Clyde & Co's Insurance Growth Report explores the 2018 drivers of global insurance M&A.

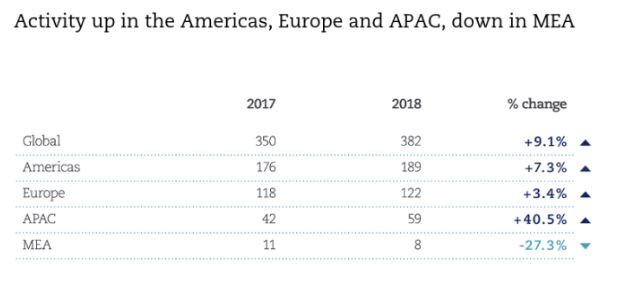

There were 382 completed mergers and acquisitions (M&A) worldwide in the insurance sector in 2018, up 9% (from 350) from the previous year. With 196 deals in the second half of the year, following 186 in the first six months, there have now been three consecutive six-month periods of M&A growth for the first time since 2009.

While the Americas remained the most active region for insurance sector M&A with 189 deals in 2018, there was a slight drop off in deal activity in the Americas in the second half of the year with 92 transactions, down from 97 in the first six months. The slowdown in the Americas in the second half of last year is indicative of heightened investor caution, and we predict 2019 will be a year of two halves – a slowdown in M&A in some markets in the first six months, while the second half should see a return to form.

The insurance industry c-suite in the US is grappling with several challenges at this time: uncertainty about the economy and financial markets, the rapid developments in insurtech, the growing role of alternative capital, and the excess capital that continues to add pricing pressure in various lines. M&A continues to be one of the key tools for positioning companies to face those challenges.

Key deal-making drivers in 2018 and those to watch in 2019 include:

- Widening pool of targets in scope: At the top end of the market the idea that size matters still holds. In 2018 there were 18 mega-deals valued in excess of $1 billion, including the year's largest, AXA's $15.1 billion acquisition of XL Catlin. A growing acceptance that alternative capital is here to stay has seen some re/insurers move in on ILS targets, with Markel's acquisition of Nephila being a leading example. In 2019, further consolidation is expected with a number of large businesses across the world actively on the acquisition trail.

- Technology as a primary deal driver: Technology cemented its position as a key driver of M&A in 2018, underpinning deals of every size. Examples of insurers taking stakes in insurtech start-ups increased across every geography. In the US, many carriers have developed VC-type funds to invest in newer technology companies or are linking up with insurtech startups that are looking for the backing of insurance. Various insurance groups have also established insurtech-focused companies and businesses separate and apart from their legacy businesses to allow the innovation to occur in essentially a greenfield-type environment.

- Regulation leading to consolidation: Regulators in a number of countries have been introducing legislative changes that are having an impact on M&A. Tighter capital requirements in markets across South East Asia, the Middle East and South Africa will lead to consolidation or players being forced out of the market.

- Lull in M&A will pass as uncertainty clears: While we predict a slowdown in transactions in some markets in the first six months of 2019, this should only be a temporary lull as greater clarity emerges such as in Europe around the shape of Brexit and in the US around trade tensions with China.

For more information on insurance M&A activity on a global scale, read our full Insurance Growth Report.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.