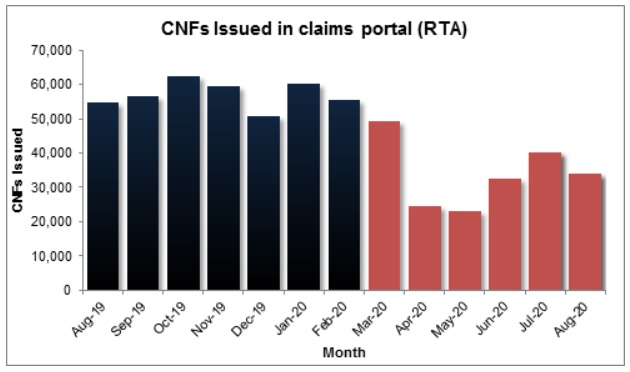

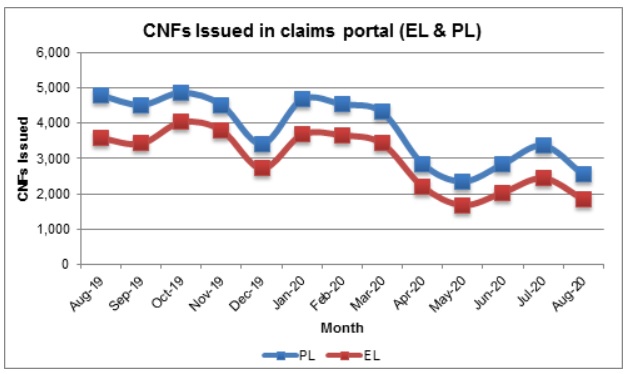

The Portal Company has released the personal injury claims statistics for August 2020, and despite the number of issued Claims Notification Forms (CNFs) increasing in June and July as the lockdown restrictions in the UK were eased, the recent figures for August dropped below the numbers recorded in July.

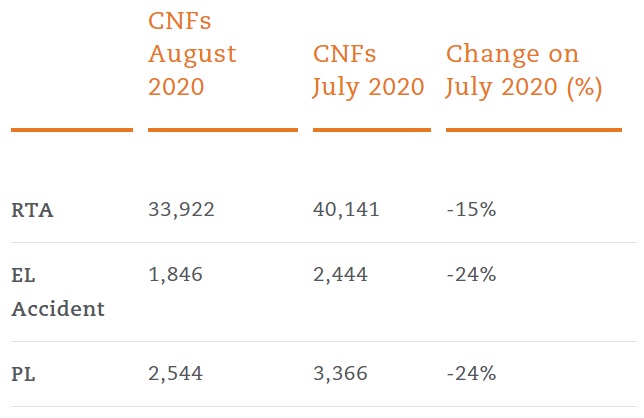

CNFs for claims relating to road traffic decreased 15% from July to August, with EL and PL claims falling by around a quarter. However, the figures recorded for August still remain above the claims numbers recorded in May, the lowest totals since the start of the pandemic.

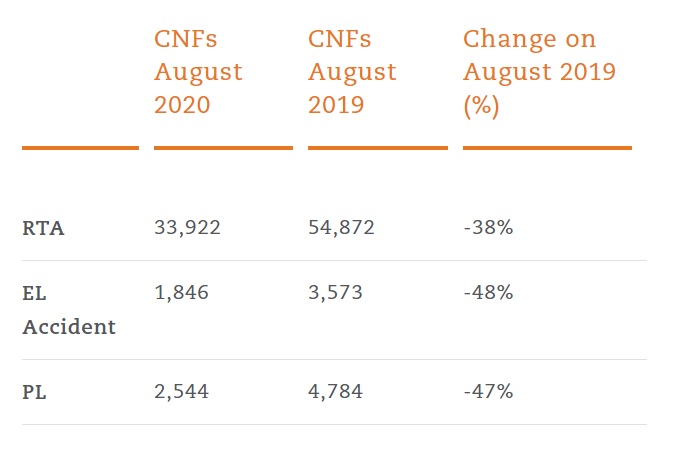

The tables below show the difference between CNFs issued in July and August 2020 as well as August 2019 and 2020.

As can be seen in the graphs below, August interrupts the recovery in numbers of CNFs issued in the RTA, Employment Liability and Public Liability claims portals, since the low point of May 2020.

The reason for the decline in claims numbers between July and August are not immediately apparent, particularly as claims do not necessarily enter the portal in the same month/immediate aftermath of the incident causing the injury. However, a review of the claims numbers for July and August in previous years suggest that declines month to month can be expected, and could be attributable to the school holidays and annual leave being taken over the summer.

- In respect of the year on year decreases, the drop of almost 50% in CNFs issued for employers' liability claims are likely to be a consequence of the lockdown and subsequent restrictions with significant numbers of workers still furloughed or working from home.

- Similarly, the effect of the lockdown in use of public amenities, shopping facilities and locations related to the hospitality industry are likely to be attributable to the decrease in public liability claims.

- Looking forward, it has been recently reported by a leading claims management firm that enquiry volumes relating to personal injury claims reached a low of 30% of normal volumes in April, but have risen to approximately 70% in August. This uptick in enquiries may manifest itself in increased claims numbers over the coming months.

- The figures for the next 3 months may provide an indication of the effect on claims numbers of the reopening of schools, the Government's previous efforts to encourage the return of employees to their usual workplace, and the associated effect on travel patterns.

- However, this may again be tempered by the Government's recently announced measures to stem a second wave of infections, with a likely impact on incidents giving rise to claims, and also possibly affecting the appetite of injured parties to pursue claims. As set out above, the initial impact of lockdown on claims enquiries was substantial and potentially damaging to claimant firms, and the next 6 months may present similar evidence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.