"The publication of ESMA's standards on EMIR sees the EU taking its final steps towards meeting the G20 commitment on bringing OTC derivatives trading under supervision, and provides clarity to the market on the shape of the new regime." - Steven Maijoor, ESMA Chair

The European Market Infrastructure Regulation ("EMIR"), which came into force on 16 August 2012, created a new framework with the aim of introducing greater transparency and risk management mechanisms to the over the counter ("OTC") derivatives market in Europe.

On 27 September 2012, the European Securities and Markets Authority ("ESMA") released a final report (the "Report") to supplement EMIR with certain implementing and regulatory technical standards. The Report sets out specific details of EMIR's requirements and how they are to be implemented in practice and is divided into three sections (i) OTC derivatives, (ii) Centralised Clearing Parties ("CCPs") and (iii) Trade Repositories.

Perhaps it is stretching the point a little for ESMA to call these EMIR technical standards the final steps. They still need to be adopted by the European Commission (the "Commission") in its delegated rulemaking acts and some anticipated ESMA standards still remain undrafted, but certainly these represent a large step towards meeting Europe's G20 commitments.

Our previous client alert1 outlines the main effects of EMIR in Europe, in relation to mandatory clearing and reporting of OTC derivatives, risk management of non-cleared derivatives and constitutional and operational requirements for central clearing counterparties and trade repositories. This update will focus on the potential impact of the Report on parties entering into OTC derivatives contracts, as well as briefly highlight these technical standards proposed in relation to CCPs which are of most interest to derivatives counterparties.

OTC Derivatives

Clearing Obligation Procedures

Under EMIR, there are two ways for new classes of OTC derivatives contracts to be included in the list of contracts requiring mandatory clearing:

1. The top down approach - where ESMA mandates that certain contracts must be included; and

2. The bottom up approach - where CCPs are given authorisation to clear certain contracts by their local competent authority and, based on the notification by the competent authority of those contracts, ESMA will determine the classes of OTC derivatives to be mandatorily cleared in all Member States.

The primary purpose of the Report with regard to mandatory clearing is to ensure greater transparency in respect of the bottom up approach. Once a competent authority clearing notification is received by ESMA, information related to the relevant class of derivative contract will be published on ESMA's website and in a public register. This is to allow market participants of all Member States time to prepare for a potential new class of derivatives that may become subject to a clearing obligation. ESMA will then have six months to hold a public consultation, consult with the European Systemic Risk Board, and publish draft technical standards for any class of derivative which it proposes will become mandatorily clearable. However, to the extent that ESMA decides not to further recommend the relevant class of derivatives to the Commission for mandatory clearing, there is no requirement for it to publicise such negative assessment. It is to be assumed from the absence of public consultation or publication of technical standards within such six month period that the Commission's assessment is negative.

While early warning through publication on the website is a step in the right direction, concerns in respect of this procedure are twofold. Firstly, during the initial months of EMIR being implemented in full, there may be a large number of classes of contracts authorised for CCP-clearing by local competent authorities. This would create undue administrative burdens on market participants as they would need to make preparations to enable adequate recording of all such contracts in which they may participate in relating to the recommended classes of derivatives contracts, since any subsequent mandatory clearing obligation can affect a relevant contract from the date of such notification. Secondly, not publicising negative assessments will leave market participants in a position where they are collating data and assessing their positions for six months, without any clarity on the final decision until the end of the six month period.

Non-Financial Counterparties

The Report provides detail with regard to when a non-financial counterparty would be obliged to clear contracts which are subject to a mandatory clearing obligation. The threshold has been set at €1 billion of gross notional value for OTC credit or equity derivatives contracts and €3 billion of gross notional value for foreign exchange, interest rate, commodity or any other OTC derivatives contract. The value of contracts is calculated on the basis of a 30 day rolling period. The conditions attached to the thresholds are stringent in that should any one threshold be reached or exceeded, non-financial counterparties are automatically subject to clearing obligations with respect to all classes of derivatives contracts entered into, even if the thresholds for other classes are not exceeded. Thresholds are subject to review and will need to be monitored for change.

At first glance, the high value of the thresholds seems divergent from earlier consultations which recommended a low level threshold. However, since the aggregate is set with respect to gross notional value rather than the mark-to-market ("MTM") based threshold suggested by many respondents to ESMA's earlier consultations, the levels are largely in line with former ESMA proposals.

Commercial Hedging Exemption

Contracts which are "objectively measurable as reducing risks directly relating to the commercial activity or treasury financing activity of a non-financial company or its group" (or "hedging contracts") are excluded under EMIR from being aggregated when calculating the gross notional value of OTC derivatives used by non-financial counterparties to decide whether a threshold for clearing has been reached. The Report has clarified some of the existing ambiguity around what could be considered a hedging contract. Hedging contracts now include proxy hedging, portfolio hedging (strictly restricted to when there is a clear reduction of commercial risk), employee benefit schemes, stock options and OTC derivatives contracts offsetting superfluous hedges. In addition, the Report clarifies that a derivatives contract, which reduces risk relating to the acquisition of a company by a non-financial company, can be regarded as reducing commercial risks, as can the entry into a contract to protect against the credit risk of counterparties of the non-financial company.

