- within Environment topic(s)

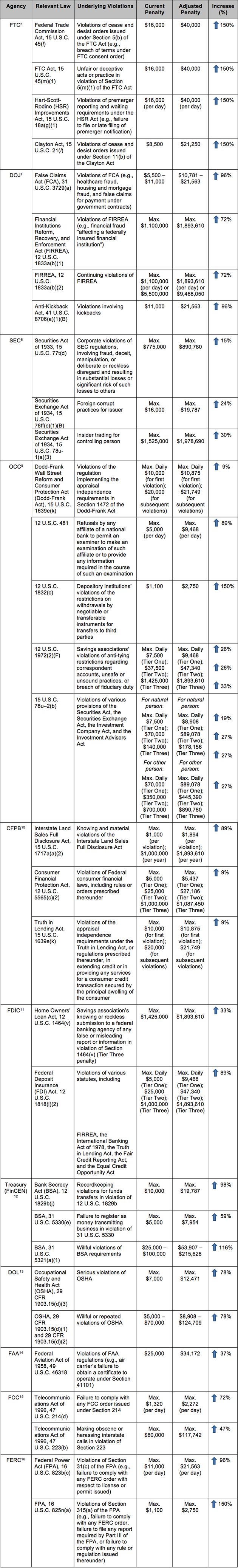

Civil fines across federal agencies have recently been increased dramatically under the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (2015 Act) (Sec. 701 of Public Law 114-74), with some more than doubling. Companies violating the Hart-Scott-Rodino (HSR) Improvements Act, the Securities Exchange Act, or the Occupational Safety and Health Act (OSHA), among others, could soon face civil monetary penalties that are up to 150% higher than the existing levels. According to the Congressional Budget Office, the 2015 Act would increase the federal government's revenue by $1.3 billion over the next ten years.1

The 2015 Act requires federal agencies to (1) adjust the level of civil monetary penalties with an initial "catch-up" adjustment through interim final rulemaking; and (2) implement subsequent annual adjustments for inflation based on the Office of Management and Budget (OMB)'s annual guidance.2 The 2015 Act takes effect on August 1, 2016, when agencies will begin applying the new penalty levels to any penalties assessed on and after that date. Accordingly, the penalty increases can apply to ongoing investigations of conduct that occurred long before August 1 (if the relevant agency decides to assess penalties on or after August 1).3 The 2015 Act, however, does not retrospectively change any previously assessed or enforced penalties.4 Also, penalties under the Internal Revenue Code and the Tariff Act are exempt from the 2015 Act's inflation adjustment.5

Below are some of the notable increases in federal civil fines under the 2015 Act:

The 2015 Act mandates that federal agencies publish interim final rules with the initial penalty adjustments by July 1, 2016, and there is no requirement that they provide notice and comment process before promulgation.17 Agencies have taken slightly varied approaches to determining their respective fine increases under the 2015 Act. For instance, the Federal Trade Commission, the Financial Crimes Enforcement Network of the Department of Treasury, and the Federal Aviation Administration, among others, published their finalized fine increases in late June and early July. Some agencies, such as the Department of Justice, the Securities and Exchange Commission, and the Federal Deposit Insurance Corporation, have invited public comment on their published increases with comment periods variously closing from mid-August to early September. Notably, these published fine increases will take effect on August 1, 2016 per the 2015 Act, notwithstanding the notice and comment period will not have expired.

Footnotes

1 Congressional Budget Office, Estimate of the Budgetary Effects of H.R. 1314, the Bipartisan Budget Act of 2015, as reported by the House Committee on Rules on October 27, 2015, Oct. 28, 2015, at 4.

2 OMB Memorandum M-16-06, Implementation of the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, Feb. 24, 2016 ("OMB Memorandum M-16-06"), at 1.

3 Id. at 3-4.

4 Id. at 4.

5 Id. at 1. Penalties under OSHA and the Social Security Act (which were previously exempt) are now subject to the 2016 and subsequent inflation adjustments under the 2015 Act. Id.

6 Adjustment of Civil Monetary Penalty Amounts, 81 Fed. Reg. 42,476 (June 30, 2016).

7 Civil Monetary Penalties Inflation Adjustment, 81 Fed. Reg. 42,491 (June 30, 2016). The DOJ requested for public comments to be submitted by August 29, 2016.

8 Adjustments to Civil Monetary Penalty Amounts, SEC Release Nos. 33-10104; 34-78156; IA-4437; IC-32162; File No. S7-11-16 (June 27, 2016). The SEC requested for public comments to be submitted by August 15, 2016.

9 Rules of Practice and Procedure; Rules of Practice and Procedure in Adjudicatory Proceedings; Civil Money Penalty Inflation Adjustments, 81 Fed. Reg. 43,021 (July 1, 2016). The Office of the Comptroller of the Currency (OCC) requested for public comments to be submitted by August 30, 2016.

10 Civil Penalty Inflation Adjustments, 81 Fed. Reg. 38,569 (June 14, 2016). The Consumer Financial Protection Bureau (CFPB) requested for public comments to be submitted by July 14, 2016, the effective date of this rule.

11 Rules of Practice and Procedure, FDIC 3064-AE43 (June 21, 2016). The FDIC requested for public comments to be submitted by September 1, 2016.

12 Civil Monetary Penalty Adjustment and Table, 81 Fed. Reg. 42,503 (June 30, 2016).

13 Appendix 1: Inflation Adjustment Act – Penalty Adjustments, Dep't of Labor.

14 Revisions to the Civil Penalty Inflation Adjustment Tables, 81 Fed. Reg. 43,463 (July 5, 2015).

15Order, In the Matter of Amendment of Section 1.80(b) of the Commission's Rules: Adjustment of Civil Monetary Penalties to Reflect Inflation, DA 16-644 (FCC June 9, 2016). This order took effect as of July 1, 2016.

16 Civil Monetary Penalty Inflation Adjustments,

155 FERC 61,320, Dkt. No. RM16-16-000, Order No. 826 (June 29,

2016).

OMB Memorandum M-16-06 at 3.

17 OMB Memorandum M-16-06 at 3.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.