- in United States

- with readers working within the Advertising & Public Relations industries

- within Strategy topic(s)

The Commodity Futures Trading Commission's ("CFTC") new enforcement advisory introduces several major changes in policy and a matrix helping those facing potential or actual CFTC investigations quantify the extent to which cooperation, self-reporting, and remediation can be expected to reduce penalties (a.k.a. "mitigation credit") that the CFTC staff would otherwise recommend to the commission in most cases.

On February 25, 2025, the CFTC's Division of Enforcement ("Enforcement") issued an advisory establishing both the factors Enforcement will consider in evaluating the extent to which self-reporting, cooperation, and remediation should reduce civil monetary penalties that Enforcement recommends to the CFTC and how Enforcement will evaluate those factors. The advisory replaces all prior policies on these topics.

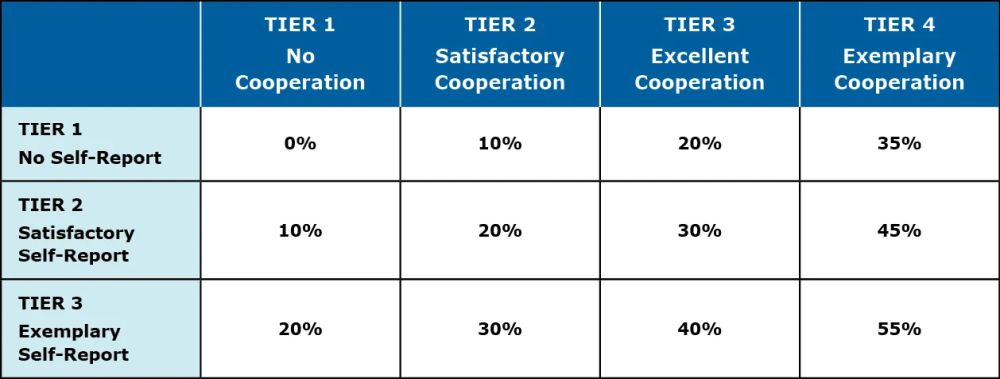

Much of the advisory merely condenses and arranges in charts the substance of the CFTC's prior self-reporting, cooperation, and remediation advisories, which is now described in terms of three self-reporting levels and four cooperation levels (the impact of remediation is factored into cooperation). However, the advisory also provides clear guidance on what is required for an action to be categorized as a particular level of cooperation or self-reporting. The advisory illustrates the effect of different combinations of those levels by arranging them in a 3 x 4 matrix (shown below) listing percentage reductions in penalties warranted by those combinations, which Enforcement will—subject to certain caveats noted below—use to determine recommended mitigation credit.

Although the matrix may draw much of the attention, the advisory also adopts several previous recommendations by Acting Chairman Pham, which will effect notable changes in Enforcement's approach. In addition to introducing quantification in the new matrix, the advisory also permits self-reporting to the operating division primarily responsible for the relevant regulation(s); previously, the self-report had to be provided directly to Enforcement. To address concerns that incorrect self-reports could be treated as false statements to the CFTC, Enforcement will now provide a safe harbor for good faith self-reporting if inaccurate information is supplemented and corrected promptly after discovery.

The advisory repeats prior advisories' warnings that Enforcement and the CFTC retain discretion in factors to consider, recommendations, and CFTC decisions. Despite these caveats, the introduction of the matrix and other changes indicate an intent by the acting chairman to provide greater assistance in mitigating the consequences of potential or actual CFTC investigations. To the extent the advisory is preserved by future CFTC chairmen, it should significantly assist relevant parties in their cooperation, self-reporting, and remediation analyses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.