The U.S. Federal Trade Commission (FTC) has announced its annual revisions to the notification and filing fee thresholds of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR).1 HSR is an antitrust statute that authorizes the FTC and the Antitrust Division of the Department of Justice (DOJ) to suspend certain types of acquisitions and evaluate their potential anticompetitive effects. HSR requires the parties contemplating certain mergers or acquisitions that meet or exceed certain jurisdictional thresholds to provide information to the FTC and DOJ regarding the parties' business operations and the acquisition, and to await the expiry of a statutory waiting period before completing the proposed transaction. The FTC revises those thresholds annually, on the basis of the change in gross national product.

For the first time since revisions have been made, the various thresholds have decreased, as a result of a decrease in gross national product in 2009. For example, the size of transaction threshold has been decreased to $63.4 million, from $65.2 million. Therefore, acquisitions resulting in the acquiring person holding assets and/or voting securities of the acquired person valued in excess of $63.4 million may be subject to the HSR notification and waiting requirements.

New HSR Thresholds

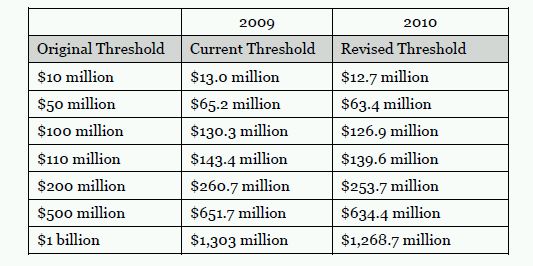

The following table lists the original HSR thresholds, the 2009 threshold

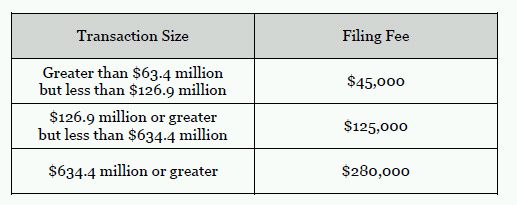

The schedule for filing fees required when making an HSR notification filing with the FTC and DOJ will be as follows as of February 22, 2010. Note that only the transaction size thresholds have changed, not the filing fees themselves.

Footnotes

1. As required by the 2000 amendments to Section 7A of the Clayton Act.

The content of this article does not constitute legal advice and should not be relied on in that way. Specific advice should be sought about your specific circumstances.