- within Immigration topic(s)

Earlier this year, the World Intellectual Property Organisation published a report, entitled "Hydrogen fuel cells in transportation", which explores recent patenting trends of hydrogen fuel cells, with a particular focus on transportation.

In this article I provide my own summary of the findings of the report in areas of particular interest.

Introduction

As set out in the report, the European Environment Agency (EAA) indicates that transportation is responsible for around 25% of carbon dioxide (CO2) emissions from fuel combustion. Road transport (including cars, trucks, buses and motorcycles) accounts for around 75% of the total CO2 emissions across all transportation sectors (e.g. including aviation, shipping, rail etc.), and the proportion of total emissions produced by aviation and shipping continues to rise. The transport sector therefore clearly has a significant role to play in the desired global reduction of CO2 emissions.

Fuel cells, particularly hydrogen fuel cells, are just one of a number of different options available for providing cleaner power to the transport sector, with another being battery electric vehicles (BEV).

Fuel cells convert energy stored in hydrogen to electrical power that can be used to drive electric motors. Crucially, no greenhouse gases are produced during operation of a fuel cell itself, with only water and heat being produced as by-products (as well as the electrical output).

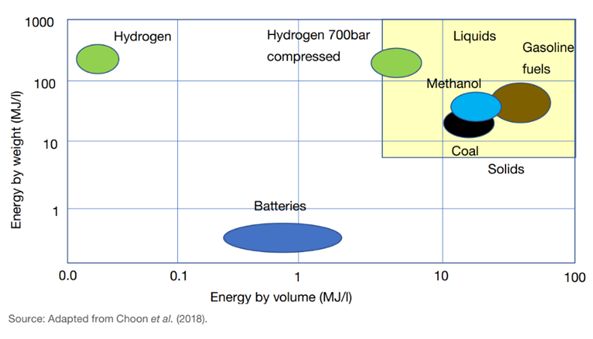

As illustrated in Figure 1 below, one reason that hydrogen is an attractive option as a 'transport' fuel is that the energy density of hydrogen by weight is high at around 120 MJ/kg, and is even higher than carbon-based fuels such as gasoline and coal. However, unfortunately hydrogen has a comparatively low energy by volume, particularly compared to carbon-based fuels. When liquefied, the energy density by volume can be increased to around 8 MJ/l in comparison to around 32 MJ/l for gasoline. Again, as indicated by Figure 1, in comparison batteries have a very low energy density by weight and are therefore comparatively heavier for a given energy output.

A challenge associated with the green energy transition in transportation is that existing carbon-based fuels are both relatively dense in energy by weight and energy by volume.

Figure 1 – Energy density plot showing energy density by volume and weight for different fuels [source: Figure 2 of WIPO report "Hydrogen fuel cells in transportation"]

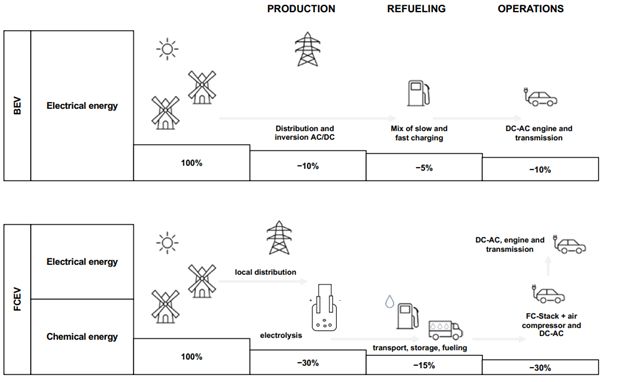

Although not a focus of the present article, nor the WIPO report, for completeness Figure 2 indicates that the supply, transportation and utilisation of hydrogen, at least in fuel cell electric vehicles (FCEV), has greater associated losses than those of BEVs.

Figure 2 – Efficiency of fuel cell electric vehicles (FCEV), in comparison to BEVs, across production, refuelling and use [source: Figure 3 of WIPO report "Hydrogen fuel cells in transportation"]

Patenting trends in fuel cells

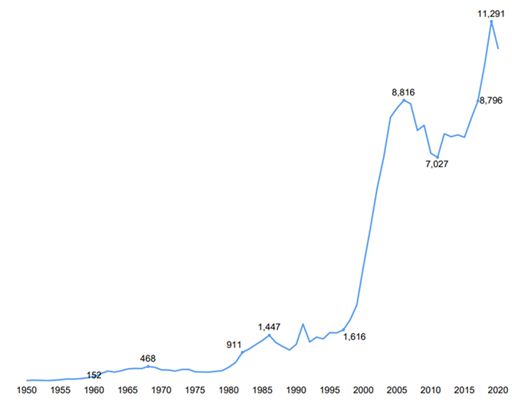

Figure 3, below, illustrates the general trend of patent filings in the field of fuel cells between 1950 and 2020. The data used to plot Figure 3 is not limited to fuel cells in the transport sector specifically.

