The UK's transition period with the EU comes to an end on 31st December 2020. After that, EU Directives governing tax and other matters will no longer be directly applicable between the UK and the other 26 Member States.

In this article we consider the direct tax implications of the loss of these Directives for corporate groups which have cross-border relationships spanning the UK and the EU. More specifically, the loss of the EU Parent-Subsidiary and Interest and Royalties Directives may result, in some cases, in tax cash-flow issues and/or increased tax leakage.

This article focuses on direct tax aspects for corporate groups only. Separate articles are available on other matters such as the impact on VAT and Customs Duties.

Loss of EU Directives governing intra-EU corporate income flows

Despite the UK formally leaving the EU on 31st January 2020, under the Withdrawal Agreement EU law has continued to apply during the Transition Period which will almost certainly come to an end on 31st December 2020.

From 1st January 2021, key EU Directives which govern withholding taxes (WHT) on cross-border income flows between EU companies in different Member States will no longer be applicable where a UK company is a party to the payment:

- The EU Parent-Subsidiary Directive (PSD). Under this Directive, intra-EU dividend flows are free of WHT regardless of domestic (non-treaty) or bilateral (tax treaty) WHT rates, broadly where there is a 10% shareholding relationship between the payer and payee companies; and

- The EU Interest and Royalties Directive (IRD). Under this Directive, intra-EU interest and royalty flows are free of WHT regardless of domestic (non-treaty or bilateral (tax treaty) WHT rates, broadly where there is a 25% shareholding relationship between the payer and payee companies.

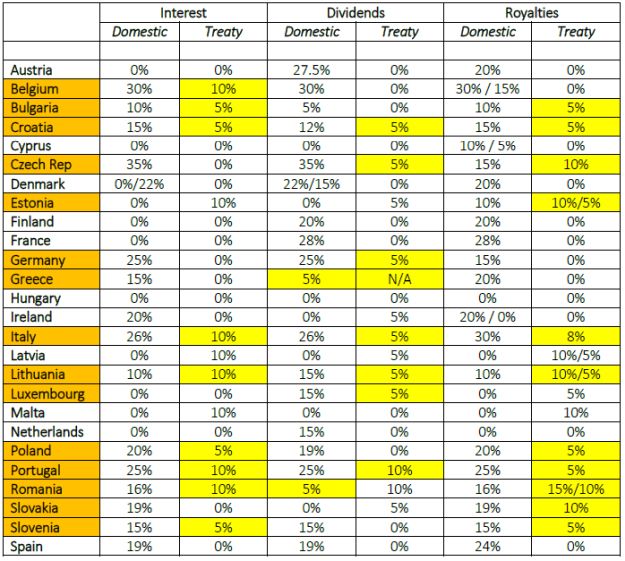

In the absence of these Directives, the fallback position for WHT rates on payments between a UK resident company and an EU resident company will be the rate agreed in any applicable bilateral Double Tax Agreement (DTA) and/or the domestic (non-treaty) rate of WHT in force in the paying jurisdiction, whichever is lower. Please see Table 1 for these rates throughout the EU: those jurisdictions highlighted in orange face withholding rates greater than zero from 1 January 2021 and the applicable income flow(s) and rates are highlighted in yellow.

As can be seen, in certain circumstances there could be additional tax leakage than under the prevailing EU Directives, and groups should be taking action to determine their exposure as soon as possible.

The position will differ, at least initially, between outbound payments from the UK to the EU and inbound payments from an EU Member State to the UK.

Outbound payments from the UK to the EU from 1st January 2021

Perhaps ironically, the two Directives will continue to apply to payments made by UK resident companies to EU resident companies after 1 January 2021. This is due to the fact that the UK's EU Withdrawal Act (2018) provides that EU legislation applicable to the UK, and UK domestic law implementing EU Directives applicable to the UK, remains in force.

