Watch for assertion against companies operating across mobile devices, messaging and wireless networking technologies.

The long-awaited patent sale by BlackBerry has been confirmed. This announcement sees BlackBerry high-grade its patent portfolio to the core assets that underpin its operational business segment of Software and Services.

The deal will allow BlackBerry to focus its strategic efforts on building its core Cybersecurity Platform and IoT Solutions offerings which combined generated US$621 million in revenue fiscal year 2021.

The transfer of non-core patent assets to Catapult IP represents a material increased risk to companies operating across mobile devices, messaging and wireless networking technologies.

BlackBerry, formerly Research In Motion (RIM), has an established history of successful litigation against tech power players including NXP, Qualcomm, Apple and Facebook.

The company appears to have paused on actively asserting its patent portfolio as this deal has been worked through over the last year, but the assets are now back in play.

Catapult IP has financed the deal with debt, majority funded through a syndicate led by Toronto-based investment firm Third Eye Capital.

The level of debt combined with the near-term expiry of some assets included in the sale puts immediate pressure on Catapult IP to identify and pursue opportunities to extract value fast.

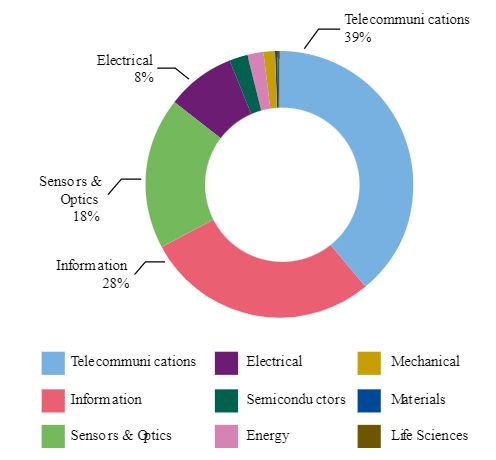

Using the Cipher Universal Technology Taxonomy we have identified the top areas of technology innovation protected by the BlackBerry portfolio. These include:

- Wireless Networks

- Touch Sensors

- Security

- Wired Networks

- Speech Recognition

Combined, these areas cover more than 60% of the BlackBerry portfolio.

Classification BlackBerry Inventions | By UTT Superclass

Source: Cipher, BlackBerry Company Snapshot, February 2022

Reminder that the agreement only includes BlackBerry's non-core assets. It's likely that much of the Touch Sensors, Security and Wired Network related assets are retained by BlackBerry in support of the company's cybersecurity and IoT business segments.

However, assets within the top technology category of Wireless Networks, 27% of the full BlackBerry portfolio, are likely to have been included in the deal.

Assuming that's the case, this places Catapult IP as the top tier non-practising entity (NPE) owner of Wireless Networks technology area patents, ahead of Intellectual Ventures, Provenance Asset Group and WSOU Holdings.

The core markets protected by the BlackBerry portfolio are the US and Europe. Screening across the top US and Europe innovators in Wireless Networks is an obvious place for Catapult IP to start building its opportunity pipeline of assertion targets.

Material revenue generating companies in this list include:

- Qualcomm

- Samsung

- Apple

- Deutsche Telekom

- NTT

- Intel

- Sony

- Alphabet

- AT&T

- Cisco Systems

- Verizon.

The Deal

Announced on 31 Jan 2022, just in time to ring in the Year of the Tiger, BlackBerry announced an agreement to sell substantially all of its non-core patent assets to Catapult IP for a total consideration of $600 million.

Patents that are essential to BlackBerry's current core business operations are excluded from the transaction. BlackBerry will receive a license back to the patents being sold, which relate primarily to mobile devices, messaging and wireless networking.

Deal completion is conditional upon regulatory approval in both Canada and the United States, which according to BlackBerry could take up to 210 days.

As of 28th February 2021, BlackBerry owned approximately 38,000 worldwide patents and applications. The total number of assets included in this sale is not disclosed.

Readiness and preparation is the game now to ensure the best defence against this rising NPE threat.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.