It is observed that filings generally increased from 1950 to around 1990, at which point the first fuel cells were integrated into cars. A sharp rise in filings followed between 2000 and 2005, before filings slowed in around 2010, but a further sharp rise occurs in around 2016. Figure 3 suggests that significant fuel cell innovation has occurred since around the year 2000 (although Figure 3 does not incorporate any data beyond around the year 2020). It can be expected that the number of patent filings related to fuel cells will continue to increase as global efforts are focussed on meeting strict emissions deadlines in the coming years.

Figure 3 - Fuel cell patent filings by year of filing (1950-2020) [source: Figure 5 of WIPO report "Hydrogen fuel cells in transportation"]

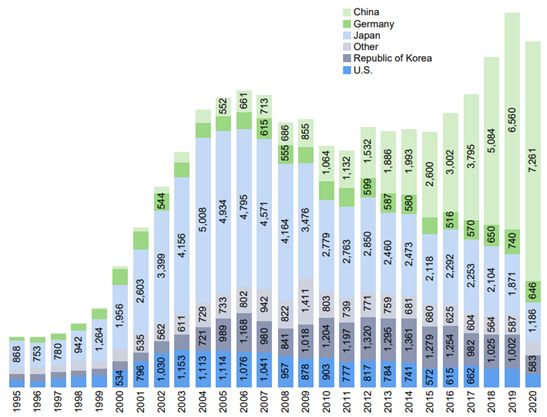

Turning to Figure 4, a graph is provided showing a breakdown of the number of fuel cell patent filings by five key locations of inventors: China, Germany, Japan, Republic of Korea and the US (and all other territories). Figure 4 illustrates that inventors based in China contributed to significant growth in filing numbers since around 2010, going on to overtake the previously largest contributor to fuel cell technologies by inventors based in Japan. Although Figure 4 indicates a significant contribution by inventors based in China, at least part of the significant recent increase in filing numbers may be attributable to domestic policy in China in which there exists various incentives for individuals and organisations to file patent applications.

Figure 4 - Fuel cell patent filings by inventor location [source: Figure 6 of WIPO report "Hydrogen fuel cells in transportation"]

Patenting trends in fuel cells in transportation

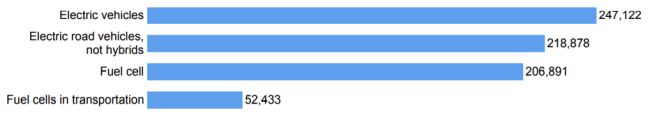

As shown in Figure 5, the number of patent filings directed to fuel cells in the transportation field accounts for around a quarter of the total number of filings directed to fuel cells generally. Furthermore, the number of filings directed to fuels cells in transportation remains comparatively low in comparison to the number of applications directed to electric vehicles and electric road vehicles which are not hybrids. Although not shown in Figure 5, the report indicates that the number of active patent portfolios (e.g. the number of patent families that have live patents or applications pending) for electric vehicles is equal to around half the number of the total patent filings number shown in Figure 5. That number is slightly lower for fuel cell patent families. This would suggest, perhaps not unsurprisingly, that applicants have been more inclined to file comparatively more speculative applications directed to fuel cells.

Figure 5 – Patent filings for fuel cells and electric vehicles [source: Figure 6 of WIPO report "Hydrogen fuel cells in transportation"]

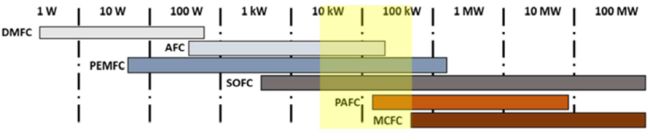

Fuel cells come in a number of different varieties as indicated by the different bars shown in Figure 6. These varieties include: direct methanol fuel cells (DMFCs), alkaline fuel cells (AFCs), polymer electrolyte or proton exchange membrane fuel cells (PEMFCs), solid oxide fuel cells (SOFCs), phosphoric acid fuel cells (PAFCs), and molten carbonate fuel cells (MCFCs). Figure 6 illustrates that the various varieties of fuel cells have different associated power outputs, which determines the applicability of the different varieties of fuel cell in different fields. The report suggests that road transportation typically requires around 50-125 kW of power output, with special vehicles (e.g. off-road vehicles, such as forklifts) requiring between around 100-160 kW, and trains and ships being at least 50-200 kW, and possibly more. The region highlighted yellow in Figure 6 therefore indicates that a number of different varieties of fuel cell can provide the output generally required by the transport field.

