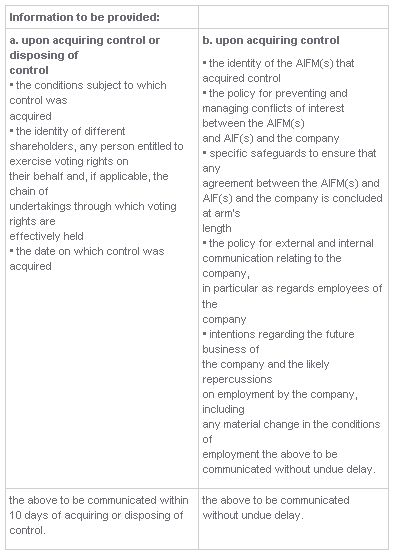

Under the draft Regulations, when an AIF acquires control of a

non-listed company, the AIFM must use its best efforts to ensure

that the board of the company provides certain information to

employee representatives or, where there are none, to employees of

the acquired company.

The category of information in which employees will be most

interested is the AIF's intentions regarding the future

business of the company and the likely repercussions on employment

by the company, including any material change in the conditions of

employment. This is similar to information requirements introduced

into the UK Takeover Code following the Kraft/Cadbury takeover,

although does not go quite as far. It is designed to force

disclosure of significant planned changes, such as the closure of a

site, and would require notification of firm plans to change the

business that may affect employees adversely. Often, however,

post-acquisition plans are provisional and are subject to

assessment of business or individual performance, further

board

discussions, trading conditions and other factors and an AIFM would

probably be justified in not revealing details of plans of that

nature.

Breach of these obligations may result in a sanction being imposed by the FCA but does not add to the employment rights that individual employees or their representatives already have. Therefore, the motivation for an employee to claim that the AIF or AIFM has not complied is either to embarrass or to use the breach as evidence in support of an ordinary employment claim.

However, many employees will not even be aware of these

disclosure obligations unless they have employee representatives

who have experience of or training on them. The obligations fall

away if providing the information would seriously harm the

functioning of the company or would be seriously prejudicial to it,

which sets a high threshold for anyone looking to fall within the

exception.

There is a duty on employees and employee representatives who

receive the information to keep it confidential. However, normal

precautions should be taken to preserve confidentiality, such as

marking any written notification as confidential.

The draft Regulations contain no requirement for the notification

to be in writing, although written notifications will more readily

demonstrate compliance.

Share buybacks from employees

Under the proposed anti-asset stripping provisions in the

Regulations, within the period of 24 months following the

acquisition of control an AIFM may not facilitate, support

(including by voting in favour at a board meeting) or instruct any

distribution, capital reduction, share redemption or acquisition by

the company of its own shares unless certain financial tests are

met.

One relatively routine situation in which the new tests will apply

is where an employee who is a shareholder leaves or is dismissed

and the company wants to buy back their shares. This will not be

permissible if, in broad terms, the company's net assets as at

the end of the last financial year are less than the amount of the

subscribed share capital (plus non-distributable reserves) or would

become so as a result of the share acquisition. Such a situation is

far from impossible.

The Regulations thus impose an additional test on the company with which it will have to demonstrate compliance, in addition to the requirement under the Companies Act 2006 to have distributable profits out of which to purchase the shares. In our view, the wording of the anti-asset stripping regulations could benefit from some additional clarity. However, as the draft Regulations must implement similar wording the AIFM Directive, the scope for exceptions to be made by the UK government in the final Regulations is extremely small.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.