The lowest U.S. merger notification threshold will exceed $100 million for the first time effective February 23, 2022.

The Federal Trade Commission ("FTC") announced that the Hart-Scott-Rodino ("HSR") Act filing thresholds will increase in 2022, after slightly decreasing last year. These thresholds determine which mergers and acquisitions must be reported to the federal government before consummation. The higher thresholds are expected to take effect on February 23, 2022, and will remain in effect through early 2023.

This marks the first time that the minimum size-of-transaction threshold will exceed $100 million. Parties to any transaction that will close on or after February 23, 2022, may wish to confirm their HSR filing analysis using the adjusted thresholds.

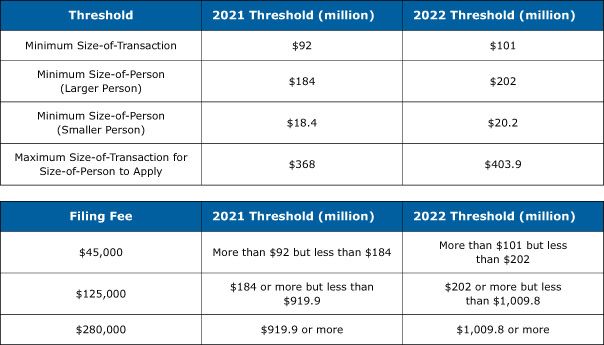

Adjusted HSR Jurisdictional Thresholds

Size-of-Transaction Threshold. An HSR filing may be required if an acquirer will hold, as a result of a transaction, voting securities, noncorporate interests, and/or assets of an acquired person valued in excess of $101.0 million (the 2021 threshold was $92.0 million). If the Size-of-Transaction is between $101.0 million and $403.9 million, the transaction also must satisfy the Size-of-Person threshold, described below. Transactions valued in excess of $403.9 million need not satisfy the Size-of-Person threshold.

Size-of-Person Threshold. A transaction meets the Size-of-Person threshold if either the acquired or acquiring person has annual net sales or total assets of at least $202.0 million and the other party to the transaction has at least $20.2 million in annual net sales or total assets. (The 2021 thresholds were $184 million and $18.4 million, respectively.) If the acquired person is not "engaged in manufacturing," the threshold is not met unless that person has at least $20.2 million in total assets or $202 million in annual net sales.

The tables below summarize these threshold changes.

Earlier in January, the FTC announced an increase in the maximum civil penalty for violations of the HSR Act (among other statutes) from $43,792 per day to $46,517 per day.

There are exceptions to the reporting requirements under the HSR Act. Qualified counsel should be consulted whenever a transaction may implicate this statute.

Interlocking Directorates Thresholds and Civil Penalties Amounts Also Increase

The FTC also increased the jurisdictional thresholds for the prohibition on interlocking directorates under Section 8 of the Clayton Act. Section 8 prohibits a person from serving as an officer or director of competing corporations if each company has a net worth of more than $41,034,000. However, there is no violation if the competitive sales of either are less than $4,103,400. The Section 8 thresholds went into effect on January 24.

Earlier in January, the FTC announced an increase in the maximum civil penalty for violations of the HSR Act (among other statutes) from $43,792 per day to $46,517 per day.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.