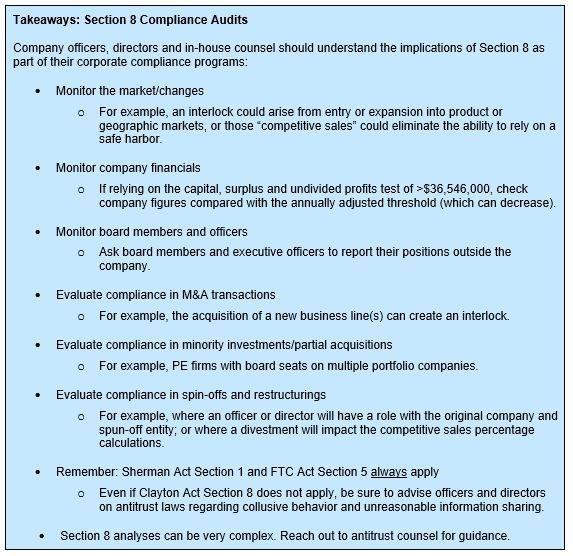

The FTC and the DOJ Antitrust Division have again warned companies, along with their board members and officers, of the legal prohibition on interlocking directorates: when an individual, or an organization's agent(s), simultaneously serves as an officer or director of two competing companies. In a recent FTC blog, and prior post, the agency flagged the importance of monitoring for interlock issues during standard antitrust compliance. The DOJ Antitrust Division likewise recently made clear in remarks by Assistant Attorney General Makan Delrahim and Principal Deputy Assistant Attorney General Andrew Finch, that it, too, is closely monitoring interlocks, particularly during transaction reviews. In-house counsel, board members and executive officers must routinely monitor interlock issues, or risk an independent government investigation or side investigation to an M&A review.

The Law

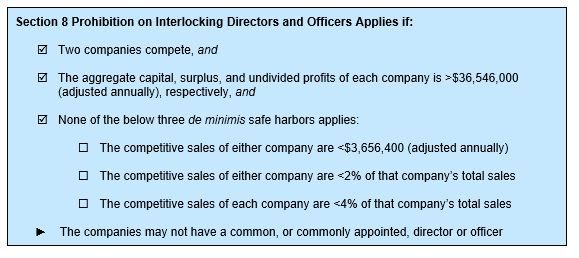

Section 8 of the Clayton Act, 15 U.S.C. § 19, prohibits "interlocking directorates." The concern is that officer or director interlocks between competitors could result in inappropriate coordination or the sharing of competitively sensitive information, in violation of antitrust laws. The purpose of Section 8 is therefore to "nip in the bud incipient violations of the antitrust laws by removing the opportunity or temptation to such violations through interlocking directorates." U.S. v. Sears, Roebuck & Co., 111 F. Supp. 614, 616 (S.D.N.Y. 1953).

Q:Which positions are covered?

A: "Director" means a member of the board of directors, and "officer" means a position elected or chosen by the board. The prohibition applies not only to the same individual serving as an officer and/or director of two competing companies but also to entities (like private equity firms) that have their agent(s) or representative(s) serving in these roles.

Q:Which entities are covered?

A: While the statute specifically refers to interlocks among "corporations," DOJ Antitrust Division AAG Delrahim recently signaled a willingness to enforce Section 8 against unincorporated entities such as LLCs, as the potential harm is "the same regardless of the forms of the entities." The FTC has taken similar positions in, for example, investigating interlocks involving banks, which Section 8 exempts, and competing non-bank corporations.

Q:What are "competitive sales"?

A: "Competitive sales" are "the gross revenues for all products and services" sold by one company in competition with the other, "determined on the basis of annual gross revenues for such products and services in [the company's] last completed fiscal year." Companies are "competitors" if an agreement between them would violate antitrust laws. 15 U.S.C. § 19(a)(1)(B), (a)(2). The FTC has advised companies to look at their ordinary course business documents and to speak to knowledgeable employees in determining if two companies compete.

Q:Is there a grace period for compliance?

A: If an interlock did not violate Section 8 at the time it was established but, later, changed circumstances cause a prohibited interlock (such as two companies that previously did not compete becoming competitors), the companies or individuals will have one year to cure. During that time frame, parties must remember that other antitrust laws still apply.

When an interlock violates Section 8 from the time it was established, there is no grace period to cure.

The Risks

Section 8 violations are inherently illegal and do not require proof that the interlock resulted in harm to competition. The government's remedy for a Section 8 violation is injunctive relief—elimination of the offending interlock, typically with an officer or director's resignation. But any interlock — in violation of Section 8 or not—could give rise to claims under other antitrust laws. Section 1 of the Sherman Act prohibits combinations and conspiracies in restraint of trade, and Section 5 of the FTC Act prohibits unfair or deceptive acts in restraint of commerce. The FTC has stated it may use Section 5 to reach interlocks that may not "technically meet" the ban in Section 8 of the Clayton Act but which the agency determines may "violate the policy against horizontal interlocks expressed in Section 8." Private plaintiffs also could bring a Sherman Act claim for treble damages.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.