ESMA has also specified that any contract considered to be a hedging contract, in accordance with International Financial and Reporting Standards, will be considered to reduce risk.

Risk Mitigation for Non-Cleared OTC Derivatives Contracts

Electronic Trade Confirmation. ESMA has adopted a phased-in implementation of the obligation for financial counterparties and non-financial counterparties exceeding the clearing threshold ("relevant non-financial counterparties") to confirm the terms of a trade electronically. An extended timeline has been implemented for relevant non-financial counterparties under the prescribed thresholds. Following the expiry of the phase-in periods (until (a) the end of February 2014 for credit default swaps and interest rate swaps, and (b) the end of August 2014 for all other derivatives) electronic confirmation will be required for financial counterparties and relevant non-financial counterparties on the same business day as the finalisation of trades. For all other non-financial counterparties, the deadline will be the second business day thereafter. The Report has a further extension of up to one business day for trades completed after 4:00 p.m. and for those executed between parties in different time zones.

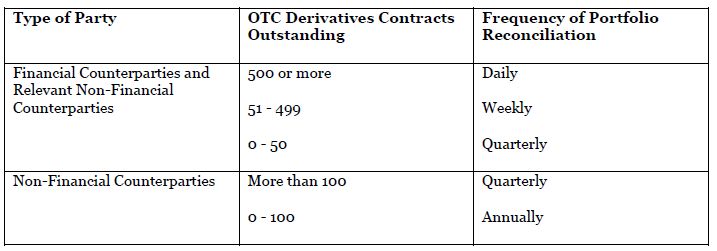

Reconciliation of non-cleared OTC derivatives contracts. Financial and non-financial counterparties (relevant and otherwise) are now required to agree, in writing or electronically, all material terms for portfolio reconciliation prior to entering into an OTC derivatives contract. This is to ensure that all discrepancies are resolved at an early stage. The frequency with which reconciliation must take place depends on the number of outstanding OTC derivatives contracts between those two counterparties and the classification of the counterparties (i.e., financial, relevant non-financial or non-financial) as follows:

Portfolio Compression. The Report recommends, but does not mandate, portfolio compression exercises for all types of counterparties to reduce counterparty risk. Each counterparty must establish procedures to determine on a regular basis whether such an exercise is appropriate, and be prepared to provide a reasonable explanation to the relevant competent authority where it determines that the exercise is not appropriate. The Report encourages entities to perform the procedure as often as possible (according to the amount of exposure they have), but at least twice every year if a party has a portfolio of 500 or more non-cleared OTC derivatives contracts. However, in order to give counterparties time to prepare for portfolio compression, this requirement is proposed to become effective only six months after the entry into force of any regulation implementing the draft technical standards.

Marking-to-Model instead of Market.

ESMA is tasked under EMIR with specifying market conditions which prevent marking-to-market (and therefore permit prudent and reliable marking-to-model instead). To ensure that risk mitigation is standardised amongst entities and is closely aligned with market conditions, the Report states that the only two situations where marking-to-model would be considered appropriate are (i) if the relevant market is inactive; or (ii) if the range between fair value estimates is large and probabilities of the estimates cannot reasonably be assessed. A market is considered inactive when quoted prices are not readily and regularly available and when those prices that are available do not represent actual, regularly-occurring, arm's-length transactions. Detailed requirements for models are included in the Report.

Intragroup Exemptions

Intragroup non-cleared transactions are exempt from EMIR's requirements with regard to risk mitigation, so long as the relevant competent authority or authorities within the EU determine that the counterparties have robust risk-management procedures and there is no perceived legal or practical obstacle preventing the transfer of capital or repayment of the liabilities between the counterparties. Counterparties intending to invoke the intragroup exemption must notify their intention to the relevant competent authorities. The intragroup exemption requires two issues to be addressed by ESMA's technical standards: (i) the applicability of the exemption in practice; and (ii) the details that must be submitted by entities to a competent authority to be considered for the intragroup exemption. The Report considers only the latter issue at length, because the former is intended to be developed jointly by ESMA, the European Banking Authority ("EBA") and the European Insurance and Occupational Pensions Authority ("EIOPA"). The required particulars include details of the relationship between the entities, the contractual documentation and the transactions that are being requested to be exempted from clearing. ESMA has also mandated public disclosure of the notional aggregate amount, type of exemption (partial or full) and relationship between parties in respect of each entity benefiting from the exemption.

The public disclosure requirement has generated significant controversy and is likely to be assessed very carefully by the Commission, due to the potential for such disclosure to encompass commercially sensitive information.

Centralised Clearing

EMIR establishes that for any counterparty to comply with clearing obligations it must:

- Become a clearing member of a CCP;

- Become a client of a clearing member; or

- Establish an indirect clearing arrangement with a clearing member.