The practical effect is that the UK will continue to apply the PSD and IRD until such time as UK Parliament repeals or amends the UK implementing legislation. We would not recommend that groups seek to rely on this position beyond the short term, as it is likely that the UK will seek to remove the benefits of these Directives sooner rather than later, unless suitable bilateral agreements can be agreed which provide identical benefits to both jurisdictions.

Note that, even where the PSD is repealed in UK law, there will continue to be no WHT on outbound UK dividend payments by virtue of the UK domestic law exemption.

Inbound payments from EU to the UK from 1st January 2021

The position will almost certainly be different for payments to the UK, as domestic implementing legislation in the EU states will require that the recipient company is resident in the EU. In other words, the PSD and IRD will cease to apply and the position with be governed by the relevant Double Tax Treaty/domestic rates of WHT.

Example – UK/Italian Group – UK inbound payments

London Limited is a UK holding company which owns a number of overseas subsidiaries. One of those is Roma SpA, a company resident in Italy, of which London Ltd owns 100% of the issued share capital, and from which it receives dividends, interest and royalties in any typical year.

At the moment, Roma SpA makes payments of dividends, interest and royalties to London Ltd under the applicable EU Directives, suffering zero WHT.

From 1st January 2021, Roma SpA will be required to apply the lower of the Italian domestic WHT rates and the rates applicable in the UK-Italy Double Tax Agreement. Turning to the rates shown in Table 1, the treaty rates (which are lower than the Italian domestic rates) are:

- Interest: 10%

- Dividends: 5%

- Royalties: 8%

Cashflow position

London Ltd is therefore in a worse position from a cash-flow perspective, as it will receive only 90%, 95% and 92% of the respective payments made to it from Italy from 1 January 2021.

Is there an overall tax leakage?

It should be noted that, despite possible higher WHT rates being applicable from 1 January 2021, in many cases there will be no overall tax leakage, as the tax withheld will be available as a credit against the UK corporation tax liability on the same income. The prevailing rate of UK corporation tax is 19%, such that foreign WHT suffered at 19% or less will receive a full tax credit in the UK, providing that income is taxable in the UK.

The exception to this is the receipt of foreign dividends. In most cases, dividends received from a treaty jurisdiction are exempt from UK corporation tax under UK domestic law. This would normally mean that any WHT levied on foreign dividends is lost (although it is possible to elect into tax and under certain circumstances this can be advantageous).

In our above example, the overall tax leakage is 5% on dividends only. The Italian WHT suffered on interest and royalties is available as a full credit against the UK corporation tax liability.

Alternative Structures/Restructuring

In the event that the loss of the Directives may have a significant effect on group cash-flows or tax liabilities, thought could be given to migrating a UK holding company to an EU Member State or to moving its assets to a new holding company established in another EU Member State.

This would however need careful consideration and advice as there are a number of factors to consider:

- Whilst the tax residence of a UK company can be migrated, the company remains a UK company in law and subject to UK company law and filing requirements

- A tax migration can only be effective if made to a treaty jurisdiction with a suitable corporate residence tiebreaker clause

- There may be a UK exit tax charge on migration

- The distribution or transfer of assets from a UK company to a non-UK company would trigger deemed disposals of those assets (c.f. exit tax)

- In the post-BEPS era, any holding company in a new jurisdiction is likely to require a sufficient degree of substance to benefit from EU Directives and/or Double Tax Agreements

Taking Advice

We would recommend that all groups with cross-border EU/UK exposure take advice as soon as possible to identify their exposure to tax going forward and to identify whether any steps may be taken to mitigate it.

Table 1: Domestic and Treaty rates between the UK and the 26 EU states on cross-border income flows between companies post 1 January 2021

Note: This table is not a substitute for professional advice. Many Double Tax Agreements contain supplementary requirements for access to treaty benefits which we have not included here; inter alia: specific requirements as to relationship between payer and payee companies, subject-to-tax clauses, beneficial ownership requirements and anti-abuse provisions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.