-of-construction date of a project.

In the case of wind facilities, a taxpayer may elect to treat these facilities as "energy property" and thereby claim the ITC in lieu of the PTC, subject to a phase-down similar to the PTC phase-down. The Extenders Bill allowed taxpayers to elect to receive the ITC with a 40% reduction (i.e., to 18%) for wind facilities the construction of which begins before January 1, 2021. The Relief Bill extends eligibility at the 18% level for one year for projects that begin construction before January 1, 2022. There is no statutory requirement for wind projects to be placed in service so long as they satisfy the start-of-construction requirements.

The following table summarizes the effect of the Relief Bill on the PTC and the ITC in lieu of the PTC for wind projects:

The following table summarizes the effect of the Relief Bill on the ITC for solar projects and on the related statutory placed-in-service deadlines to be eligible for the related ITC percentage (not taking into account the Continuity Safe Harbor):

*Otherwise, only 10% ITC is available. We would expect that, for projects that began construction in 2019 or 2020, taxpayers would attempt to meet the four-year Continuity Safe Harbor.

Offshore Wind Provisions

The Relief Bill amends Section 48(a)(5) of the Code to allow greater tax credit flexibility for "qualified offshore wind facilities." These provisions allow offshore wind farms to elect either the PTC or the ITC, with the ITC extended by five years, allowing a full 30% investment tax credit for offshore wind farms that begin construction before January 1, 2026. Although offshore wind is a relatively recent development in the United States, the general view is that the ITC provides a greater incentive than the PTC for these projects due to their high development costs (and thus a higher tax basis in the project that results in a correspondingly higher ITC). There is no statutory requirement for offshore wind projects to be placed in service so long as they satisfy the start-of-construction requirements.

Residential Credit

The residential energy efficient property credit under Section 25D of the Code allows for a credit equal to the applicable percentage of the cost of qualified property. Previously, this applicable percentage was 30% for property placed in service before January 1, 2020; 26% for property placed in service before January 1, 2021; and 22% for property placed in service before January 1, 2022. Qualifying property includes solar electric property, solar water heaters, geothermal heat pumps, small wind turbines and fuel cell property that are used in or in connection with a dwelling unit in the United States that is used as a residence by the taxpayer. The Relief Bill extends some of these deadlines, allowing a 26% credit for property placed in service before January 1, 2023, and a 22% credit for property placed in service before January 1, 2024.

Carbon Capture Tax Credit

Section 45Q of the Code provides a tax credit on a per metric ton basis for carbon oxides that are captured by a taxpayer with carbon capture equipment at a qualified facility and disposed of either in secure geological storage or through certain other methods. A "qualified facility" includes any industrial facility, electricity generating facility or direct air capture facility, the construction of which begins before January 1, 2024, if either the construction of carbon capture equipment begins before that date or the facility was originally designed to include carbon capture equipment.

For carbon capture projects, which currently must begin construction before January 1, 2024, the Relief Bill extends this deadline and allows credits for projects that begin construction before January 1, 2026.

Omissions

The Relief Bill notably omits any provisions relating to standalone battery storage tax credits and direct pay provisions for ITCs. In addition, although the Relief Bill included credits for the purchase of fuel cell vehicles and two wheel plug-in electric vehicles, it did not expand the consumer tax credit for purchase of electric vehicles, which phases down once a manufacturer sells 200,000 vehicles. It remains to be seen whether Congress will address these items in 2021 once there is a new Congress and administration.

1 H.R. 133, available at https://docs.house.gov/billsthisweek/20201221/BILLS-116HR133SA-RCP-116-68.pdf.

2 PTC rates shown in this table are prior to adjustment for inflation.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.