- within Transport topic(s)

- in United Kingdom

On 23 September, the new Chancellor announced the Government's 'Growth Plan'. As part of the measures, which aim to 'release the huge potential in the British economy by tackling high energy costs and inflation and delivering higher productivity and wages', the Chancellor announced changes on personal taxation. In this note we explore some of these changes and how personal taxation in Scotland will compare with the rest of the UK as a result.

Changes to Income Tax rates

The basic rate of income tax which applies to non-savings, non-dividend income in England, Wales and Northern Ireland) is to be cut from 20% to 19% a year earlier than planned, from April 2023.

On average, basic rate taxpayers will save £130 and higher rate tax payers will save £360 in the 2023/24 tax year. Top rate taxpayers will also now benefit from the personal savings allowance of £500, from which they are currently excluded.

Changes to Gift Aid will take place over a four year transition period to maintain the basic rate relief at 20% until April 2027 and support UK charities.

Previous plans to freeze the personal allowance at £12,750 remain unchanged.

The additional rate of income tax is to be abolished.

At present, income over £150,000 is taxed at the additional rate of tax; 45% (39.35% for dividends). This band is to be scrapped from April 2023. All income above the higher rate threshold (£50,270) will then be taxed at the higher rate of 40% (33.75% for dividends).

Scotland

While the changes noted above will reduce top rates of tax on all income received by taxpayers in England, Wales and Northern Ireland, the position in Scotland is not so straight forward. In particular, while income received on savings and investments by Scottish tax payers will follow these new reduced rates, the Scottish Rate of Income Tax will apply on other income such as earnings or property income. For these forms of income, the top rate of income tax in Scotland remains and is at the rate of 46% for earnings over £150,000. The higher rate of tax is also greater north of the border, at 41%. At the basic rate level, rather than adopting a flat rate, Scotland already has a starter rate of income tax on earnings up to £14,732 of 19% and it also has an intermediate rate of 21%. The budget changes will means that gap between higher earning Scottish taxpayers and their UK counterparts will grow.

What is a Scottish taxpayer?

On the basis that tax payers subject to the Scottish Rate of Income Tax will have greater exposure to tax, an important question is who is a Scottish taxpayer?

Separate Scottish rates of income tax have applied since April 2017 to 'Scottish taxpayers'. While most people living in Scotland will be treated as Scottish tax payers, for those people with places of residence in more than one part of the UK, the test can be quite complicated. We shall not go into the test in detail in this note but the following points are relevant. Firstly, in order to be a Scottish tax payer the relevant person must be resident in the UK under the normal statutory residence test. In addition, the relevant person must have a close connection to Scotland. If the person has only one place of residence in the UK and that is in Scotland, the person will be a Scottish Taxpayer. If they have two places of residence and one is not in Scotland (e.g. a flat in Glasgow and a house in Carlisle) then further consideration is necessary. In particular a person will have a close connection to Scotland (and so be a Scottish tax payer) if their main residence is in Scotland. This is not necessarily the address as which they spend most of their time but rather a review of various factors (such as their family and social connections) may be relevant. A list of the factors considered relevant by HMRC can be found here.

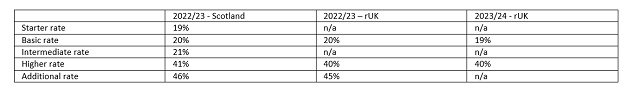

The table below compares Scottish rates with those applying in the rest of the UK (rUK). It also shows the rates as planned in rUK for 2023/24.

While these rates mean that some Scottish taxpayers will pay more tax than their counterpart in other parts of the UK, lower rest of UK taxes will have the effect of increasing the size of the Scottish budget under the Barnett formula (the system which determines central government funding for devolved administrations). It remains to be seen if there will an equivalent tax cut in Scotland. The Scottish Government has committed to publishing the outcome of its Emergency Budget Review within 2 weeks of the Chancellor's mini-budget statement. The full Scottish Budget for 2023/24 will be later this year, possibly following a full UK budget in Autumn.

National Insurance Contributions reduction and Reversal of Health and Social Care Levy

This levy was introduced on a temporary basis from April 2022 by way of a 1.25% increase in National Insurance Contributions (NICs). Class 1 (payable by employees and employers) and Class 4 (payable on profits by the self-employed) NICs will now be reduced by 1.25% from 6 November, and the introduction of the Health and Social Care Levy as a separate tax from April 2023 will be cancelled.

Basic rate tax payers will see an average saving of £75 in the remainder of the current tax year, rising to £175 in 2023/24. For higher rate tax payers, the average saving will be £700 next tax year. For additional rate taxpayers, the savings will rise to £3,890 on average next year.

Those who are self-employed will pay a blended rate of National Insurance - taking into account the changes in rates throughout the year - when they submit their annual self-assessment return.

Scotland:

The NIC changes are UK wide and therefore will apply to Scottish taxpayers.

Dividend tax

As noted above, the top rate of dividend tax will also be scrapped. And a recent increase on dividend rates will be reversed from April 2023.

Additional rate taxpayers currently pay a top rate of dividend tax of 39.35%. This is to be scrapped.

Dividend rates were increased from April 2022 from 7.5% (basic rate) and 32.5% (higher rate) to 8.5% and 33.75% respectively; these increases will be reversed.

The combination of freezing corporation tax at 19% and lower tax on dividends may make Family Investment Companies (FICs) a more attractive means of succession planning. They may also encourage some businesses to incorporate.

Scotland:

Scottish taxpayers pay the same tax as the rest of the UK on dividend and savings income.

Trusts

Discretionary trusts pay income tax at the highest rates on all income over £1,000 (being the trust basic rate band) (with such tax being paid on the general UK rates). UK resident trusts currently therefore pay 45% on non-dividend income and the additional dividend rate (39.35%) on dividend income. While the mini-budget was not accompanied by the usual supporting documentation, it is assumed that UK resident trusts will also benefit from the removal of the additional rate of tax and pay tax at 40% instead of 45% on non-dividend income and 32.5% on-dividend income from April 2023.

How trust 'tax pools' will operate as a result of a mis-match of tax pool credits coming in and going out will need to be ironed out. From April 2023 distributions from a trust will be made with a 40% tax credit and so consideration will need to be given to the timing of distributions from trusts: pre-5 April 2023 and the tax credit will be 45%.

Scotland:

UK resident trusts are taxed on a UK wide basis; there is no Scottish rate of income tax for trusts. Scottish taxpayers who receive income from a trust, however, may need to pay tax on the income and that would be at Scottish rates.

Many other changes were announced in last Friday's statement. You can read about them on HM Revenue & Customs' website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.