Figure 6 – Indicative power outputs of different fuel cell varieties [source: Figure 12 of WIPO report "Hydrogen fuel cells in transportation"]

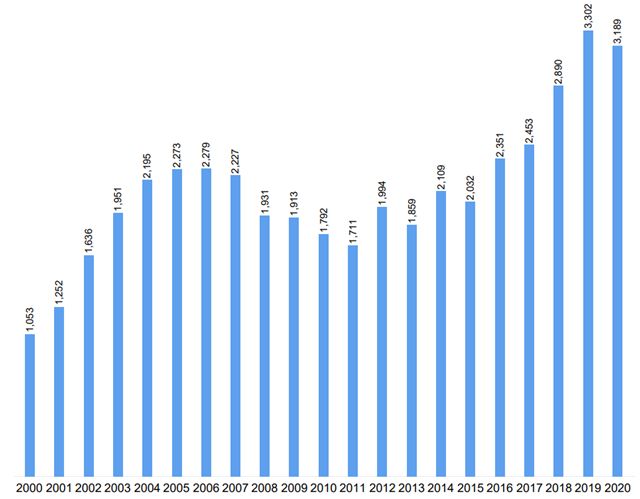

Figure 7 shows the total number of patent filings describing fuel cells in transport between the years 2000 to 2020. It will be observed that the trend shown in Figure 7 generally corresponds to the trend shown in Figure 3 (which, for completeness, shows fuel cell patent filings not limited to transport). The number of filings generally increases until a dip between around 2006 and 2015, before the number of filings increases again before a slight dip in 2020. The report suggests the fluctuation is owing to external factors including changes in demand and research funding. That said, the data would certainly appear to support a hypothesis that innovators are presently highly active in the field of fuel cells in transportation, and we can expect to see a continued upward trend in the number of filings directed to fuel cells in transport.

Figure 7 – Number of patent families directed to fuel cells in transport [source: Figure 19 of WIPO report "Hydrogen fuel cells in transportation"]

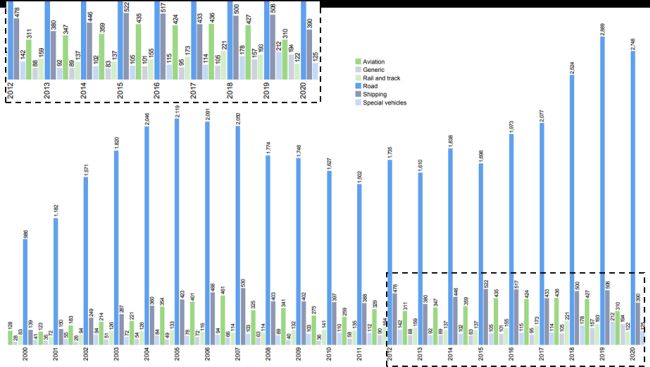

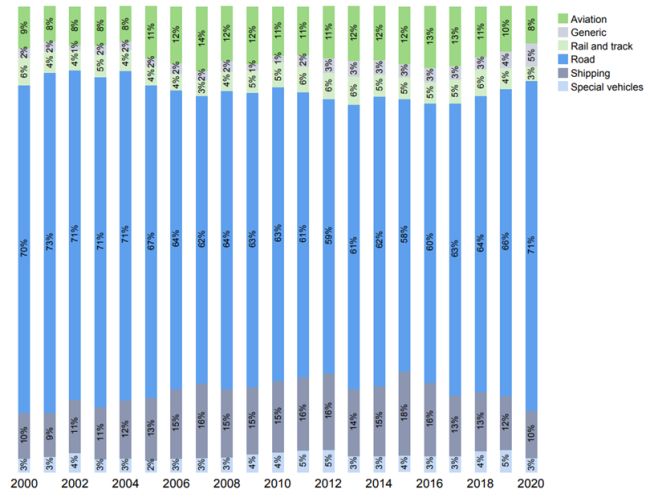

Turning to Figure 8, fuel cell patent filings are broken down into a number of different transport fields. These fields are: aviation, generic, rail and track, road (including cars, motorcycles and trucks), shipping, and special vehicles (including forklifts, airport tugs, tractors and construction vehicles). Figure 8 indicates that road-related applications represent a significant majority of fuel cell filings in the transport field. Somewhat surprisingly, the number of fuel cell applications in the shipping field has remained relatively consistent for a number of years, and the number of filings for special vehicles has increased as of late.