An indirect clearing arrangement has been defined as "the set of contractual relationships between the CCP, the clearing member, the client of a clearing member and indirect client [i.e., the client of the clearing member's client] that allows the client of a clearing member to provide clearing services to an indirect client". In other words, indirect clearing arrangements are those entered into between a client of a clearing member and an indirect client. In order to ensure indirect clients have access to CCPs, the initial recommendations made by ESMA included a mandatory obligation on all clearing members to accept indirect clients on reasonable commercial terms that are publicly disclosed, and a requirement for the clearing member to directly manage indirect client positions for at least 30 days following the failure of a direct client.

The proposal to make indirect clearing access a mandatory requirement has now been dropped by ESMA so that the requirements in respect of indirect clearing arrangements now apply only where a clearing member agrees to permit indirect clearing services to be performed by their direct clients.

Where a clearing member agrees to facilitate such indirect clearing services, it must do so on reasonable commercial terms and must publicly disclose the general terms on which it will do so. If required by the direct client, it must keep separate records and accounts allowing for segregation both of direct client assets from indirect client assets, and also of assets of one indirect client from those of another indirect client. It is also required to establish robust procedures to manage the default of a direct client, including a credible mechanism to transfer positions to an alternative direct client or clearing member.

In addition, responses to early consultations highlighted that the 30 day requirement provided indirect clients with more protection than was enjoyed by direct clients and the discrepancy was not mandated under EMIR. In the Report, the 30 day requirement has been removed.

The Report's change of approach to indirect clearing services avoids imposing onerous obligations on unwilling clearing members, but will inevitably also have the effect of reducing the methods and routes through which a counterparty (particularly a non-financial counterparty) can comply with its clearing obligations.

Trade Reporting

All counterparties must report their OTC trades to trade repositories. Details of the content required are provided for in the final section of the Report. Reporting is to be done through the use of two tables: (i) Table 1 consists of counterparty data and must be submitted separately by each counterparty (or an appointed reporting entity, which may or may not be the other counterparty); and (ii) Table 2 consists of common data relating to the trade and needs to be reported only by one of the counterparties.

ESMA has also clarified, through the technical standards, that EMIR reporting will be required, even if it leads to double-reporting as a result of an entity being governed both by EMIR and the Markets in Financial Instruments Directive, or the Regulation on Wholesale Energy Market Integrity and Transparency (for energy commodity derivatives).

Double-reporting may prove to be both a burden for reporting parties and a hindrance for those receiving the information. Providing information in different forms with slightly different content will lead to higher costs for reporting parties as well as possible operational risk. At the same time, for the end receivers of this information, the differing content provided in respect of the same transactions may also prove to be more difficult to analyse and thus may not justify the added cost of reporting. Discussions regarding the standardisation of form and content to be reported are still taking place.

Requirements for CCPs

The Report also lays down a number of technical standards in relation to the operation of CCPs, including:

- Details of the margin requirements, including the minimum confidence interval2 to be covered by margins, the appropriate look-back period3 and the appropriate liquidation period. The draft technical standards require CCPs to ensure that their policies for selecting the above factors will limit pro-cyclicality4 (to the extent this does not negatively impact the financial soundness of the CCPs);

- Prescription of the percentage of own resources (or â€Üskin in the game' capital) that CCPs must contribute to the default fund for application in priority to the default fund contributions of non-defaulting clearing

- members (a decrease from 50% to 25% of the amount of initial capital required pursuant to Article 16 of EMIR), as well as a reduction in the amount of time a CCP will have to replenish any capital used (from 3 months to 1 month);

- Brief guidance on the recognition of third country CCPs;

- Practical arrangements for establishment of the regulatory colleges that will be supervising the CCPs; and

- Criteria for determining the types of collateral considered highly liquid as well as the appropriate valuation haircuts to be applied and the circumstances in which commercial bank guarantees can be acceptable by CCPs as collateral.

Next Steps

The Commission has until the end of December 2012 to decide whether to adopt (in whole or in part) the technical standards recommended by ESMA.

ESMA is also expected to publish technical standards on other EMIR issues including:

- Interoperability between CCPs;

- The scope of EMIR's possible extraterritorial effects; and

- Together with EBA and EIOPA, risk mitigation techniques for non-cleared derivatives contracts, including, but not limited to, margin requirements, capital requirements and exchange of collateral.

Although the draft technical standards for interoperability are expected before the end of 2012, the Commission has yet to set a date for delivery of the two other sets of standards.

The Report and the technical standards put a lot more flesh on the EMIR skeleton, and allow counterparties to further develop their planning for post-EMIR clearing and reporting, but the full effect of EMIR will only start to become apparent, at the earliest, next year when competent authorities and ESMA start to operate the bottom up and top down approaches to selection for mandatory clearing.

Footnotes

1 See Morrison & Foerster client alert "Regulating Europe's Derivative Markets - Where Are We Now?" http://www.mofo.com/files/Uploads/Images/120524-Regulating-Europe-s-Derivative-Markets.pdf .

2 The minimum confidence interval percentage of movement in exposure for a clearing instrument that a CCP is required to cover over a certain liquidation period.

3 The look-back period time horizon for the calculation of historical volatility.

4 Pro-cyclicality refers to change in risk management practices that are positively correlated with business or credit cycle fluctuations and that may cause or exacerbate financial instability.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved