Valsartan, an angiotensin II receptor antagonist, developed by Novartis and marketed as its flagship-product, is sold under the brand name Diovan. Labelled the "world's number-one selling high blood pressure medication", Diovan accounted for US $6 billion in sales worldwide in 20091. With patent protection on its active ingredient due to expire in most major territories in the near future, this month's Drug In Focus analyses the patent landscape surrounding Valsartan based on information contained in GenericsWeb's Pipeline Selector report.

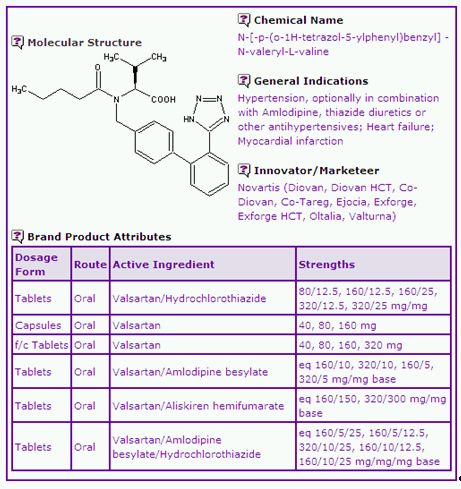

Table 1: Valsartan General Information

The Valsartan General Information (Table 1) shows that there are two dosage forms containing the single active compound and three dosage forms containing a combination of Valsartan with one or more other active ingredients. The single-active dosage form is indicated for hypertension, congestive heart failure and post Myocardial-Infarction, whilst the combination products are indicated for hypertension. In April 2010, Novartis was granted a new paediatric indication for the use of Diovan for the treatment of hypertension in children and adolescents 6-18 years of age by the European Commission (EC), and intends to launch an oral solution dosage form2.

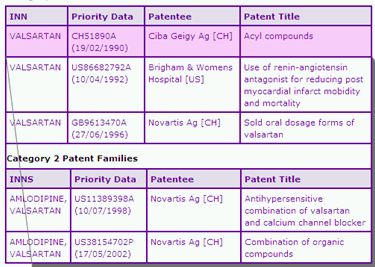

Table 2: Valsartan Key Patent Indicator

The Key Patent Family Indicator (Table 2) identifies five key patent families that are considered to protect at least one aspect of the Diovan product. These are separated into two categories, Category 1 relating to protection of all products containing Valsartan and Category 2 relating only to protection of combination products.

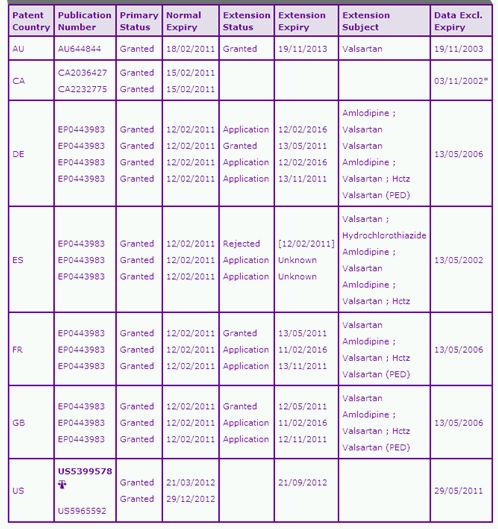

The first patent family in Category 1 protects the Valsartan active ingredient per se. The Australian member of this family has been granted a patent term extension until November 2013 whilst the Canadian patent is due to expire much earlier, in February 2011, due to there being no extension provisions. Multiple SPC applications based on this patent family are identified across Europe in relation to the single active and combination products. SPCs on the single-active product benefit from only a 3 month extension period except for Spain where SPCs on the combination products only are identified. However, in those countries where the SPC is granted in respect of the single-active product, the implementation of a PIP3 (that ultimately resulted in the paediatric indication) should make the SPC eligible for extension of the SPC term by 6 months. Such applications are also identified in the Key Patent Indicator. Other SPC applications based on patents in this family relate to the combination of Valsartan with Amlodipine and with Amlodipine and HCTZ, both of which would benefit from a full five year SPC extension period, where granted, offering protection until 2016. One of the issues in harmonisation of the patent protection across Europe is that many patent offices treat the eligibility of SPCs for combination products differently where the patent does not specifically claim the combination per se. One can expect a wide range of launch dates of generic combination products across Europe as a result of this disharmony.

The US FDA Orange Book (OB) listed patent in this family, US5399578 ('578), is set to expire in November 2012 following the grant of a 6-month paediatric extension term. It is worth noting that Ranbaxy Laboratories, after filing a Paragraph IV certification in 2007 claiming the US '578 patent as invalid pledged not to make, use, sell, offer to sell, or import Valsartan until the November 2012 expiry date or earlier if the patent were to be found unenforceable or invalid. Ranbaxy now has tentative approval for many strengths of tablet and is hoping for 180 days exclusivity upon expiry of the '578 patent for being the first to file, possibly shared with Teva's who also has tentative approval.

The second Category 1 family identified appears to protect the indicated use of Valsartan for the treatment of post Myocardial Infarction until expiry in 2017 in most territories. However it is unlikely that this patent family will constrain generic competition since the indication is one of many for the product and can often be carved out of the indications carried on any generic product.

Patents in the third key family in this category generally claim a "dry-granulation" oral formulation of Valsartan, optionally in combination with Hydrochlorothiazide. Based on the US tentative approvals discussed above for Valsartan, as well as those relating to the combination with HCTZ (Mylan) and with Amlodipine (Par, Synthon & Matrix) it appears that this protected technology is not difficult to circumvent, at least in the US. Similarly, approvals for tablet forms in the UK from many generic competitors suggest that the European counterparts are also not constraining to generic competition.

Data exclusivity (DE)can be a major constraint for companies interested in developing a generic equivalent as it acts independently to delay generic competition even if the patented period has expired. However, for the single active Valsartan product data exclusivity has expired in all territories except in the US where limited protection is in force until May 2011relating only to the new paediatric indication. The DE periods for the combination products are set to expire later in the US with the Valsartan/Hydrochlorothiazide expiring in 2011 and the Valsartan/Hydrochlorothiazide/Amlodipine and Valsartan/Aliskiren periods expiring in 2012 however it is not thought that these will constrain generic products beyond any relevant patent protection for these combinations (discussed below).Similarly in Europe, data exclusivity for Valsartan alone has expired, but further protection is in force until Aliskiren expires early 2017 while the Valsartan/Hydrochlorothiazide/Amlodipine combination is set to expire in October 2019 in most of the European territories.

Given that the generic competition for Diovan following expiry of patents and SPCs in the first family appears to be very strong, perhaps Novartis is hoping to retain some value from the therapeutic category by relying on the combination products and switching patients over to these dosage forms.

The first key patent family of Category 2 protects the use of a combination of Valsartan with Amlodipine until July 2019 in Australia, Canada and the US, whilst the majority of the European territory members have been granted SPC extensions until January 2022 except Great Britain which loses patent protection in December 2021.This difference is due to the effect of the UK patent office correcting the SPC record to reflect the ECJ decision that a Swiss MA is to be considered as an EU marketing authorisation date due to its automatic recognition in Liechtenstein. SPCs having the later 2022 expiry date use the EU centralised MA as the first authorisation in the community. This type of problem is highlighted in a forthcoming report by GenericsWeb, wherein many first EU marketing authorisation dates are cited for the same products across different SPC applications and represents an opportunity for generic companies to challenge the published data and possibly launch early. In any case, it is unlikely that generic versions of Amlodipine and Valsartan will not appear in major territories until 2019 unless patents in this family are successfully challenged.

The final key patent family claims a composition comprising Valsartan, Amlodipine and Hydrochlorothiazide. The Canadian, US and European members of this family have their patents in force until May 2023 whilst a patent term extension on the Australian patent has extended its expiry period until April 2025.

Of particular interest is the fact that two patents EP1507529 and EP1096932 from this category have come under heavy opposition in Europe by generic companies such as Synthon, Lupin, Ratiopharm and Teva strongly suggesting that they wish to commercialise generic versions of these important combinations. If unsuccessful, it is likely that generic products containing Valsartan in combination with Amlodipine (with or without HCTZ) will not appear for some time in major markets.

However, it therefore does not appear that the combination of Valsartan and HCTZ is protected by any patents beyond the Valsartan molecule patent in major territories, hence it is expected that generic versions of this product will be launched at the same time as the single active product, as indicated by the UK and (tentative) US approvals.

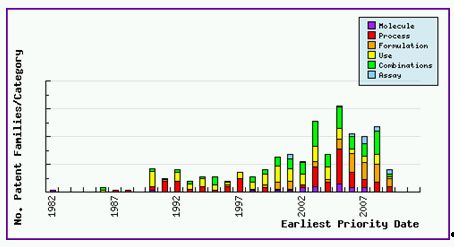

As seen in the Patent Filing Trends (Figure 1) for Valsartan, there has been an increased filing of formulation and combination type patent applications in the last eight years. This is clear evidence that much research has gone into discovering and protecting new combinations with a view to managing the lifecycle of this valuable active ingredient.

Figure 1: Valsartan Patent Filing Trends

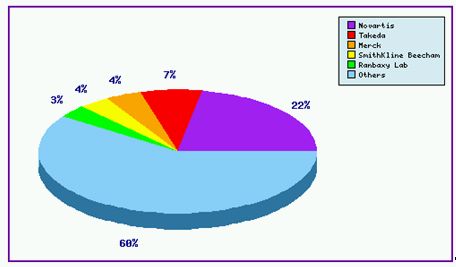

The Top Patent Applicants (Figure 2)further shows Novartis having invested heavily in trying to protect technology surrounding the Valsartan product suite in occupying 22% of the total patent families, whilst almost 60% of applications are accounted for by mostly generic companies indicating strong competition for this valuable product.

Figure 2: Valsartan Top Patent Applicants

In conclusion, Novartis has undertaken active measures with its life cycle management of Valsartan by filing patent term extensions, researching and developing fixed-dose combinations and gaining approval for new paediatric indications thus earning extra extensions in key territories. However, with the looming expiry of the '578 US patent and equivalents, generic companies having already shown an aggressive approach with regards to patent filing are provided with a great opportunity to enter the high blood pressure therapies market. Novartis, on the other hand will perhaps aim to secure future revenues by hoping it can convince medical practitioners and patients alike of the benefits of its fixed-dose combination products that expire much later.

Comprehensive data for patent families relating to Valsartan, based on professional patent searching, may be accessed by subscribing to the GenericsWeb Pipeline Developer report, which includes twelve monthly updates to keep you abreast of recently published patents and applications. GenericsWeb Pipeline Selector reports (Core and Extended) are available for any active ingredient upon request.

Footnotes

1. http://www.novartis.com/investors/sales-results/product-sales.shtml

2. http://www.novartis.com/newsroom/media-releases/en/2010/1407228.shtml

3. http://www.ema.europa.eu/docs/en_GB/document_library/PIP_decision/WC500005542.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.