Figure 8 - Fuel cell patent filings by transport subsector [source: Figure 21 of WIPO report "Hydrogen fuel cells in transportation"]

Figure 9 shows the breakdown of the relative proportion of filings directed to the different transport subsectors from the data shown in Figure 8. It is again observed that road-related applications have consistently dominated the number of patent filings and that, in recent years, there has been a gradual increase in the proportion of total filings that road-related applications account for.

Figure 9 – Proportion of total fuel cell patent filings by transport subsector [source: Figure 21 of WIPO report "Hydrogen fuel cells in transportation"]

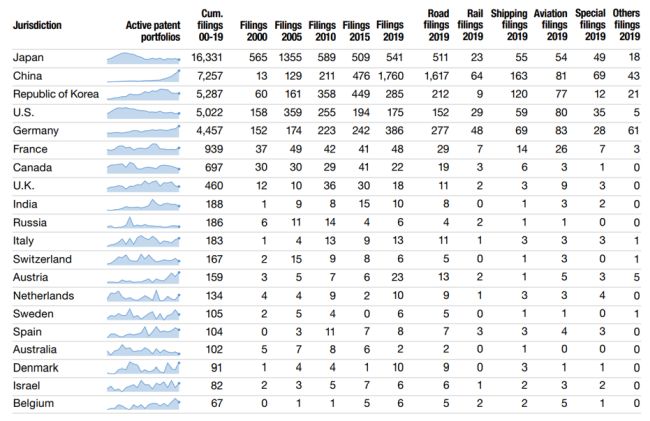

Turning to Figure 10, data is provided which shows a breakdown of the locations of inventors who contributed to patent filings for fuel cells in the transportation field on the left hand side of the table. The general trends of the active patent portfolios are also indicated by trendlines, and the total number of filings from 2000 to 2019 are also shown. A further breakdown of the filing numbers by transportation subsector is also provided on the right hand side of the table.

It can be seen that inventors based in Japan have contributed to the highest number of cumulative patent filings by some margin. That said, inventors based in China have been contributing to a significant recent increase in the number of active portfolios, with a particular focus on filings in road-related applications. The number of active portfolios is also seen to be increasing in, among others, Germany, France, Italy and Austria. The data is again indicative that inventors based in the five key locations of Japan, China, Korea, the US and Germany are significantly contributing to fuel cell development on a global scale.

Figure 10 – Top 20 inventor origins for fuel cell patent filings in transport [source: Table 1 of WIPO report "Hydrogen fuel cells in transportation"]

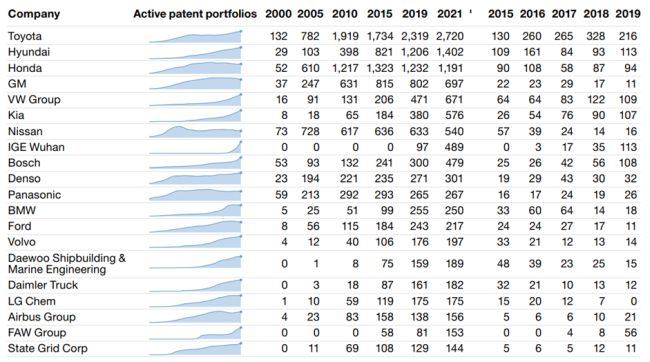

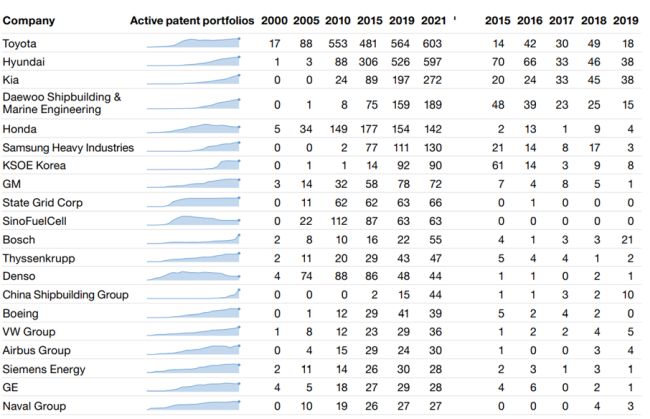

Turning to Figure 11, the top 20 applicants (by size of active patent portfolio, in 2021) for fuel cells in transportation in general are identified. The left hand side of the Figure shows the applicant, the trend in active patent portfolios, and the number of associated active patent portfolios between 2000 and 2021. The right hand side shows the number of patent filings for the years 2015 to 2019. It is observed that the top 20 is dominated by automotive manufacturers primarily, with Toyota having twice the number of active patent portfolios than that of the runner-up Hyundai. The top 20 is dominated by Japanese, German, American and Korean companies. The vast majority of the top 20 applicants have an upward trend in the number of active fuel cell patents in recent years.

