- within Media, Telecoms, IT and Entertainment topic(s)

- in United States

- within Criminal Law, Law Practice Management, Litigation and Mediation & Arbitration topic(s)

Television Broadcasting: Topics for Consideration

This paper will outline various topics related to television viewership, the growth of streaming services and the ongoing development of NextGen TV (ATSC 3.0). Topics include:

- How tens of millions of Americans depend on free over-the-air broadcasts

- The streaming services and how streaming content is delivered

- Rising programming costs and decreasing viewership

- The growth of free ad-supported television

- ATSC 3.0 and NextGen TV

- The advantages of broadcast's one-to-many delivery model

- Broadcasting as a wireless transmission platform

- Impediments to ATSC 3.0 adoption

The Macro Trends in Television Broadcasting

Macro trends in how Media and Entertainment content is created, distributed and viewed include:

- Television broadcast viewing continues to decline while Pay-TV subscriptions are growing and, in some cases, appear to be plateauing.

- Television advertising revenue is declining while digital ad revenue is increasing, although lost revenues from television are not equaled by digital gains.

- Large technology companies continue to create original content and acquire multiyear rights to major sports content.

- Without long-term rights to sports content, television broadcasters and pay-TV providers (e.g., via cable, telco, satellite) may continue to experience declining subscriber numbers and viewership.

In view of these trends, one might assume that television broadcasting is becoming irrelevant as compared with streaming alternatives. Yet, all is not what it is purported to be. Streaming providers are reassessing how they create, purchase and license content. They are examining their original content budgets and expenditures. They are, for the most part, ratcheting back.

The transition from linear television viewing to streaming viewing has no previous framework that can be used as a guide. Virtually every aspect is being looked at through the lens of this transition. Business models, talent pay scales and residuals, accurate advertising measurement and mobile consumption — everything in the content creation-to-consumption value chain is being examined. It is a period of high uncertainty, with these questions being asked:

- How many streaming platforms can exist and be profitable?

- How do pay-TV providers compete?

- In streaming, how does the increase in subscriber churn impact the economics of the broader ecosystem?

- The profit margin on high-bandwidth internet exceeds that of pay-TV component. Why continue to offer pay-TV?

- If viewing continues shifting to streaming and mobile, where does this leave traditional broadcast television?

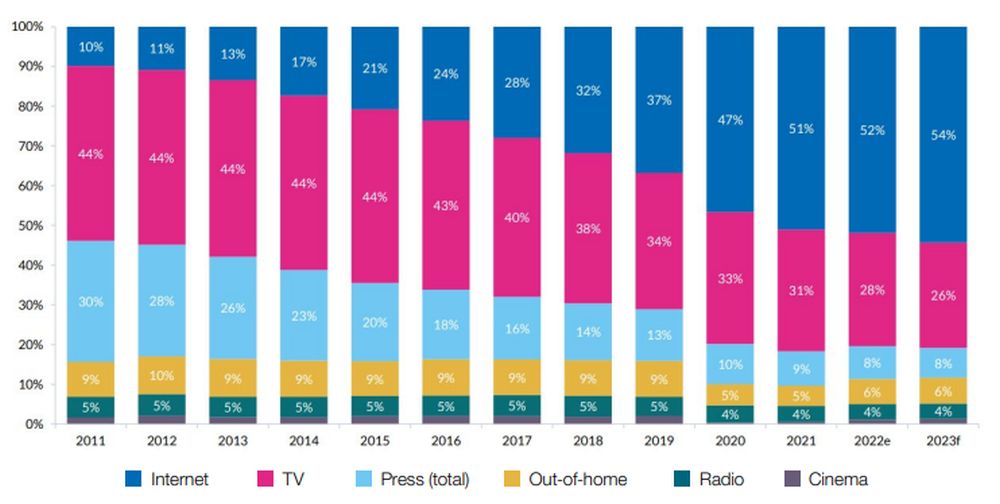

Share of display advertising by media

Television advertising revenue is declining while digital ad revenue is increasing.

Television Broadcasting Through a New and Powerful Lens

Television broadcasters, due to the technological advantages inherent in the broadcast platform, have some unique advantages over streamers that enable them not only to compete but to grow their number of services. These new services can enhance as well as diversify revenue streams.

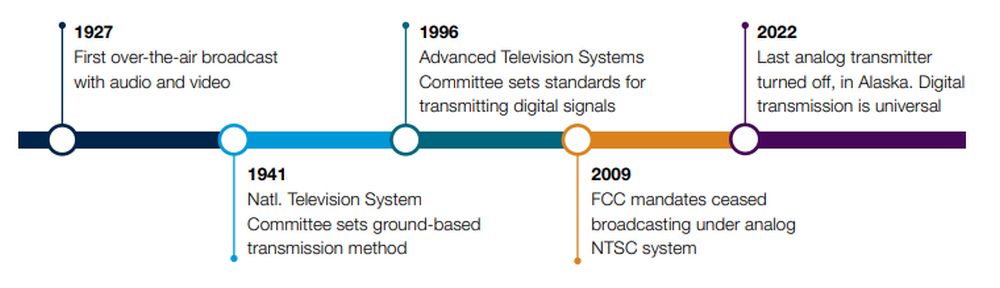

The first "television" broadcast occurred on September 7, 1927. Audio and video were transmitted over-the-air (OTA) and sent from a ground-based transmitter. This transmission method was set forth by the National Television System Committee (NTSC) in 1941.

NTSC Transitions to ATSC 1.0 Broadcasts

On June 12, 2009, the U.S. Federal Communications Commission made it mandatory that television stations in high power designations cease broadcasting under the analog NTSC system. The Advanced Television Systems Committee (ATSC) set standards for transmitting digital signals, as opposed to NTSC's analog signals. The last analog transmitter was turned off on January 10, 2022, in Alaska.

