Internal and external developments have far-reaching implications on your Treasury Management function. Modern Treasury functions need to be structured to deal with an ever-changing world, with the right systems and processes to support, not hinder, change. Deloitte Treasury and Capital Markets can support your company with this and provide you with solutions for specific concerns such as...

Quick scan

Does your treasury function still meet current requirements? Should the treasury function be improved or adapted to serve the changing requirements of internal customers and external expectations? What could be the impact on the financial result and balance sheet positions of the company, if the treasury function is structured in a different way? Can the current treasury function meet the company’s objectives? How does your treasury function compare to that of your competitors? Does your treasury function meet your international requirements, from both business and tax perspectives?

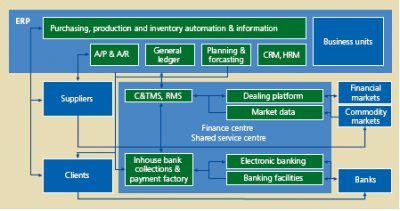

Is your infrastructure, supported by your cash and treasury management system, structured in the most efficient way? Does your treasury management organisation, and its links with the business, provide you with proper insight to make the right decisions?

Strategy – does it still fit?

Are the current strategies suitable for current and future developments? Your current business strategy is changing, but does your treasury have the ability to support the desired changes, or does it require re-positioning with respect to the treasury strategy and the risk profile? What are the opportunities resulting from developments in the field of treasury? Do you have enough influence on all disciplines within the organisation, so you can have influence on all aspects of the financial value chain?

Controls – fit for purpose?

You need to be comfortable you have a control framework to minimise the risk of mistake or fraud from treasury transactions. How does your governance structure compare to market practice for a company of your size and complexity? Do the controls in place adequately address the operational risks you face? Can technology help you automate processes and controls and thereby reduce the overhead?

Organisation of the treasury function

Whether treasury is managed centrally or has distributed responsibilities, you need to have visibility of group-wide risks and cash flows. Resource supply needs to fit skill and experience requirements to yield the value from treasury. How does your treasury organisation compare to other companies in these areas?

Should you consider outsourcing certain processes in the treasury function?

Is Treasury efficient?

How should you assess and measure whether your treasury gives the most optimal returns? Many companies successfully implement key performance indicators (‘KPIs’), but which ones should you use? Do you use technology efficiently to automate treasury processes including reporting?

Develop your documentation

The Sarbanes Oxley act has brought a renewed focus on documentation to many companies by necessity. Of key importance is whether the documentation properly defines the role of the treasury function, and supports the day to day operations. Are you comfortable your documentation of policies, processes and procedures achieve this?

The health check

The challenges raised above can seem daunting and difficult to solve. In particular with finite time and resources to address issues, how should you prioritise?

The Deloitte ‘Health Check’ provides an effective and quick tool to help you assess and prioritise treasury processes for change. We utilise our deep understanding of treasury practices and knowledge of how you compare to other companies to provide an independent viewpoint on your treasury function.

With the results of the treasury Health Check we can then work with you to develop a plan for development.

Deloitte Treasury and Capital Markets

The Treasury and Capital Markets group at Deloitte combines the skills of a broad range of professionals in treasury, banking and financial instrument accounting and valuation. We combine experience from the corporate and banking market places with consulting skills to deliver our clients first class solutions to fit their needs. We are significantly experienced in working with management at all levels of the organisation, a typical feature of consulting in the treasury market place.

We would be very pleased to discuss any aspect of treasury management in your organisation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.