Figure 11 - Top 20 applicants for fuel cell patent filings in transport [source: Table 2 of WIPO report "Hydrogen fuel cells in transportation"]

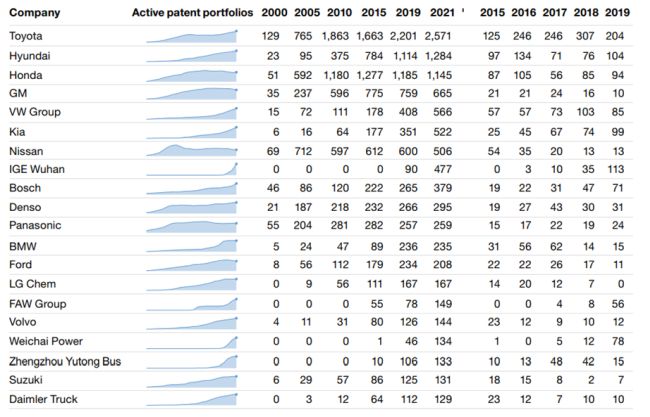

Turning to Figure 12, data is provided which shows the leading 20 applicants for fuel cells in road transportation cases specifically. Toyota and Hyundai again lead the charge by some margin, with Honda following closely behind. Interestingly, most of the top 20 applicants here are either maintaining the number of active patent portfolios for fuel cells in road transport or are increasing the number (some by a significant amount). It will be observed that very few show a reducing number of active patent portfolios. With that said, Honda, GM and Nissan are each observed to have somewhat shrinking active patent portfolios. The number of active patent portfolios for Kia, IGE Wuhan and VW group all show significant growth in recent years.

Figure 12 - Top 20 applicants for fuel cell patent filings in road-related transport applications [source: Table 4 of WIPO report "Hydrogen fuel cells in transportation"]

Turning to Figure 13, a breakdown of the top 20 applicants in fuel cells in shipping are identified. Once again, Toyota has the highest number of active patent portfolios but the lead is much less pronounced over Hyundai in comparison to, for example, the road-related applications subset.

Figure 13 - Top 20 applicants for fuel cell patent filings in shipping transport applications [source: Table 5 of WIPO report "Hydrogen fuel cells in transportation"]

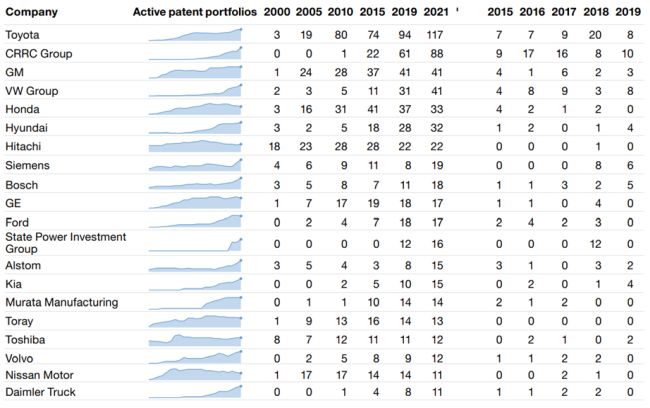

Turning finally to Figure 14, the top 20 applicants for fuel cells in rail and track vehicles are identified. Again, familiar prolific applicants are also present in the top 20 rail and track vehicles breakdown, and it will also be appreciated that the overall number of active portfolios and filings is comparatively lower in this field in comparison to, for example, road vehicles. That said, this is a trend that can be observed generally across rail and track vehicle technologies.

Figure 14 - Top 20 applicants for fuel cell patent filings in rail and track vehicle subsector [source: Table 7 of WIPO report "Hydrogen fuel cells in transportation"]

Conclusion

For the reasons set out above in this article, hydrogen represents a promising option for replacing more conventional fossil fuels in at least some transportation sectors.

Significant innovation is occurring, and has been occurring for some time, in the road transport field, which represents the vast majority of patent applications filed for fuel cells in the transport area. That said, the patent filing trends suggest there is a growing appetite for fuel cells in other transport subsectors e.g. shipping and special vehicles.

As deadlines for hitting emissions targets loom, it is likely that fuel cell innovation will continue and be reflected by a growing number of patent applications filed in the transport field and beyond.

Intellectual property continues to play an important role in protecting the investment made by innovators in meeting stringent emissions targets. Please do not hesitate to get in touch if you have any intellectual property queries regarding fuel cells or the transport sector more generally.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.