ATSC 1.0 introduced high definition signals, higher bit-rate audio and a 16 x 9 aspect ratio. These signals are delivered OTA — they are free. The number of OTA channels varies based on the designated marketing area (DMA). In the U.S. there are 210 DMAs. According to Parks Associates, of the 124 million television households, OTA is the sole manner by which 23 million households receive television.

Television broadcasting: 95 years from audio-video to digital

Pay-TV offerings from cable service providers created a consumer-focused narrative by providing the proposition of better signal quality by not being delivered OTA. Pay-TV brought with it a much greater number of channels. However, after decades of growth, pay-TV subscriber counts have continued to decrease since 2022.

Rising Programming Costs and Fewer Viewers?

In a smaller DMA, a cable provider may conclude that it cannot pass on the increased costs of programming to its subscribers and may decide to drop the pay-TV component to concentrate solely on providing broadband and telephony access. Meanwhile, a national network may determine that the primetime slots of 8 p.m. to 11 p.m. are too expensive to program given declining overall viewership and return the 10–11 p.m. slot to its local affiliates to provide local programming and advertising slots.

How the Streaming Service Providers Deliver Content

Streaming video services deliver content differently than ATSC 1.0 broadcasts. Content is delivered (streamed) as packets over an IP network and, in most cases, a content delivery network (CDN) makes delivery more reliable by situating servers closer to demand areas. Generally, delivery costs grow as the number of streams increase with a one-stream-for-each-user (one-to-one) methodology. Another way to think about this is that the more successful a program is, the more people watch and the associated delivery costs increase. That delivery mechanism is in stark contrast to the method by which television is broadcast. Television is a one-to-many methodology and thus there is no additional cost to the broadcaster if the audience is one person or a million.

Free Ad-Supported Television (FAST)

FAST channels are essentially linear television channels that are broadcast at specific times with an associated electronic programing guide. FAST channels are delivered as IP streams and also offer video-on-demand (VOD) content with advertisements. FAST is another way for content owners to tap libraries that may be too expensive for a network to run or are not current, and therefore represent a way to monetize that content.

Will Television Broadcasters Go All-Digital?

Major broadcasting institutions are voicing their positioning on terrestrial broadcasting versus streaming-only. The British Broadcasting Corporation announced in January 2023 it would pursue a digital-only strategy by 2030. The Canadian Broadcasting Company in February 2023 stated it would transition to a digital-only strategy once high-speed broadband access was available throughout the country. Will there be a day when broadcasters transition to a digital-only strategy? A recap:

- Fewer retransmission fees are being returned to local broadcasters. According to research firm BIA, revenue may drop from 50 percent to 39 percent of a station's income in the next three years.

- Networks indicate that the 10–11 p.m. prime time slot may no longer be economically beneficial to program.

- Competition from streaming services continues to drive audience fragmentation

- Growth of linear, scheduled FAST channels continues. FAST channels now measure in the thousands.

- Large technology companies are buying lucrative rights to sporting events.

TSC 3.0 AKA NextGen TV

Faced with these prevalent business and technical challenges, what are some possible scenarios that enable broadcasters to compete with the rapid evolution of content distribution and viewership?

NextGen TV enables viewers to select different camera angles, choose from multiple audio tracks, and watch in 4K resolution and High Dynamic Range (HDR). NextGen TV provides broadcasters with the ability to offer hyperlocal weather information, in-automobile broadcasts, digital data distribution services and wireless internet access. With NextGen TV, broadcasters stream content over IP but with the cost advantages of broadcast's one-to-many methodology. These powerful new capabilities also include two-way interactivity, dynamic ad insertion, a mobile component, and acquired first-party data, which is information the broadcaster is able to acquire directly from the viewer. By midyear 2024, NextGen TV was available in 70 markets, equating to over 75 percent of U.S. TV households.

ATSC as a Wireless Transmission Platform

NextGen can also function as a wireless IP transmission platform. With data sent over IP, it is feasible to provide distribution services such as software updates for the automobile industry at a fraction of the price-per-gigabyte over other methods. Data distribution over IP also allows broadcasters to offer wireless internet and telephony services.

Considerations for ATSC 3.0 Adoption

Despite the many positive aspects of NextGen TV, there are some issues that have been identified that may hamper its adoption. For the most part, these hindrances are not technical in nature but relate to business and geographical considerations. Licensing and patent issues have been identified by ATSC 3.0 television set manufacturers in regard to 3.0 tuner patent holders.

Another looming issue is the applicability of 3rd Generation Partnership Project (3GPP) 5G wireless as an alternative to NextGen TV. However, it is a misconception to think that only one technology approach will be successful. NextGen TV, 5G and broadband-only all have coverage area issues. Rural areas may suffer from receiving signals from all three implementations. Therefore, it is logical to assume that each has its place, given the geographic area.

The 2023 Broadband Equity, Access and Deployment Program (BEAD) will provide $42.45 billion for the deployment of broadband networks into areas that lack network capabilities. These areas are prioritized for those that lack network speeds of 25 megabits per second (Mbps) download and 3 Mbps upload.

Cost Take-Out, Cost Optimization and Cloud Adoption

ATSC 3.0 provides a platform for new functionality for the broadcasting industry. At the same time, the broadcast industry is evaluating how operations are undertaken and determine the best methodology to address CAPEX and OPEX budgets. These strategic decisions will invariably involve the three Cs: cost takeout, cost optimization and cloud adoption. Restructuring, to take advantage of important adjacencies that ATSC 3.0 can provide a bridge to, may be necessary to free up required capital.

Originally published by 22 October, 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.